IT’S HISTORY

Published 22 Aug 2015The Opium War started as a dispute over trading rights between China and Great Britain. Regular trade between Europe and the Chinese had been ongoing for centuries. But China’s trading restrictions frustrated the British who were eager to supply the Chinese people with the increasingly popular narcotic opium. Circumventing the government’s attempts to ban opium trade by smuggling and bribery, China declared the death sentence on Opium smuggling and refused to compensate British tradesmen for any losses. Furiously, the Brits sent out a fleet to demand compensation and end the Cohong trading monopoly. Fierce battles and attacks on the Chinese coast were followed. Find out all about the First Opium War from Indy in our new episode of Battlefields!

» SOURCES

Videos: British Pathé (https://www.youtube.com/user/britishp…)

Pictures: mainly Picture Alliance

Content:

Lovell, Julia: The Opium War: Drugs, Dreams and the Making of China

Wei, Yuan: Chinese Account of the Opium War

McPherson, Duncan: The First Opium War – The Chinese Expedition 1840-1842

Merwin, Samuel: Drugging a Nation – The Story of China and the Opium Curse

Bernard, William Dallas; Hall, Sir William Hutcheon: Narrative of the Voyages and Services of the Nemesis, from 1840 to 1843.

Isabel Hilton (The Guardian): “The Opium War by Julia Lovell – review”

Perdue, Peter C. (MIT): The First Opium War http://ocw.mit.edu/ans7870/21f/21f.02…» ABOUT US

IT’S HISTORY is a ride through history – Join us discovering the world’s most important eras in IN TIME, BIOGRAPHIES of the GREATEST MINDS and the most important INVENTIONS.» HOW CAN I SUPPORT YOUR CHANNEL?

You can support us by sharing our videos with your friends and spreading the word about our work.» CAN I EMBED YOUR VIDEOS ON MY WEBSITE?

Of course, you can embed our videos on your website. We are happy if you show our channel to your friends, fellow students, classmates, professors, teachers or neighbors. Or just share our videos on Facebook, Twitter, Reddit etc. Subscribe to our channel and like our videos with a thumbs up.» CAN I SHOW YOUR VIDEOS IN CLASS?

Of course! Tell your teachers or professors about our channel and our videos. We’re happy if we can contribute with our videos.» CREDITS

Presented by: Guy Kiddey

Script by: Dan Hungerford

Directed by: Daniel Czepelczauer

Director of Photography: Markus Kretzschmar

Music: Markus Kretzschmar

Sound Design: Bojan Novic

Editing: Markus KretzschmarA Mediakraft Networks original channel

Based on a concept by Florian Wittig and Daniel Czepelczauer

Executive Producers: Astrid Deinhard-Olsson, Spartacus Olsson

Head of Production: Michael Wendt

Producer: Daniel Czepelczauer

Social Media Manager: Laura Pagan and Florian WittigContains material licensed from British Pathé

All rights reserved – © Mediakraft Networks GmbH, 2015

November 18, 2019

The Opium War – Lost in Compensation l HISTORY OF CHINA

August 16, 2019

Rule Britannia, Britannia Rules the Salt | BETWEEN 2 WARS I 1930 Part 1 of 1

TimeGhost History

Published on 15 Aug 2019After the Great War, the British empire is at its peak in terms of population and size. However, resistance against colonialism is starting to brew in the British colonies and dominions.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Spartacus Olsson and Francis van Berkel

Directed by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post-Production Director: Wieke Kapteijns

Research by: Francis van Berkel

Edited by: Wieke Kapteijns

Sound design: Iryna DulkaPortrait Colorizations by Daniel Weiss.

Sources: National Portrait Gallery, Library and Archives Canada, Jenny Scott

A TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

June 1, 2019

QotD: Orwell’s fear of private monopolies

Professor Hayek is also probably right in saying that in this country the intellectuals are more totalitarian-minded than the common people. But he does not see, or will not admit, that a return to “free” competition means for the great mass of people a tyranny probably worse, because more irresponsible, than that of the State. The trouble with competitions is that somebody wins them. Professor Hayek denies that free capitalism necessarily leads to monopoly, but in practice that is where it has led, and since the vast majority of people would far rather have State regimentation than slumps and unemployment, the drift towards collectivism is bound to continue if popular opinion has any say in the matter.

