As with the US or Canadian government’s debt, not all debt is held at the federal level. It may take some digging to discover what the actual debt levels might be, but it’s possible. In China, however, as local governments are forbidden to issue bonds or to borrow from banks, they’ve had to become extremely creative in finding ways to borrow money for their pet projects. Not just creative — at least in some cases — legally dubious:

About 85% of Liaoning province’s 184 financing companies defaulted on debt service payments in 2010 according to a report from the province’s Audit Office. The report also noted that 120 of these borrowers, de facto government agencies, operated at a loss last year.

Since 1994, provinces and lower-tier governments have not been permitted to issue bonds or borrow from banks. Despite the strict prohibition, their debt has skyrocketed as local officials incurred obligations through LGFVs, local government finance vehicles. The central government’s National Audit Office said these companies, at the end of last year, had taken on 10.7 trillion yuan of debt. No one, however, knows the true amount of LGFV indebtedness, and some have calculated the real amount to be more than double the official figure.

Why the disagreement as to the amount of debt? Local governments have gone out of their way to hide borrowings, perhaps in part because of their doubtful legality. As famed economic journalist Hu Shuli points out, new local officials sometimes do not know the extent of obligations left by their predecessors. There have been a number of stratagems employed, from the issuance of illegal government guarantees to the transfer of funds in roundabout routes.

H/T to Jon, my former virtual landlord, for the link.

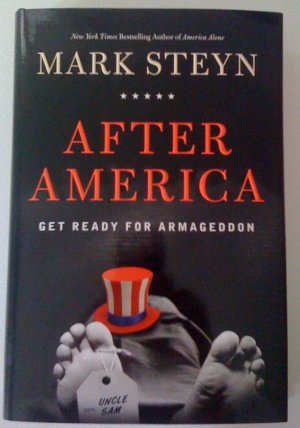

The trick in this business is not to be right too early. A week ago I released my new book — the usual doom ‘n’ gloom stuff — and, just as the sensible prudent moderate chaps were about to dismiss it as hysterical and alarmist, Standard & Poor’s went and downgraded the United States from its AAA rating for the first time in history. Obligingly enough they downgraded it to AA+, which happens to be the initials of my book: After America. Okay, there’s not a lot of “+” in that, but you can’t have everything.

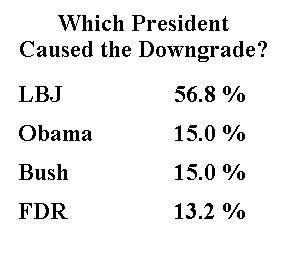

The trick in this business is not to be right too early. A week ago I released my new book — the usual doom ‘n’ gloom stuff — and, just as the sensible prudent moderate chaps were about to dismiss it as hysterical and alarmist, Standard & Poor’s went and downgraded the United States from its AAA rating for the first time in history. Obligingly enough they downgraded it to AA+, which happens to be the initials of my book: After America. Okay, there’s not a lot of “+” in that, but you can’t have everything. Well, it turns out that Social Security is a relatively minor part of the problem, so even though President Roosevelt’s policies exacerbated and extended the Great Depression, the program he created is only responsible for a small share of the fiscal crisis. To give the illusion of scientific exactitude, let’s assign FDR 13.2 percent of the blame.

Well, it turns out that Social Security is a relatively minor part of the problem, so even though President Roosevelt’s policies exacerbated and extended the Great Depression, the program he created is only responsible for a small share of the fiscal crisis. To give the illusion of scientific exactitude, let’s assign FDR 13.2 percent of the blame.