Colby Cosh tries to be nice about the Green Party and NDP platforms:

The contrast between the parties’ platforms is interesting: the Green ideas induce slightly more sheer nausea of the “literally everything in here is eye-slashingly horrible” kind, but at the same time there is a consoling breath of radicalism pervading Vision Green, a redeeming Small Is Beautiful spirit. At least, one feels, their nonsense is addressed to the individual. A typical laissez-faire economist would probably like the Green platform the least of the four on offer from national parties, but the Greens may be the strongest of all in advocating the core precept that prices are signals. At one point, denouncing market distortions created by corporate welfare, Vision Green approvingly quotes the maxim “Governments are not adept at picking winners, but losers are adept at picking governments.” (The saying is attributed to a 2006 book by Mark Milke of the Fraser Institute, but a gentleman named Paul Martin Jr. had uttered a version of it as early as 2000.)

That has always been the biggest failing of the regulatory view of politics: no matter how carefully you select the regulators, the regulated have many, many ways to (eventually) suborn them. Regulatory capture is the most common result, as the regulators become more closely attuned to the needs of their “charges” and work to protect them from competitors and social and technological change. What may have started as an attempt to rein-in over powerful industrial interests slowly becomes a de facto arm of government protection over the existing major players in that industry.

The New Democratic platform is more adult and serious than the Greens’ overall, which comes as no surprise. But it occurs to me, not for the first time this year, how much some folks love “trickle-down politics” when they are not busy denouncing “trickle-down economics”. How does Jack Layton hope to remedy the plight of the Canadian Indian? By “building a new relationship” with his politicians and band chiefs. How does he propose to improve the lot of artists? By flooding movie and TV producers, and funding agencies, with money and tax credits. He’ll help parents by giving money to day care entrepreneurs; he’ll sweeten the pot for “women’s groups” and “civil society groups”. One detects, perhaps mostly from prejudice, a suffocating sense of system-building, of unskeptical passion for bureaucracy, of disrespect for the sheer power of middlemen to make value disappear.

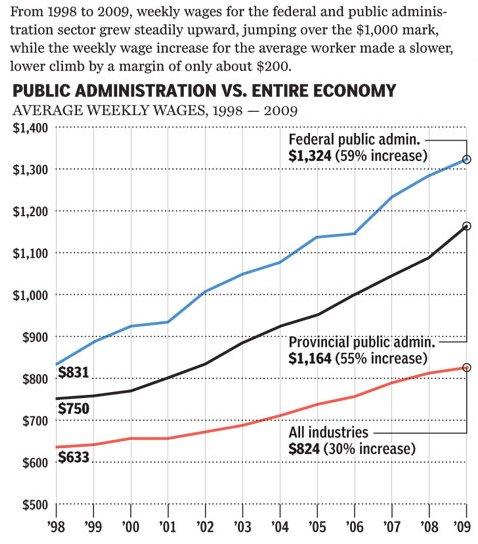

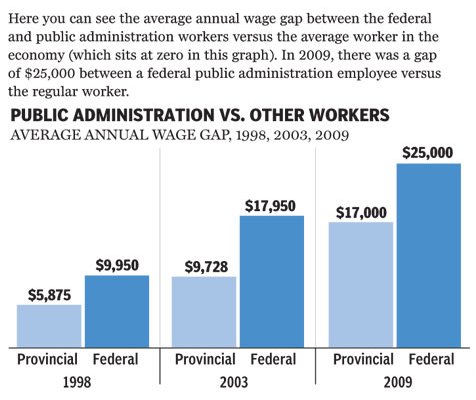

It’s useful to check who would be the actual beneficiaries of this kind of increased bureaucratization of life — and we’re generally not talking about the putative winners, but the actual ones — the ones who will staff the new agencies, bureaux, and commissions, the ones who will provide consulting services, and the ones who will study the results.

The Greens get a big thumbs-up from this corner for this particular clause of their platfom:

In 2008, according to the Treasury Board, Canada spent $61.3 million targeting illicit drugs, with a majority of that money going to law enforcement. Most of that was for the “war” against cannabis (marijuana). Marijuana prohibition is also prohibitively costly in other ways, including criminalizing youth and fostering organized crime. Cannabis prohibition, which has gone on for decades, has utterly failed and has not led to reduced drug use in Canada.

The Greens promise that cannabis would be removed from the schedule of illegal drugs and that the growth and sale of cannabis products would be regularized (and taxed), although with the usual shibboleth about the market needing to be restricted to small producers. If you’re making the stuff legal to sell, you shouldn’t try to micro-manage the product and producers you’re moving into the legal marketplace.