George Orwell, “The Road to Serfdom by F.A. Hayek / The Mirror of the Past by K. Zilliacus”, Observer, 1944-04-09.

May 22, 2019

May 1, 2019

To the surprise of nobody, Ontario’s cannabis stores are still struggling

The Ontario government created a tightly restricted retail market regime for newly legal cannabis sellers, with a tiny number of licenses issued and highly bureaucratic “safeguards” for the retailers’ guidance and control. The city of Toronto, for example, with a population in the 2.7 million range, was allocated a whopping five stores. Only one of those stores was allowed to open on the first day of legal retail sales, and today there are three in operation, despite penalties and potential loss of licenses at stake for those who haven’t opened yet. The chorus of complaints from would-be customers has not diminished much, if at all since day one:

With legalization day long come and gone (and the euphoria of being able to spark a joint in public gone with it), the turtle-paced roll-out of Toronto’s weed retail scene goes to show the government and the OCS have some work to do before purchasing legal weed can be completely glitch-free (and lineup free, too).

Here are a few of the lows of getting high, courtesy of Toronto weed stores since buying pot became legal.

Weed prices are up

According to Statistics Canada, prices for weed have steadily been on the up and up since legalization last year.While Nova Cannabis is trying to tackle its biggest competitor (illicit weed stores) with Black Market Buster deals, people who are buying their cannabis from the OCS are now paying an average of about $9.99 per gram—that’s roughly $3 more than those buying their bud from illegal stores.

Black market weed is still thriving

There’s still around 20 illegal dispensaries operating in the city, and at least 100 illegal marijuana delivery services. Why? See above: unlicensed weed stores are significantly cheaper than the legal ones, and loopholes in the city’s laws allow them to operate pretty much undisturbed, save for the occasional raids.[…]

OCS packaging

Aside from the fact every product coming out of the OCS comes triple-wrapped in excessive, sometimes non-recyclable polypropylene packaging, the containers are just plain confusing.Lack of packaging standards means your order comes in all shapes and sizes, regardless of whether you’re getting bud or pre-rolled joints, which is as confusing for buyers as it is for those behind the counter.

And that doesn’t even include the even louder chorus of complaints about the quality of the legal product…

April 29, 2019

Cannabis stores struggling against cheaper black market weed outlets

In a rational world, a license to sell legal cannabis from a storefront where you have almost a legal monopoly would be a license to print money — the market demand is very clearly real and widespread. Yet Toronto’s legal cannabis stores are still suffering:

How much would it suck to go through all the trouble of opening a legal weed store, only to have dozens of people do the exact same thing without paying for permits, inspections or meeting any sort of government regulations?

How much would it suck to then watch these people not only get away with their illegal operations, but do so while luring your customers away with cheaper prices?

Probably as much as it would suck to sink years of your life into building a retail cannabis business and then learning that only 25 of such stores could exist in all of Ontario — and that the owners of those stores would be chosen at random.

It’s been nearly one month since Doug Ford’s PC government allowed the first wave of brick and mortar retail cannabis stores to open across Ontario. Three have launched so far in Toronto, where five licenses were issued in total, but many consumers aren’t pleased with consistently long lines and higher (than pre-legalization) prices.

So, like the rest of Canada, Toronto continues to buy black market weed.

Roughly 20 unlicensed dispensary storefronts are still up and running across the city as of April 25, in addition to more than 100 illegal marijuana delivery services.

You can find them all on WeedMaps, a popular online cannabis community that’s been listing these types of businesses for adult consumers in North America since 2008.

It’s not that police and bylaw enforcement officers can’t find these illicit dispensaries — I mean, operators are advertising their locations and menus online for all to see.

The problem is that no level of government can (or will) shut them down for very long.

“Why not?” you ask? Well, it’s complicated.

April 11, 2019

What happens if you block access to all of Google’s IP addresses?

The answer is … not a lot, or at least not quickly. So many companies use Google’s services in the background that even if you can get a particular site to work for you, it’ll very likely be as slow as a mid-90’s dial-up connection. Stephen Green reports on someone’s live experiment with a Google-less internet:

Behind the scenes, [Gizmodo’s Kashmir] Hill’s specialty VPN blocked her devices from trying to ping Google’s servers more than 15,000 times — in just the first few hours. After a week, it had stopped more than 100,000 attempts to share data with Google. And to repeat, this is after Hill had stopped using any of Google’s apps or services. The company has its tendrils all throughout the internet.

