Marginal Revolution University

Published 15 Aug 2017Imagine a negative real shock, like an oil crisis, just hit the economy. How should the Fed respond?

Decreasing the money supply will help with inflation, but make growth worse. Increasing the money supply will improve growth, but inflation will climb higher. What’s the Fed to do?!

April 4, 2020

Monetary Policy: The Negative Real Shock Dilemma

September 28, 2019

How the Federal Reserve Works: After the Great Recession

Marginal Revolution University

Published on 3 Apr 2018In response to the Great Recession, the Federal Reserve has implemented some new instruments and policies – including quantitative easing, paying interest on reserves, and conducting repurchase (and reverse repurchase) agreements. In this video we cover how these tools work, and why they matter.

August 18, 2019

The Austrian School on the causes and cures of economic recessions

Tim Worstall responds to a Guardian article on recessions (we’re apparently due for another one, according to the writer) and suggests that the Austrian theories may be helpful to understand what’s going on:

A Mises Institute graphic of some of the key economists in the Austrian tradition (Carl Menger, Ludwig von Mises, Friedrich Hayek, Murray Rothbard, and Hans-Hermann Hoppe.

Mises Institute via Wikimedia Commons.

As a pencil sketch – all you can do in a single article – that’s rather good. So, fine, let’s run with that. We’ve not had a normal recession for ages, one will come along soon enough and we’ve forgotten how to deal with it.

However, we can take this idea a little further too. Off into the wild spaces of Austrian theory. There a recession happens because of the built up malinvestment across the economy. Essentially, when it’s too easy to finance stuff then too much bad stuff gets financed. We need the regular recession to flick off the froth and get back to a more sensible allocation of capital.

My own view is that there is no one correct macroeconomic theory but that all of them contain elements of the truth. The trick is to work out which theory to apply to which happenstance. Reorganising the Soviet economy wasn’t going to be done by a bit of Keynesian demand management, there was a century of misallocation to chew through. Getting out of 2008 was different because it was the financial system that had fallen over, we didn’t just have that cyclical decline in business investment. Etc. Austrians can – perish the thought, eh? – be a little too fervent in the insistence that all recessions are about misallocation that must be purged.

But note the underlying thing we can pick up from Davies here. We’ve been staving off that normal recession for decades through that management. Perhaps it’s not all that good an idea to continually do that? He really does say that the Crash stemmed from those attempts to stave off after all. Thus, in a sense, we could argue that we’re going to get the recessionary horrors come what may. Even Keynesian demand management might not be the correct solution if it just gives us once in a generation collapses rather than more regular downturns?

That is, perhaps the Austrians are at least in part right? We need the regular purges for fear of something worse?

May 27, 2019

Game of Theories: The Great Recession

Marginal Revolution University

Published on 5 Dec 2017Tyler Cowen puts Keynesian, monetarist, real business cycle, and Austrian theories to work to explain a downturn from recent economic history: the Great Recession of 2008.

May 23, 2019

Game of Theories: The Keynesians

Marginal Revolution University

Published on 7 Nov 2017When the economy is going through a recession, what should be done to ease the pain? And why do recessions happen in the first place? We’ll take a look at one of four major economic theories to find possible answers – and show why no theory provides a silver bullet.

March 5, 2019

Changes in Velocity

Marginal Revolution University

Published on 16 May 2017What happens when aggregate demand shifts because of a change in the velocity of money? You’ll recall from earlier videos that an increase or decrease in velocity means that money is changing hands at a faster or slower rate.

Changes in velocity are temporary, but they can still cause business fluctuations. For instance, say that consumption growth slows as consumers become pessimistic about the economy.

In fact, we saw this play out in 2008, when workers and consumers became afraid that they might lose their jobs during the Great Recession. This fear drove them to cut back on their spending in the short run. But, since changes in velocity are temporary, this fear receded as time passed and the economy began to recover.

Dive into this video to learn more about what causes shifts in the aggregate demand curve.

January 9, 2019

Sticky Wages

Marginal Revolution University

Published on 2 May 2017Imagine you’re an employer during a recession, and you desperately need to cut labor costs to keep your firm afloat. Are you more likely to cut wages across the board for all employees, or institute layoffs for only some?

While it may seem that wage cuts are the “better” choice, they aren’t as common as you might think. Why is that?

To answer that question, this video explores a phenomenon known as “sticky wages.”

In other words, wages have a tendency to get “stuck” and not adjust downwards. This occurs even during a recession, when falling wages would help end the recession more quickly.

