The male-warrior hypothesis has two components:

- Within a same-sex human peer group, conflict between individuals is equally prevalent for both sexes, with overt physical conflict more common among males

- Males are more likely to reduce conflict within their group if they find themselves competing against an outgroup

The idea is that, compared with all-female groups, all-male groups will (on average) display an equal or greater amount of aggression and hostility toward one another. But when they are up against another group in a competitive situation, cooperation increases within male groups and remains the same among female groups.

Rivalries with other human groups in the ancestral environment in competition for resources and reproductive partners shaped human psychology to make distinctions between us and them. Mathematical modeling of human evolution suggests that human cooperation is a consequence of competition.

Humans who did not make this distinction — those who were unwilling to support their group to prevail against other groups — did not survive. We are the descendants of good team players.

It used to be accepted as a given that males were more aggressive toward one another than females. This is because researchers often used measures of overt aggression. For instance, researchers would observe kids at a playground and record the number of physical altercations that occurred and compare how they differed by sex. Unsurprisingly, boys push each other around and get into fights more than girls.

But when researchers expanded their definition of aggression to include verbal aggression and indirect aggression (rumor spreading, gossiping, ostracism, and friendship termination) they found that girls score higher on indirect aggression and no sex differences in verbal aggression.

The most common reasons people give for their most recent act of aggression are threats to social status and reputational concerns.

Intergroup conflict has been a fixture throughout human history. Anthropological and archaeological accounts indicate conflict, competition, antagonism, and aggression both within and between groups. But violence is at its most intense between groups.

A cross-cultural study of 31 hunter-gatherer societies found that 64 percent engaged in warfare once every 2 years.

Men are the primary participants in such conflicts. Human males across societies are responsible for 90 percent of the murders and make up about 80 percent of the victims.

The evolution of coalitional aggression has produced different psychological mechanisms in men and women.

Just as with direct versus indirect aggression, though, homicide might be easier to observe and track with men. When a man beats another man to death, it is clear what has happened. Female murder might be less visible and less traceable.

Here’s an example.

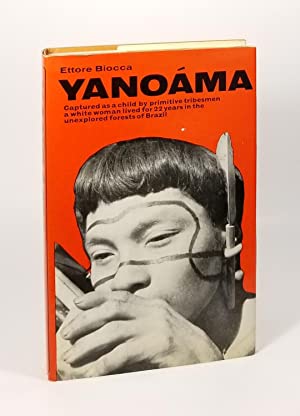

There’s a superb book called Yanoama: The Story of Helena Valero. It’s a biography of a Spanish girl abducted by the Kohorochiwetari, an indigenous Amazonian tribe. She recounts the frequent conflicts between different communities in the Amazon. After decades of living in various indigenous Amazonian communities, Valero manages to leave and describes her experiences to an Italian biologist, who published the book in 1965.

In the book, Helena Valero describes arriving in a new tribe. Some other girls were suspicious of her. One girl gives Valero a folded packet of leaves containing a foul-smelling substance. She tells Valero that it’s a snack, but that if she doesn’t like it she can give it to someone else. Valero finds the smell repulsive and sets it aside. Later, a small child picks up the leaf packet, takes a bite, and falls deathly ill. The child tells everyone that he got the leaf packet from Valero. The entire community accuses Valero of trying to poison the child, and banishes her from the tribe, with some firing arrows at her as she runs deep into the forest.

The girl who gave Valero the poisonous leaf packet formed a win-win strategy in her quest to eliminate her rival:

- Valero eats the leaf packet and dies

- Or she gives it to someone else who dies and she is blamed for it, followed by being ostracized or killed by the community

This is some high-level indirect aggression. Few men would ever think that far ahead (supervillains in movies notwithstanding). For most men, upon seeing a newcomer they view as a potential rival, they would just physically challenge him. Or kill him in his sleep or something, and that would be that.

Point is, this girl would have been responsible for Valero’s demise had she died. But no one would have known. If a man in the tribe, enraged at the death of the small child, had killed Valero, then he would be recorded as her killer. Or if Valero had been mauled by a jaguar while fleeing, then her death wouldn’t have been considered a murder.

Interestingly, the book implies that Valero was viewed as relatively attractive by the men, which likely means the girl who attempted to poison her was also relatively attractive (because she viewed her as a rival). Studies demonstrate that among adolescent girls, greater attractiveness is associated with greater use of aggressive tactics (both direct and indirect) against their rivals.