As Hill describes the process in her report to Gizmodo:

I migrate my browser bookmarks over to Firefox (made by Mozilla).

I change the default search engine on Firefox and my iPhone from Google — a privilege for which Google reportedly pays Apple up to $9 billion per year — to privacy-respecting DuckDuckGo, a search engine that also makes money off ads but doesn’t keep track of users’ searches.

I download Apple Maps and the Mapquest app to my phone…

I switch to Apple’s calendar app.

I create new email addresses on Protonmail and Riseup.net (for work and personal email, respectively) and direct people to them via autoreplies in Gmail.

Hill did literally everything an internet-connected human being can do to disconnect themselves from Google. But you don’t have to be a Google customer in order to have the company garner 100,000 little bits of data about you every single week. Or as Hill herself says, “Google, like Amazon, is woven deeply into the infrastructure of online services and other companies’ offerings, which is frustrating to all the connected devices in my house.”

The fact is, you aren’t Google’s customer: You and your data are Google’s product, served up on an electronic platter to advertisers and God-Only-Knows-Who-Else… even if, like me, you’ve boycotted all of the company’s little data-sniffing products.

As a libertarian, I have philosophical issues with the whole idea of antitrust. But when a company grows so big and so pervasive that you can’t avoid becoming its tool — even when going to the extreme lengths Hill went through — then I can draw only one conclusion, expressed in three words.

Break. Them. Up.

March 3, 2019

QotD: Four ways to corporate monopoly

1. Proprietary technology. This one is straightforward. If you invent the best technology, and then you patent it, nobody else can compete with you. Thiel provocatively says that your technology must be 10x better than anyone else’s to have a chance of working. If you’re only twice as good, you’re still competing. You may have a slight competitive advantage, but you’re still competing and your life will be nasty and brutish and so on just like every other company’s. Nobody has any memory of whether Lycos’ search engine was a little better than AltaVista’s or vice versa; everybody remembers that Google’s search engine was orders of magnitude above either. Lycos and AltaVista competed; Google took over the space and became a monopoly.

2. Network effects. Immortalized by Facebook. It doesn’t matter if someone invents a social network with more features than Facebook. Facebook will be better than their just by having all your friends on it. Network effects are hard because no business will have them when it first starts. Thiel answers that businesses should aim to be monopolies from the very beginning – they should start by monopolizing a tiny market, then moving up. Facebook started by monopolizing the pool of Harvard students. Then it scaled up to the pool of all college students. Now it’s scaled up to the whole world, and everyone suspects Zuckerberg has somebody working on ansible technology so he can monopolize the Virgo Supercluster. Similarly, Amazon started out as a bookstore, gained a near-monopoly on books, and used all of the money and infrastructure and distribution it won from that effort to feed its effort to monopolize everything else. Thiel describes how his own company PayPal identified eBay power sellers as its first market, became indispensible in that tiny pool, and spread from there.

3. Economies of scale. Also pretty straightforward, and especially obvious for software companies. Since the marginal cost of a unit of software is near-zero, your cost per unit is the cost of building the software divided by the number of customers. If you have twice as many customers as your nearest competitor, you can charge half as much money (or make twice as much profit), and so keep gathering more customers in a virtuous cycle.

4. Branding. Apple is famous enough that it can charge more for its phones than Amalgamated Cell Phones Inc, even for comparable products. Partly this is because non-experts don’t know how to compare cell phones, and might not trust Consumer Reports style evaluations; Apple’s reputation is an unfakeable sign that their products are pretty good. And partly it’s just people paying extra for the right to say “I have an iPhone, so I’m cooler than you”. Another company that wants Apple’s reputation would need years of successful advertising and immense good luck, so Apple’s brand separates it from the competition and from the economic state of nature.

Scott Alexander, “Book Review: Zero to One”, Slate Star Codex, 2019-01-31.

January 14, 2019

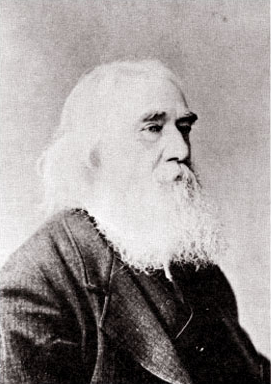

Lysander Spooner and the US postal system

Naomi Mathew recounts the battle between anarchist Lysander Spooner and the United States Post Office:

This is a story about a philosopher, entrepreneur, lawyer, economist, abolitionist, anarchist — the list goes on. As his obituary summarizes, “To destroy tyranny, root and branch, was the great object of his life.” Although he is rarely included in mainstream history, Lysander Spooner was an anarchist who didn’t merely preach about his ideas: He lived them. No example illustrates this better than Spooner’s legal battle against the US postal monopoly.

