In the Hector Drummond Magazine, Dan C. discusses what he calls the “comfort of fear”:

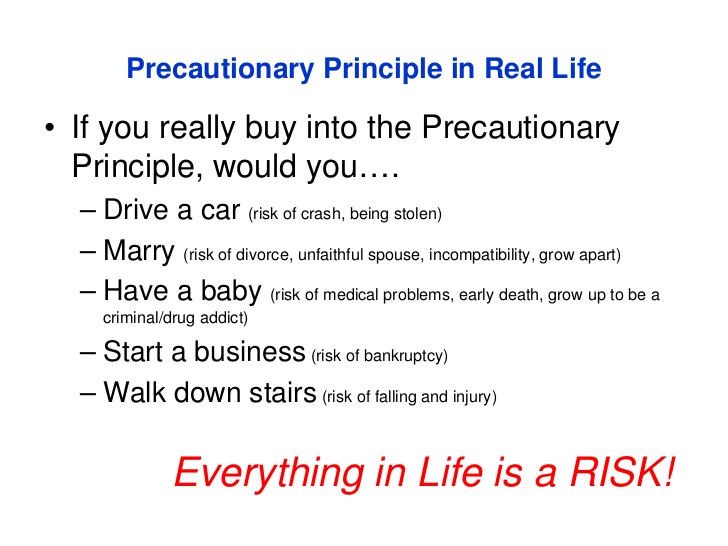

This is the sort of glib response (akin to “so you WANT people to die then?”) that has essentially hijacked all conversation and debate since the start of the Coronavirus outbreak. I didn’t respond, partly because I didn’t have the energy for an argument with a friend (at least Twitter rows tend to be anonymous) and quite frankly, what does one say to this? That we shouldn’t send out children back to school ever again in case one child happens to pass away from any illness or disease? That we should continue in lockdown until we cure death itself?

My concern is that this bizarre way of thinking is commonplace right now for many parents. Locked inside their houses for weeks on end, soaking up an endless stream of Netflix programs, mawkish Instagram feeds and daily Government briefings, convinced that Black Death Mk II has landed outside their front door, paid by the state to stop working and lapping up every rainbow-based hashtag that emerges from “our NHS”, all sense of balance and perspective has vanished. With such an unprecedented paradigm shift, this new state of heightened safety has led many to consider their view on illness and risk for the very first time in their lives and unfortunately the concept of critical thinking has been found lacking. Real life, which has been slowly eroded for many decades, has suddenly been switched off completely overnight and the worst of it is that most people don’t seem to care.

The scary part of all of this is that if the adults in the room have suddenly lost their desire to engage in the outside world, to have meaningful human interaction, to take risks (don’t get me started on the definition of “risk”) and to live their lives in the fullest possible way then what chance do children stand? After all, you can’t miss what you’ve never had.

Historians will look back in bewilderment at this period, noting that it took no more than a month during the spring of 2020 for fearlessness to completely evaporate in society. In its place is a comfortable sense of fear.