However, that’s not to say that wages cannot adjust downward for an individual during a recession. This can happen, but likely only after an employee has been fired from their initial job, and eventually rehired by a different firm at a lower wage rate.

Back to our original question — why are employers unlikely to cut wages? A big reason has to do with the effect on morale. Employees may become disgruntled and angry when they experience a nominal wage cut, and become less productive.

An important note here — notice that we said nominal wage cut, meaning, not adjusted for inflation. If an employee receives a 3% raise in nominal wages, they may remain happy in their current position. But what if inflation is 5%? What does this mean for their real wage? (Hint: For an in depth answer to this question check out our earlier Macroeconomics video on “money illusion.”)

Next week we’ll return to our discussion on the AD/AS model for a look at how factors such as “sticky wages” affect the economy in the short run.

October 11, 2017

The Great Recession

Marginal Revolution University

Published on 9 Aug 2016There’s already been much discussion over what fueled the Great Recession of 2008. In this video, Tyler Cowen focuses on a central theme of the crisis: the failure of financial intermediaries.

By 2008, the economy was in a very fragile state, with both homeowners and banks taking on greater leverage, many ending up “underwater.” Why did managers at financial institutions take on greater and greater risk? We’ll discuss a couple of key reasons, including the role of excess confidence and incentives.

In addition to homeowners’ leverage and bank leverage, a third factor played a major role in tipping the scale toward crisis: securitization. Mortgage securities during this time were very hard to value, riskier than advertised, and filled to the brim with high risk loans. Cowen discusses several reasons this happened, including downright fraud, failure of credit rating agencies, and overconfidence in the American housing market.

Finally, a fourth factor joins homeowners’ leverage, bank leverage, and securitization to inch the economy closer to the edge: the shadow banking system. On the whole, the shadow banking system is made up of investment banks and various other complex financial intermediaries, highly dependent on short term loans.

When housing prices started to fall in 2007, it was the final nudge that pushed the economy over the cliff. There was a run on the shadow banking system. Financial intermediaries came crashing down. We faced a credit crunch, and many businesses stopped growing. Layoffs ensued, increasing unemployment.

What could have been done to prevent all of this? You’ll have to watch the video to find out.

October 5, 2017

Four Reasons Financial Intermediaries Fail

Marginal Revolution University

Published on 26 Jul 2016As we’ve discussed in previous videos, financial intermediaries bridge savers and borrowers. When these bridges crumble, the effects can be disastrous. For businesses, credit shortages can lead to bankruptcy, or layoffs. For individuals, they rely on credit to invest in education or a new home or car. These negative effects show you how crucial intermediaries are to our lives.

Still, what exactly causes failed intermediation? Four answers:

First, insecure property rights. Simply speaking, when you save money at a bank, you expect the ability to pull out your funds when needed. But what if your deposits are frozen? Or confiscated altogether? For instance, in 2013 amidst a financial crisis, the government in Cyprus confiscated bank deposits to help pay down the country’s budget shortfall. You can see how insecure property rights can scare away potential savers.

Second, controls on interest rates. Interest rates are the price of borrowing. Thus, controls on interest rates, often called usury laws, are effectively price ceilings—they set the interest rate lower than the market equilibrium interest rate. With this forced lowering of interest rates, borrowers will want to borrow more, but lenders won’t want to lend. The effect? A lending shortage.

Third, politicized lending. Banks profit by assessing risk, and then loaning, based on that assessment. Banks that excel at assessment succeed. Those poor at it die out. Problems arise when the government intervenes to prop up failing banks, resulting in what we call “zombie banks.” In such cases, intervention undercuts normal competition, and intervention tends to favor banks that are politically connected. In fact, it’s been shown that there’s an inverse correlation between government ownership in banks and a country’s GDP per capita and productivity growth.

Fourth, you have runs, panics, and scandals. Remember, trust is vital to the financial system. When trust erodes, depositors may rush to withdraw their money from banks, causing what is known as a “bank run.” This can cause banks to fail, as we saw during the Great Depression. Scandals can also depress market confidence. Enron, WorldCom and Bernie Madoff may come to mind.

So, which of these four factors contributed to the Great Recession of 2008?

We’ll discuss that in our next video.

August 13, 2017

Saving and Borrowing

Published on 21 Jun 2016

On September 15, 2008, Lehman Brothers filed for bankruptcy, and signaled the start of the Great Recession. One key cause of that recession was a failure of financial intermediaries, or, the institutions that link different kinds of savers to borrowers.

We’ll get to intermediaries in the next video, but for now, we’ll first look at the market intermediaries are involved in.