Born in 1808 in Athol, Massachusetts, Lysander Spooner was raised on his parent’s farm and later moved to Worcester to practice law. Eventually, he found himself in New York City, where business was booming — but not for the Post Office.

The Postal System of the 1840s

In Spooner’s day, government subsidized the cost of building infrastructure used for mail routes. Postage rates paid for these subsidies, which in turn made the rates expensive. For example, in 1840 it cost 18.75 cents, over a quarter of a day’s wages, to send a letter from Baltimore to New York.

Corruption was another issue facing the post office. Positions appeared to change after each election cycle, indicating political cronyism. Congress was also under pressure from the coach contractor lobby, and favorable postage routes were often given to contractors with political connections. Thanks to a legal monopoly it had enjoyed since the Confederation, the Post Office remained the sole legal mail business despite its skyrocketing costs and corruption.

In his book Uncle Sam, The Monopoly Man, William Wooldridge describes how high postal costs led some to defy postal laws: Traveling individuals doubled as temporary, private postmen. By the 1840s, these illicit services were chipping into government revenues. Eventually, a court ruled it legal for individuals (but not companies) to carry mail. As a result, underground mail enterprises sprung up. Agents covertly used the existing rails, coaches, and steamboats to transport letters. It is estimated that in 1845, a third of all letters were transported by private mail firms.

November 26, 2018

England: South Sea Bubble – Too Big to Fail – Extra History – #2

Extra Credits

Published on 14 Mar 2015Support us on Patreon! http://bit.ly/EHPatreon

____________Frustrated at every turn by the Whig-controlled Bank of England, Harley and Blunt decide to start their own institution: a trading company that will exchange government debt for stock shares. This new South Sea Company will have a monopoly on trade in the rich new lands of South America, but all the ports there are controlled by Spain, with whom Britain is at war. So Blunt pushes the country into a premature and unfavorable peace with Spain, enlisting famous authors to write his propaganda and convincing Queen Anne herself to tip the balance of Parliament in his favor. After the queen dies and the government changes hands, Blunt kicks Harley and his Tory leaders out of the company. He manages to bring King George I himself on board as a ceremonial leader, linking the success of the South Sea Company with the reputation of the monarchy. But while his maneuvering inflates the value of his company’s stock, it’s never produced anything close to the amount of money he’s convinced people to invest in it.

August 15, 2018

QotD: State economic intervention in theory and practice

The economic theory: the state intervenes in the economy in order to prevent free-riding – in order to internalize externalities – in order to better ensure that all private parties pay the full marginal costs of their activities, and that all private parties reap the full marginal benefits of their activities – in order to promote competition – in order to protect the weak from the strong.

The political reality: the state intervenes in the economy in order to promote free-riding – in order to externalize costs and benefits that the market has reasonably internalized – in order to better ensure that politically powerful private parties escape the full marginal costs of their activities, and that politically disfavored groups be stripped of much of the marginal benefits of their activities – in order to promote monopoly – in order to render some people weak who are then pillaged by the strong.

Don Boudreaux, “Economists’ Normative Case for Government Intervention is a Very Poor Positive Theory of that Intervention”, Café Hayek, 2016-09-26.

July 7, 2018

QotD: Crony rules

The direction [by government] of economic activity thus necessarily involves discrimination between persons, the creation of monopoly and privilege, while the aim of the Rule of Law is the abolition of all privilege, be it in favor of the strong or of the weak. And it is no less fatal to freedom if exemption from general legal rules is granted to the weak than when it is granted to the strong. Once the door is opened to differentiation on the ground of deserts or needs, it will be arbitrary will instead of objective rule which will govern men.

F.A. Hayek, “The Political Ideal of the Rule of Law”, 1955.

