Business schools, which focus naturally on the fortunes of the individual firm, teach that “competitiveness” is all. They believe it follows that government, not price signals from the world economy, should choose winners. The economists in the business schools have had hard time persuading their colleagues that the pattern of trade and specialization is determined, on the contrary, by “comparative advantage,” which has nothing to do with absolute advantage, and which professors of management and of history regularly mistake it for. Pakistan exports clothing to the United States, the economists preach (without much effect on editorial boards and politicians), not because it is better per hour at making socks and sweaters but because it is comparatively better at them than at making jet airplanes and farm tractors.

Deirdre McCloskey, Bourgeois Equality, 2016.

November 30, 2019

QotD: Comparative advantage

July 27, 2018

“Tariffs are the classic example of government interventions with concentrated benefits and dispersed costs”

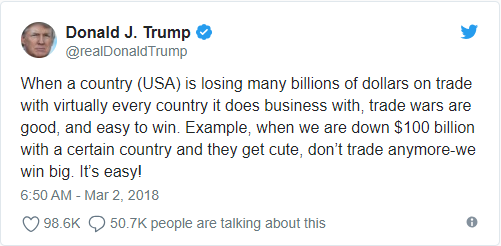

Robert Higgs on what he describes its supporters as “waging the trade war to end all trade wars”:

… even as Trump spouts venerable fallacies to justify and seek support for his destructive trade policies and related ad hoc actions, he and his supporters have sometimes offered a strange defense of their tactics: they purport to be seeking, at the end of the game, universal free trade, a world in which all countries have abandoned tariffs, quotas, subsidies, and other government intrusions in international exchange. In Wilsonian terms, they claim to be waging the trade war to end all trade wars. The idea is that by raising U.S. tariffs, they will induce other governments to lower and ultimately eliminate their own.

Of course, this rationale may be nothing more than wily claptrap, tossed out as a rhetorical bone to Republicans who favor freer trade. The administration’s actions to date certainly give no indication that it is aiming at global free trade. On the contrary. So the Wilsonian gambit may consist of nothing but hot air.

But if Trump and his trade advisers actually take this tactic seriously, they are deluding themselves.

First, and surely obviously, U.S. tariff increases will not induce other governments to lower their own, but to raise them, as the EU, China, Mexico, Canada, and other trading partners have already demonstrated. That’s why it’s called a trade war — because the “enemy” shoots back. History has shown repeatedly, most notably in the early 1930s, in the wake of the Smoot-Hawley Tariff Act of 1930, that such trade wars only spiral downward, choking off more and more trade, despoiling the international division of labor in accordance with comparative advantage, and thereby diminishing real income in all the trading countries.

Second, the prospect of the U.S. government’s ever abandoning tariffs is slim to none. Tariffs are the classic example of government interventions with concentrated benefits and dispersed costs. This character makes them attract great support from protected special interests and little opposition from the general public — including other producers — when they are enacted or extended. They are easy for politicians to put in place and diabolically difficult for anyone to eliminate. Although the costs are great — much greater than the benefits for the economy as a whole — hardly anyone’s costs are great enough to justify mounting a potent political attack on the tariffs.

People who get tariffs put in place to protect them in the first place are well positioned to marshal strong opposition to any political attempt to eliminate these taxes on consumers who buy from competing, foreign suppliers. Consumers rarely know anything about why foreign goods are priced as they are, and producers, in general, are usually not affected enough by tariffs on imported raw materials and components to justify well-funded politicking against them.

December 22, 2017

Learning To Be Yourself With Buddy The Elf

Foundation for Economic Education

Published on 7 Dec 2017The classic holiday film Elf offers a lot more than a good time and a bunch of laughs. It teaches you how to get the most out of your life by finding your comparative advantage – the intersection between what you’re good at and what people need.

After watching this video, download our free ebook “Your Life, Your Work” to learn more about how to find your own comparative advantage and build a life you’re excited about.