This market is the combination of savers and borrowers — what we call the “market for loanable funds.”

To start, we’ll represent the market, using two curves you know well—supply and demand. The quantity supplied in the market comes from savings, and the quantity demanded comes from loans. But as you know, we have to factor in price. In the case of the market for loanable funds, the price is the current interest rate.

What happens to the supply of savings when the interest rate goes up? When are borrowers compelled to borrow more? Or less? We’ll cover these scenarios in this video.

One quick note: there’s not really one unified market for loanable funds. Instead, there are many small markets, with different sorts of lenders, lending to different sorts of borrowers. As we said in the beginning, it’s financial intermediaries, like banks, bond markets, and stock markets, which link these different sides of the market.

We’ll get a better understanding of these intermediaries in our next video, so stay tuned!

May 18, 2017

You Can’t Trust Employment Statistics

Published on 17 May 2017

There is no truly good way to measure unemployment, which makes it pretty easy for successive administrations to claim that unemployment is consistently improving. But when we do our level best to include all of the unemployed in the numbers, what we learn is that unemployment levels now are higher than they were at the beginning of the Great Recession. That’s the bad news. The good news is that things actually have been getting better over time. In this week’s episode, James and Antony take a look at the actual unemployment numbers to get to the bottom of what they really mean.

Get the facts here:

https://fee.org/articles/you-cant-trust-unemployment-statistics/

October 17, 2016

Hillary Clinton tells us to expect a major US recession shortly after January 20, 2017

Fortunately, as Tim Worstall explains, politicians can rarely be believed — especially when it comes to economics:

Hillary Clinton Vows To Slam The Economy Into Recession Immediately Upon Election

This probably isn’t quite what Hillary Clinton intended to say but it is what she did say at a fundraiser on Friday night. That immediately upon election she would slam the US economy into a recession. For what she has said is that she’s not going to add a penny to the national debt. Which, in an economy running a $500 billion and change budget deficit means tax rises and or spending cuts of $500 billion and change immediately she takes the oath. And that’s a large enough and fierce enough change, before she does anything else, to bring back a recession.

[…]

Now, what she meant is something more like this. That she has some spending plans, which she does. And she is also proposing some tax rises. And that her tax rises will balance her spending plans and thus the mixture of plans will not increase the national debt. Which is possibly even true although I don’t believe a word of it myself. For her taxation plans are based upon static analyses when we really must use dynamic ones to measure tax changes. This is normally thought of as something that the right prefers. For if we measure the effects of tax cuts using the dynamic method then there will be some (please note, some, not enough for the cuts to pay for themselves) Laffer Effects meaning that the revenue loss is smaller than that under a static analysis. But this is also true about tax rises. Behaviour really does change when incentives change. Thus tax rises gain less revenue in real life than what a straight line or static analysis predicts.

That is, as I say, probably what she means. But that’s not actually what she said. She said she’ll not add a penny to the national debt. Which means that immediately on taking office she’s got to either raise taxes by $500 billion and change or reduce spending by that amount. Because the budget deficit is that $500 Big Ones and change at present and the deficit is the amount being added to the national debt each year. The problem with this being that that’s also some 3.5% or so of GDP and an immediate fiscal tightening of that amount would put the US economy back into recession.

January 1, 2015

The Laffer Curve at 40

In the Washington Post, Stephen Moore recounts the tale of the most famous napkin in US economic history:

It was 40 years ago this month that two of President Gerald Ford’s top White House advisers, Dick Cheney and Don Rumsfeld, gathered for a steak dinner at the Two Continents restaurant in Washington with Wall Street Journal editorial writer Jude Wanniski and Arthur Laffer, former chief economist at the Office of Management and Budget. The United States was in the grip of a gut-wrenching recession, and Laffer lectured to his dinner companions that the federal government’s 70 percent marginal tax rates were an economic toll booth slowing growth to a crawl.

To punctuate his point, he grabbed a pen and a cloth cocktail napkin and drew a chart showing that when tax rates get too high, they penalize work and investment and can actually lead to revenue losses for the government. Four years later, that napkin became immortalized as “the Laffer Curve” in an article Wanniski wrote for the Public Interest magazine. (Wanniski would later grouse only half-jokingly that he should have called it the Wanniski Curve.)

This was the first real post-World War II intellectual challenge to the reigning orthodoxy of Keynesian economics, which preached that when the economy is growing too slowly, the government should stimulate demand for products with surges in spending. The Laffer model countered that the primary problem is rarely demand — after all, poor nations have plenty of demand — but rather the impediments, in the form of heavy taxes and regulatory burdens, to producing goods and services.