March 29, 2018

January 13, 2018

The common factor of the Net Neutrality fight and the EpiPen price gouging scandal

Lili Carneglia explains what these two examples of “capitalist excess” are actually the result of regulatory failures:

Without net neutrality, regulations that prevent internet service providers (ISPs) from charging more for priority speeds and higher bandwidth-use sites would disappear. Most Americans are pretty confused by the revised rules but highly skeptical that this action could have any benefits. Many people, especially those living in the rural south where choices are limited, feel like these companies have been taking advantage of their customers for years, and loosening regulatory constraints on these companies seems like a terrible idea.

Net neutrality was a regulatory policy set under the Obama administration in 2015 that mandated ISPs to treat the internet like other utilities, such as highways and railroads, under laws established before most people had TVs. Under these rules, companies must act as neutral gateways to the internet without controlling the content or the speed of the content that passes through that gateway. Supporters of the rule argue that these regulations ensure the free flow of information, while those against the policy see net neutrality as a misapplication that stifles an industry that is more dynamic than other public utilities.

[…]

Yes, a handful of industry giants can and have abused their market power. Most consumers have limited ISPs to choose from in a given area, and options are more limited outside of big cities, where “three-quarters of American homes have no competitive choice for the essential infrastructure for 21st-century economics and democracy,” according to the former FCC chairman Tom Wheeler. It is important to consider how these circumstances came about before deciding that federal regulation might help consumers.

Governments, by and large, prefer to have fewer players in a given market as it makes that market easier to regulate, and the easiest market to regulate is a monopoly. When cable networks were beginning to spread across North America, many local governments were persuaded that a single cable provider would be the best option for their jurisdiction and the broadband internet market that came later was heavily shaped by the already carved-up markets for cable TV. For many, there were no competitive options because the local government had precluded the chance of competition for their already entrenched cable monopoly (or, in a few cases, tight oligopoly).

Competition is the best answer to monopolistic abuse of customers … if you get shitty service from the Blue Cable Company, you’ll be more likely to switch to the Red Cable Company. If you only have Red and Blue to choose from, your leverage is small, but if you have a full rainbow of competing options, Red and Blue are forced to make their services at least comparable to what Orange and Pink and Magenta are offering, or they lose too many customers. If there’s no threat of a competitor scooping up unhappy customers, there’s no incentive for the existing company to do more than the absolute minimum to keep customer complaints down to a dull roar. The customer’s only recourse — other than giving up the service or moving to a different jurisdiction — is to complain to the regulator.

The base problem with Mylan’s EpiPen price gouging is the same: an effective monopoly supported by the government:

The arguments against net neutrality repeals center around fears about what producers will do without regulation since they have significant market power and the ability to raise prices to levels that would not be sustainable under more competitive conditions. The concern about increased internet prices is similar to what happened in 2016 when a pharmaceutical company with market power, Mylan, increased the price of life-saving EpiPens by about 400 percent.

The “greedy” pharmaceutical companies were hung out to dry as Congress berated Mylan representatives in hearing after hearing. There were similar cries of outrage and demands that the federal government do something to prevent such selfish price-gouging, similar to what many consumers fear ISPs will do absent regulations.

Even (supposed) free-market advocates started supporting further regulation during the EpiPen debate. Most notably, then fiscal hawk representative and now Trump budget director Mick Mulvaney, defended further market intervention on the condition that, “If you want to come to the state capitols and lobby us to make us buy your stuff, this is what you get. You get a level of scrutiny and a level of treatment that would ordinarily curl my hair.”

However, in all of those hearings, almost no one bothered to unearth the problem that Mulvaney hinted at: Why was Mylan able to increase that price in the first place? Government intervention. Burdensome FDA regulations and other laws pressuring public schools to buy the drug essentially granted Mylan a monopoly. It was as misguided then as it is now to think that these same institutions can be trusted to clean up the mess they created.

Mylan had no effective competition, so there was nothing to stop the price gouging until it got so bad that even the regulator had to pay attention. If there were other pharmaceutical companies allowed to compete, do you think Mylan would have risked jacking up the price only to watch their competitors gaining market share?

Scott Alexander explained the Mylan monopoly quite expansively in 2016.

December 26, 2017

What makes a diamond priceless? – James May’s Q&A (Ep 7) – Head Squeeze

BBC Earth Lab

Published on 14 Feb 2013James May imparts his knowledge to let us know that diamonds aren’t that rare after all.

James May’s Q&A:

With his own unique spin, James May asks and answers the oddball questions we’ve all wondered about from ‘What Exactly Is One Second?’ to ‘Is Invisibility Possible?’