Get it here: https://info.fee.org/your-life-your-work

November 5, 2017

QotD: Explaining comparative advantage

Actually, it’s dead easy. No math, no arithmetic. It is in fact the soul of common sense. But you have to understand that comparative advantage is the principle of cooperation, as against competition. The word “advantage” gets us thinking of competition, which is perfectly reasonable in our own individual lives — we do compete with other businesses or other writers or whomever. But the system as a whole, whatever it is, does well of course by cooperating, in business or science or family life. It’s not all we do, admittedly. We also compete. But within a household or a company or a world economy the job is to produce a result in the best way, cooperatively. If you are running a household or a sports team or a world economy, you would want to assign roles to the various contributors to the common purpose sensibly. It turns out to be precisely on grounds of comparative advantage.

Consider Mum and 12-year old Oliver, who are to spend Saturday morning tidying up the garage. Oliver is incompetent in everything compared with Mum. He cannot sweep the floor as quickly as she can, and he is truly hopeless in sorting through the masses of rubbish that garages grow spontaneously. Mum, that is, has an absolute advantage in every sub-task in tidying up the garage. Oliver is like Bangladesh, which is poor because it makes everything — knit goods and medical reactors — with more labor and capital than Britain does. Its output per person is 8.4 percent of what it is in Britain. So too Oliver.

What to do? Let Mum do everything? No, of course not. That would not produce the most tidied garage in a morning’s work. Oliver should obviously be assigned to the broom, in which his disadvantage compared with Mum is comparatively least — hence “comparative advantage.” An omniscient central planner of the garage-tidying would assign Mum and Oliver just that way. So would an omniscient central planner of world production and trade. In the event, there’s no need for an international planner. The market, if Trump does not wreck it, does the correct assignment of tasks worldwide. Bangladesh does not sit down and let Britain make everything merely because Britain is “competitive” absolutely in everything. And in fact Bangladesh’s real income has been rising smartly in recent years precisely because it has specialized in knit goods. It has closed its ears to the siren song of protecting its medical reactor industry. It gets the equipment for cancer treatment from Britain.

Comparative advantage means assigning resources of labor and capital to the right jobs, whatever the absolute productivity of the economy. It applies within a single family, or within a single company, or within Britain, or within the world economy, all of which are made better off by such obvious efficiencies. Following comparative advantage enriches us all, because it gets the job done best. Policies commonly alleged to achieve absolute advantage lead to protection — that is, extortion, crony capitalism, and the rest in aid of “competitiveness.”

Dierdre N. McCloskey, “A Punter’s Guide to a True but Non-Obvious Proposition in Economics”, 2017-10-16.

October 7, 2015

The enigma of the Trans-Pacific Partnership

We don’t know what’s in it, so it could be a multi-national version of “we have to pass it to find out what’s in it”. Megan McArdle manages to raise one cheer for the agreement:

I’ve spent the morning reading about the Trans-Pacific Partnership. I went in prepared to deliver a column full of details, winners and losers, strong opinions about the good provisions and the bad. But what really comes to mind is a dismal thought: “Is this the best we can do?”

Oh, yes, I know the statistics. Forty percent of the world’s economy. Thousands of tariffs falling. I know the opposition points too, about giveaways to business, intellectual property rules, outsourcing jobs. No one is talking about the larger story, though, which is that the biggest trade news in a decade involves a regional deal of relatively limited impact.

It was not always thus. When I was a fledgling journalist, a wee slip of a thing, we economics writers looked to major global trade negotiations to advance the cause of freer markets, and not incidentally, the material progress of mankind. We looked down on regional side-deals because they were such weak tea compared with the robust brew of a global agreement. Regional deals distorted the flow of trade, encouraging people not to exploit comparative advantage and production capabilities, but rather to seek the best combination of tariff rules from among competing regional frameworks. I have heard arguments that such deals, by distorting trade and weakening the pressure to make global deals, were actually worse than doing nothing. Indeed, I may have made such arguments.

