Ted Gioia clearly isn’t a Facebook fan — and I sympathize, having lost access to my Facebook account a few years ago — but it’s not just people like us that have contributed to Facebook’s epic decline:

Most companies fail because of competition. They simply aren’t fast enough or smart enough to keep up with the marketplace.

But the big web platforms aren’t like that.

In many instances, they are quasi-monopolies. They are so big and powerful that they hardly need to worry about competition.

After all, who can match Google for search? Who can beat Amazon for online shopping? Who does more to keep you connected with family and friends than Facebook? Who helps you clean out the junk in your garage better than eBay?

But even the most dominant players can falter. There was a point in living memory when Sears controlled 30% of all retail spending in the US. I’m not exaggerating: three out of every ten dollars were spent at Sears.

Sears once operated 3,500 stores. Today only 22 are left. Many of my readers have never seen the inside of a Sears store.

This happened because Sears was so big that it didn’t need to worry about competitors.

That sounds impossible. How can you fail by being too powerful? But this has happened in many instances, even on the web. There was a day when Yahoo was the leader in search. There was a day when MySpace was the dominant social network. There was a day when Tumblr was the place to share photos.

There was even a day when the two companies in total control of your access to the Internet were called Netscape and America Online.

Not anymore.

This has happened before and will happen again. The bigger they are, the harder they fall.

[…]

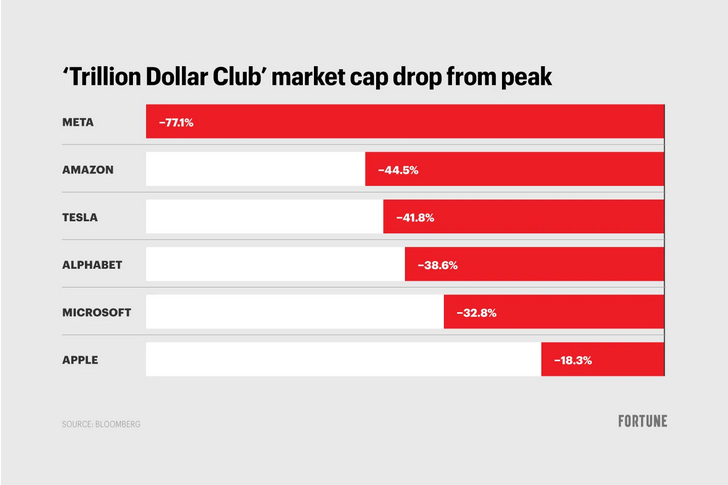

The situation at Facebook is now uglier than MC Hammer’s wardrobe closet. Meta is the worst performing stock in the S&P 500 this year. In other words, there were 499 other companies in the composite that did better — and this was a tough year all around in financial markets.

Mark Zuckerberg has personally lost more than $100 billion. In fact, he lost $11 billion in a single day. Has that ever happened before in human history? Almost exactly 12 months earlier, I’d written an article entitled “Meta Is for Losers” — but even I never envisioned losses on this scale,

Of course, there are many losers in this story — including the 11,000 workers who got fired a few days ago.

What’s going on?

You probably think that this is the result of Zuckerberg’s fool’s bet on the Metaverse. That’s what everybody is saying. But as we shall see, the Metaverse is just a symptom not a cause.

I can actually explain the problem in one sentence:

Instead of serving users, the dominant company decides it’s better to control them.

This would never occur to a small business. The owner of your neighborhood deli or gas station has no grand plans to control people — for the simple reason that this is an impossible dream.

That’s the reason why they say: “The customer is always right.” It’s not because the customer isn’t often wrong. Customers are frequently wrong — go listen to them sometimes and cringe at the stuff they demand. But if you’re in business, you must act as if they’re right even when they aren’t. And you do learn things by listening, even (or especially) when their demands are excessive.

By the way, you succeed by listening in every sphere of your life — starting at home.

There’s a good reason why students at hospitality school are told never to use the word never — or “no” or “can’t” or “impossible” — when talking to clientele. Instead of saying: “No way, dude, we’re not putting mayonnaise on your pizza, that’s disgusting”, you offer something positive:

I wish we could do that, dude, because it does sound super tasty — but I will put extra mozzarella on your slice, and our high temperature oven will give it a kind of mayo texture.

That’s how you roll in retail.

But at Facebook, the customer is always wrong.