It’s hardly news anymore that public-sector pension promises will be made good (or not) on the backs of taxpayers, but I still think that the average private-sector packmule has no idea of the amount they’re going to have to pony up to vouchsafe the various municipal, state, and federal pension promises. The amount required over the next several decades beggars the imagination. In fact, the amount is preposterous: there’s no way the money is ever going to be paid out as promised. Even if it were mathematically possible (which it isn’t), taxpayers would revolt over the massive increases that would be required. If I were a public-sector worker, I’d be making a point of saving every dime of my own money that I could, because that fat public sector pension is unlikely to ever be paid out in full. (And I’m not even getting into the healthcare benefits, which are even more onerous than the pension benefits.) Basically, the bedrock truth is this: money that can’t be paid out, won’t be, no matter what agreements were signed or what the courts say.

Monty, “The Daily DOOM”, Ace of Spades HQ, 2012-01-12

January 12, 2012

QotD: When a figure is too high to be repaid, it won’t be repaid

December 27, 2011

Retirement age will have to rise: The Economist

In a development that should surprise nobody at all, governments around the world are slowly, reluctantly, grudgingly starting to make changes to their state pension systems:

Put aside the cruise brochures and let the garden retain that natural look for a few more years. Demography and declining investment returns are conspiring to keep you at your desk far longer than you ever expected.

This painful truth is no longer news in the rich world, and many governments have started to deal with the ageing problem. They have announced increases in the official retirement age that attempt to hold down the costs of state pensions while encouraging workers to stay in their jobs or get on their bikes and look for new ones.

Unfortunately, the boldest plans look inadequate. Older people are going to have to stay economically active longer than governments currently envisage; and that is going to require not just governments, but also employers and workers, to behave differently.

November 1, 2011

Long Island Rail Road: “The scandal isn’t what’s illegal — but what’s legal“

Nicole Gelinas points out that the Long Island Rail Road (LIRR) pension scam is only part of the problem:

Last week, the feds indicted 11 Long Island Rail Road retirees and their alleged associates in a “massive fraud scheme” to steal a billion dollars through fake disability claims. But the bigger outrage is that for decades the LIRR has held state taxpayers and riders hostage — thanks to outdated Washington labor laws.

The first inkling of the scandal came in 2008, when a press report noted that nearly every LIRR worker retired early, getting an MTA pension and a federal benefit. Looking into the anomaly, federal prosecutors unearthed evidence that at least two doctors and other “facilitators” had for years signed off on fake injuries and ailments so that workers could take their pensions.

[. . .]

The state’s fear of an LIRR strike helps drive up the railroad’s costs. Last year, the Empire Center reported, the average LIRR worker pulled in $84,850 — not including benefits.

That’s more than anywhere at the MTA except headquarters — and 23 percent more than subway and bus workers make. Seven of the top 10 people who made more in overtime than they did in regular wages hailed from the LIRR — including one conductor who tripled his $75,390 salary. Plus, workers pay nothing for health benefits.

October 27, 2011

Postponing retirement: late Boomers and Gen X’ers face reality

Jonathan Chevreau shows that those of us getting a bit closer to retirement will have to wait longer than the previous generation before retiring:

The “double whammy” of falling stock prices and low interest rates has impacted members of DC pensions and RRSPs, who must cover the deficit through reduced personal spending and/or deferred retirement.

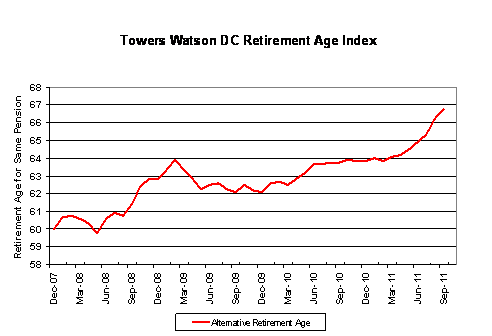

Towers Watson has issued its first quarterly DC Retirement Age Index, which it describes as a pension freedom tracker. It tracks the performance of a balanced portfolio of a DC plan member who has contributed to the plan from age 40 to 60. At that point, an annuity would be purchased but its value and monthly payout would depend on the performance of the plan over those 20 years.

[. . .]

With recession threatening, ongoing market volatility and falling interest rates, Towers Watson expects the Pension Freedom Age could move up to 67, or two years after the traditional retirement age (when Old Age Security and full Canada Pension Plan benefits commence).

September 11, 2011

July 17, 2011

Federal government to unveil new retirement scheme

Jonathan Chevreau looks at the federal government’s plan to introduce Pooled Registered Pension Plans (PRPPs):

This is a giant potential opportunity for the nation’s banks, mutual fund companies, insurance firms and a growing number of manufacturers of exchange-traded funds. Pension consultants, actuaries, financial planners and investment advisors will also see various business opportunities created as PRPPs catch on — primarily with small- and medium-sized businesses that never before offered its workers a pension plan. Mr. Menzies, the cabinet minister responsible for PRPPs, says he’s travelled the country consulting with the provinces.

“When the concept of the pooled RPP was shared with the provinces and territories they all came together to agree this makes sense.”

[. . .]

PRPPs will be (hopefully) low-cost defined contribution schemes run by the private sector where ultimate benefits will depend on how financial markets perform. The PRPPs would resemble the United States’ 401(k)s or Australia’s superannuation scheme.

They will be administered by financial institutions rather than employers, which is why Bay Street views them as a potential bonanza. As the “pooled” part of their name suggests, assets are co-mingled for investment purposes to keep down costs.