You don’t hear those arguments any more, and that’s because we free-traders have largely given up on global trade agreements. The Doha round of World Trade Organization talks collapsed in the face of European agricultural protectionism and intransigence among countries with large numbers of subsistence farmers. Nativism, protectionism, nationalism seem to be rising as a political force in many countries. Global trade volumes are looking anemic. In this climate, regional agreements seem attractive, in much the same way that the remaining bar patrons assume a winsome glow around closing time.

How have things come to such an unpretty pass?

September 23, 2015

Comparative Advantage and the Tragedy of Tasmania (Everyday Economics 4/7)

Published on 24 Jun 2014

What can a small, isolated island economy teach the rest of the world about the nature and causes of the wealth of nations? When Tasmania was cut off from mainland Australia, it experienced the miracle of growth in reverse, as the reduction in trade and human cooperation forced its inhabitants back to the most basic ways of living. In an economy with a greater number of participants trading goods and services, however, there are more ways to find a comparative advantage and earn more by creating the most value for others. Let’s join Bob and Ann as they teach us the “Story of Comparative Advantage” like you’ve never seen it before.

August 27, 2015

Comparative Advantage Homework

Published on 25 Feb 2015

Make sure you’ve completed the homework introduced in the Comparative Advantage video before you watch this video, as we’ll be going over the answer. We take a look at our example which compares shirt and computer production and consumption in Mexico and the United States. At the end of this video, you’ll have a better understanding of why it makes sense for countries to engage in trade.

August 24, 2015

Comparative Advantage

Published on 25 Feb 2015

What is comparative advantage? And why is it important to trade? This video guides us through a specific example surrounding Tasmania — an island off the coast of Australia that experienced the miracle of growth in reverse. Through this example we show what can happen when a civilization is deprived of trade, and show why trade is essential to economic growth.

In an economy with a greater number of participants trading goods and services, there are more ways to find a comparative advantage and earn more by creating the most value for others. Let’s dive right in with an example from our new friends, Bob and Ann.

August 17, 2009

I hope he’s right

Publius has some interesting insights into the evolution of the Canadian economy from highly dependent on regional conditions (that is, largely tied to US markets) to a more independent one:

What the FTA and NAFTA did was to help fundamentally restructure the Canadian economy over the last two decades. While economic nationalists warned of increased dependency on the American juggernaut, the exact opposite has happened. NAFTA in particular allowed Canada to follow the laws of comparative advantage, shifting our economy away from manufacturing toward services. Nations have historically traded with countries nearest to them due to obvious transaction costs. When the wealth of nations is increasingly intellectual (which includes figuring out how to extract natural resources), those transactional costs become nearly irrelevant. A service economy is one less dependent on trading with nearby partners, instead it can reach out to the world. Buoyed by Canada’s traditional strength in natural resources — fur, fish, timber, wheat and now oil — we have become to a surprising extent decoupled from the American economy. Even in bulk products like oil and minerals, our clients are increasingly global. There is a massive glut of cheap shipping — refer to the Baltic Dry Index — to take our natural bounty where ever customers beckon.

We weathered the 2001 American recession easily, and we are weathering this one rather well. Harper knows this. He knows Barack Obama is shackling and regulating the American economy into near term stagnation. In the past this would have proven disastrous for Canada, today it will be an advantage. For decades Britain and the City of London have proven a relative free market haven to international businesses seeking to invest in Europe. There is no reason Canada cannot, and will not, play that same role in North America. In a year or so Canada may very well be leading other OECD countries in economic growth, all while the American giant is stuck in a slow motion recovery. The Prime Minister’s moderately statist approach will seem to many voters as a work of pragmatic genius. Not too much intervention, not too little. Just right. Harper the Helmsman. More image than reality. Such is the game of politics.