[…]

Solid supporting evidence came during the Reagan years. President Ronald Reagan adopted the Laffer Curve message, telling Americans that when 70 to 80 cents of an extra dollar earned goes to the government, it’s understandable that people wonder: Why keep working? He recalled that as an actor in Hollywood, he would stop making movies in a given year once he hit Uncle Sam’s confiscatory tax rates.

When Reagan left the White House in 1989, the highest tax rate had been slashed from 70 percent in 1981 to 28 percent. (Even liberal senators such as Ted Kennedy and Howard Metzenbaum voted for those low rates.) And contrary to the claims of voodoo, the government’s budget numbers show that tax receipts expanded from $517 billion in 1980 to $909 billion in 1988 — close to a 75 percent change (25 percent after inflation). Economist Larry Lindsey has documented from IRS data that tax collections from the rich surged much faster than that.

November 18, 2014

Finland’s Great(est) Depression

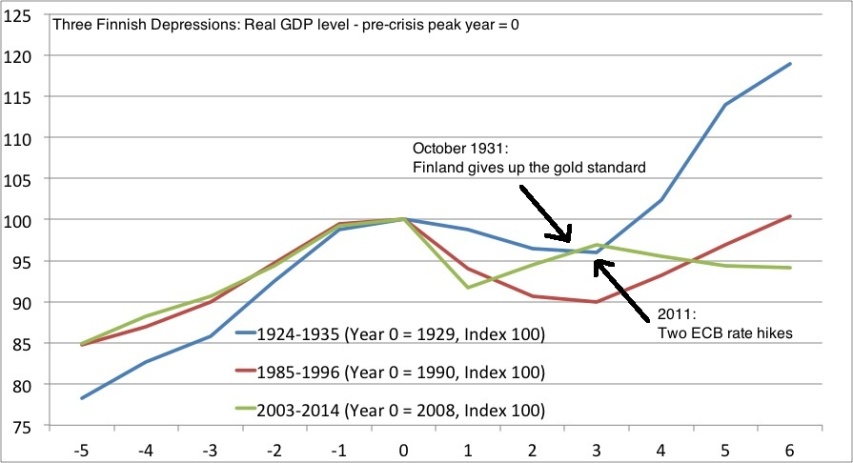

Lars Christensen explains why — economically speaking — Finland is suffering through an economic phenomena even worse than the Great Depression:

In my post from Friday — Italy’s Greater Depression — Eerie memories of the 1930s — I inspired by the recent political unrest in Italy compared the development in real GDP in Italy during the recent crisis with the development in the 1920s and 1930s.The graph in that blog post showed two things. First, Italy’s real GDP lose in the recent crisis has been bigger than during 1930s and second that monetary easing (a 41% devaluation) brought Italy out of the crisis in 1936.

I have been asked if I could do a similar graph on Finland. I have done so — but I have also added the a third Finnish “Depression” and that is the crisis in the early 1990s related to the collapse of the Soviet Union and the Nordic banking crisis. The graph below shows the three periods.

[…]

The most interesting story in the graph undoubtedly is the difference in the monetary response during the 1930s and during the present crisis.

In October 1931 the Finnish government decided to follow the example of the other Nordic countries and the UK and give up (or officially suspend) the gold standard.

The economic impact was significant and is very clearly illustrate in the graph (look at the blue line from year 2-3).

We have nearly imitate take off. I am not claiming the devaluation was the only driver of this economic recovery, but it surely looks like monetary easing played a very significant part in the Finnish economic recovery from 1931-32.

October 16, 2014

Italian recession officially ends, thanks to drugs and prostitution

As Kelly McParland put it, it’s “another reason to legalize everything nasty“:

Italy learnt it was no longer in a recession on Wednesday thanks to a change in data calculations across the European Union which includes illegal economic activities such as prostitution and drugs in the GDP measure.

Adding illegal revenue from hookers, narcotics and black market cigarettes and alcohol to the eurozone’s third-biggest economy boosted gross domestic product figures.

GDP rose slightly from a 0.1 percent decline for the first quarter to a flat reading, the national institute of statistics said.

Although ISTAT confirmed a 0.2 percent decline for the second quarter, the revision of the first quarter data meant Italy had escaped its third recession in the last six years.

The economy must contract for two consecutive quarters, from output in the previous quarter, for a country to be technically in recession.

It’s merely a change in the statistical measurement, not an actual increase in Italian economic activity. And, given that illegal revenue pretty much by definition isn’t (and can’t be) accurately tracked, it’s only an estimated value anyway.