The original idea was that PRPPs would be mandatory for employers that don’t offer their own registered pension plan but Mr. Menzies says that decision would be up to the provinces. “We’re putting it out there that there is an option for the employer and for the employee. I’ve spoken to many small businesses that said ‘finally here’s a low-cost affordable plan I can enroll my employees in.’ It will be a retention and enticement tool.”

Employers won’t be forced to make contributions, but may choose to do so. Employees will be automatically enrolled at a base contribution rate, but they can opt out.

There will be two types of members: Employed and individuals. The latter include the self-employed and employees of organizations that do not offer PRPPs. Benefits are portable. Employers offering PRPPs can move to a new plan if they wish. There are fewer portability restrictions for individual members, making them convenient if they later change jobs and want to take their pension with them.

That portability is key: I’ve wondered for years why unions have not been hammering on that aspect in their negotiations with big employers (although unions generally pay most attention to the needs of current union members at the expense of both retired and future members). By the time you’ve worked at a company long enough to qualify for their pension scheme, you’re often locked in due to the lack of portability of your pension. If you leave the firm, voluntarily or not, you lose much of the potential return on the pension contributions you’ve already made (if you don’t lose them altogether).

This proposal may well solve much of that problem.

June 10, 2011

With extended lifespans . . . will come later retirement dates

For all of us who’ve spent our working lives assuming that 65 was the age of retirement (or 55 for those of you who paid closer attention to retirement planning 20 years earlier than the rest of us), you won’t like this:

Americans better get used to working longer, even until they are 80 years old, according to a study by the Employee Research Benefit Institute (via Robert Powell at MarketWatch).

Naturally, those with lower incomes will need to work longer.

Here’s how it breaks down (via MarketWatch):

- If you make around $11,700 dollars a year you have to work to age 84 to have a 50% chance of affording retirement.

- If you make between $11,700-$31,200 a year you have to work to age 76 to have a 50% chance affording retirement

- If you make between $31,200-$72,500 a year you have to work to age 72 to have a 50% chance of affording retirement.

- If you make $72,500 or more a year you have to work to age 65 to have a 50% chance of affording retirement.

This study does point out one bright spot for those working past 65 though. If you are putting your money into some kind of retirement fund, your chances of saving enough increase substantially.

May 13, 2011

April 28, 2011

Kevin Milligan: Corporations are not really people

The notion that corporations are “legal persons” is useful for legal purposes, but terribly misleading when politicians are trying to formulate tax policies:

Pretending that corporations are people leads to tax policies with perverse consequences; some can even produce the opposite of what the policy is intended to do.

[. . .]

Some people want to tax corporations heavily because the corporations are ‘rich.’ But, if corporations are not people, they can’t be rich. The owners or employees of the corporation can be rich, but not an artificial legal entity. As my Economy Lab colleague Stephen Gordon wrote, “Claiming that ‘wealthy corporations’ pay [corporate taxes] makes about as much sense as claiming that ‘rich buildings’ pay property taxes.”

This is not an obscure debate. The owners of corporations do not all wear top hats and monocles like the fellow from the Monopoly game. In reality, Bay Street IPO-mongers quake in fear of two large stockholders. One is the Ontario Teachers Pension Plan. The other is the Canada Pension Plan Investment Board. These two pension plans are the largest holders of corporate equity in Canada, and their stakeholders are broadly middle income. Tax policy that hurts the dividends of Canadian corporations has a direct impact on the vast Canadian middle that hold pensions through these two, and similar, pension entities. Of course, many high-income Canadians also own corporate equities. But, if we desire to change the tax burden on high income individuals, though, it is best to do so directly through the personal income tax rather than taxing things high income people may or may not own.

April 13, 2011

March 14, 2011

March 4, 2011

December 23, 2010

Prichard, Alabama defaults on civil service pensions

The town failed to fully fund the pension plan for their employees, and it ran out of money in 2009. In spite of state law, they stopped paying the pensioners:

Since then, Nettie Banks, 68, a retired Prichard police and fire dispatcher, has filed for bankruptcy. Alfred Arnold, a 66-year-old retired fire captain, has gone back to work as a shopping mall security guard to try to keep his house. Eddie Ragland, 59, a retired police captain, accepted help from colleagues, bake sales and collection jars after he was shot by a robber, leaving him badly wounded and unable to get to his new job as a police officer at the regional airport.

Far worse was the retired fire marshal who died in June. Like many of the others, he was too young to collect Social Security. “When they found him, he had no electricity and no running water in his house,” said David Anders, 58, a retired district fire chief. “He was a proud enough man that he wouldn’t accept help.”

The situation in Prichard is extremely unusual — the city has sought bankruptcy protection twice — but it proves that the unthinkable can, in fact, sometimes happen. And it stands as a warning to cities like Philadelphia and states like Illinois, whose pension funds are under great strain: if nothing changes, the money eventually does run out, and when that happens, misery and turmoil follow.

Prichard is only the start: far too many local governments are approaching the same situation.

December 20, 2010

“The typical budgeting strategy of most Canadians is 1. Get paid 2. Spend it all 3. Borrow more.”

Kelly McParland looks at the efforts of the Canadian and provincial governments to come to some sort of agreement over pension reform:

If you want a hint of the difficulty of winning agreement on an issue like Canada’s creaking pension system, consider this carefully considered statement from Finance Minister Jim Flaherty:

“It’s a multi-jurisdictional challenge to get a consensus on the CPP,” he said.

If you speak politics, you realize that “multi-jurisdictional challenge” means that getting the country’s federal and provincial leaders to agree on anything beyond what time to quit for lunch is beyond the power of mere mortals. It is especially hopeless on an issue as fraught with electoral danger pensions, which, after all, are all about old people and their money. Who votes in far bigger numbers than any other demographic? Old people. What gets them more excited than half-price fares to Florida? Their money.