You see? This is what’s wrong with private enterprise, especially in California. Those wimps aren’t willing to invest in something that will “pay for itself” ten times over in a “very short period of time”. That’s why all the greatest economic advances have come from over-aged students, business council speechifiers, bureaucrats, and career apparatchiks!

If you believe calling your opponents names is a sign that you have lost the argument, then this new high-speed rail commercial from the California Alliance for Jobs — in which unexpectedly macho proponents of the

$41 billion,$110 billion,$98.5 billion, $68.4 billion high-speed rail project deride skeptics as “wimps” — is pretty much the end of the line […]What reveals the intellectual bankruptcy of the high-speed rail project is not the insults but that what is supposed to be a rousing propaganda piece comes off like an orientation video for new hires at a failing company.

The video’s cast includes

hacksrespected citizens from Operating Engineers Local 3, including Alliance for Jobs Executive Director Jim Earp, along with leaders from what’s usually referred to as the “business community” whose skill sets cluster around serving on business councils rather than doing any actual business. There’s also a career apparatchik and the founder of the “I Will Ride” Student Coalition, who is apparently a UC Merced senior but looks at least a decade too old.[. . .]

Again, why not just claim the Fresno-Bakersfield line will end up carrying 38 million people, the entire population of California, every day? It would be no less accurate than the current claims, which have been made with no data on ticket costs, no comparative studies of existing bullet-train ridership, or anything else that can reasonably pass for due diligence.

Oh, and nobody actually knows where the bullet train will go to or from. (Past, present and possibly future candidates include Corcoran, Borden, Fresno, Anaheim, Los Angeles, San Francisco, and some guy named Dave’s rec room.) You wouldn’t build a patio with the amount of planning that’s gone into the high-speed rail project.

To put the headline into a bit of perspective, note that only one high speed rail line in the world is profitable. This is an old hobby horse of mine and I’ve posted about High Speed Railways a few times before.

Update: And to answer the question about why parts of Europe, Japan, and China have high speed rail systems and neither Canada nor the United States do, here’s a brief overview I wrote last year:

The best place to build a high speed rail system for the US would be the Boston-New York-Washington corridor (aka “Bosnywash”, for the assumed urban agglomeration that would occur as the cities reach toward one another). It has the necessary population density to potentially turn an HSR system into a practical, possibly even profitable, part of the transportation solution. The problem is that without an enormous eminent domain land-grab to cheat every land-owner of the fair value of their property, it just can’t be done. Buying enough contiguous sections of land to connect these cities would be so expensive that scrapping and replacing the entire navy every year would be a bargain in comparison.

The American railway system is built around freight: passenger traffic is a tiny sliver of the whole picture. Ordinary passenger trains cause traffic and scheduling difficulties because they travel at higher speeds, but require more frequent stops than freight trains, and their schedules have to be adjusted to passenger needs (passenger traffic peaks early to mid-morning and early to mid-evening). The frequency of passenger trains can “crowd out” the freight traffic the railway actually earns money on.

Most railway companies prefer to avoid having the complications of carrying passengers at all — that’s why Amtrak (and VIA Rail in Canada) was set up in the first place, to take the burden of money-losing passenger services off the shoulders of deeply indebted railways. Even after the new entity lopped off huge numbers of passenger trains from its schedule, it couldn’t turn a profit on the scaled-down services it was offering.

Ordinary passenger trains can, at a stretch, share rail with freight traffic, but high speed trains cannot. At higher speeds, the actual construction of the track has to change to deal with the physical problem of safely guiding the fast passenger trains along the rail. Signalling must also change to suit the far-higher speeds — and the matching far-longer safe braking distances. High speed rail lines cannot be interrupted with grade crossings, for the safety of passengers and bystanders, so additional bridges and tunnels must be built to avoid bringing road vehicles and pedestrians too close to the trains.

In other words, a high speed railway line is far from being just a faster version of what we already have: it would have to be built separately, to much higher standards of construction.

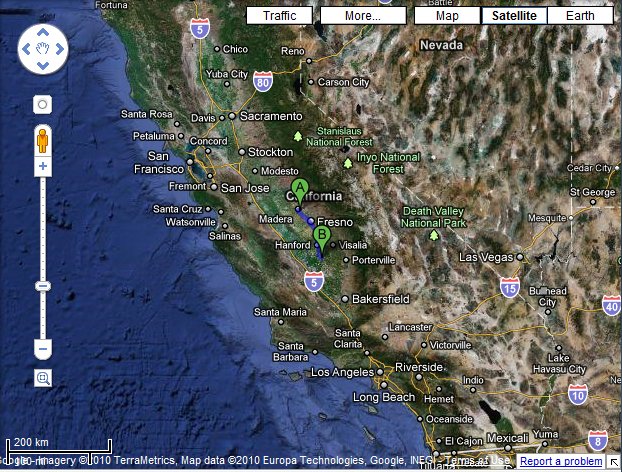

Getting back to the California HSR line; it goes from A to B on this map:

Okay, you think, at least Fresno will get some snazzy slick rail service . . . except this section will be built but not operated until further connecting sections are built . . . at a later date. Maybe. It will be the track, including elevated sections through Fresno, and the physical right-of-way, but no electrical system to power the trains; but that’s fine, because the budget doesn’t include any actual trains.