The Economist looks at innovation in the railway business:

Compared with other modes of transport, train technology might seem to be progressing as slowly as a suburban commuter service rattling its way from one station to another. Automotive technology, by contrast, changes constantly: in the past decade satellite-navigation systems, hybrid power trains, proximity sensors and other innovations have proliferated. Each time you buy a new car, you will notice a host of new features. Progress is apparent in aircraft, too, with advances in in-flight entertainment and communication, fancy seats that turn into beds, and quieter and more efficient engines. Trains, meanwhile, appear to have changed a lot less.

Actually, the perception of change is much greater for cars and airplanes, but there are few changes in those areas that are not merely evolutionary rather than revolutionary. Incremental changes are the rule of the day, as neither cars nor planes travel significantly faster than they did thirty years ago … but they do it safer and more comfortably now.

This comparison is not entirely fair. For one thing, people buy their own cars, so they pay more attention to automotive innovation. Carmakers are engaged in a constant arms race, trumpeting new features as a way to differentiate their products. Nobody buys their own trains. Similarly, air passengers have a choice of competing airlines and are far more likely to be aware of the merits of rival fleets than they are of different types of train. In addition, notes Paul Priestman of Priestmangoode, a design consultancy that specialises in transport, trains have longer lives, so technology takes longer to become widespread. The planning horizon for one rail project he is working on extends to 2050. “You have to think about longevity, whereas the car industry wants you to buy a new car in two years,” he says.

Another big difference is that the way railways operate — with a small number of powered units (locomotives) and a very large number of unpowered units (freight cars and passenger cars) that have to be reliably connected to one another and operate successfully. A car can go on any kind of road (or even none, in many places) and a plane can fly in any part of the sky, but a train needs an engineered right-of-way that falls within established standards of curvature, elevation change, and overhead and side clearance. Because of this, any piece of railway equipment that does not run on its own isolated track (like monorails or the various flavours of high speed railways) must always meet the existing standards … which have been slowly evolving since the mid-nineteenth century. With so much capital invested in existing right-of-way and rolling stock, the costs for introducing significant changes can be astronomical.

There’s also the fact that unlike other forms of transportation, passenger and freight trains operate in different and sometimes conflicting ways. Passenger trains need to operate on a known schedule between high population centres at relatively high speed. With higher speed goes a need for better braking systems and more capable signalling methods. Unlike a train full of new cars or iron ore, you can’t just park a train full of living human beings on a siding for a few hours to allow slower trains to clear the way (unless you’re Amtrak or VIA). Passenger trains have to have top priority, which often means the railways have to delay freight traffic to ensure that the passengers are not unduly delayed.

One solution to the problem is to provide separate tracks for the passenger trains, but this can be very expensive, as the places where the extra tracks would be most effective is also where the land is at peak cost: in and around major cities. Most passenger trains are now run by government agencies or corporations acting as agents for local, regional, or state governments, so they sometimes use the power of eminent domain to gain access to the land. This is a politically fraught area, as the more land they need to take, the tougher the process will get.

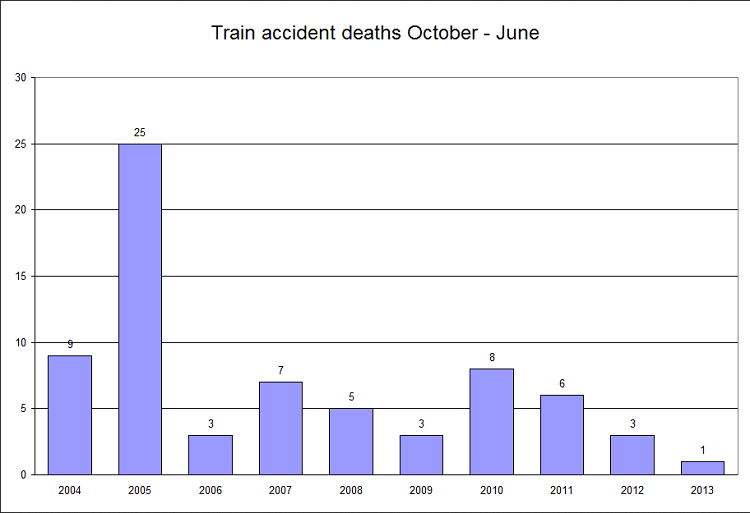

Brakes are also getting an upgrade. Stopping a train can take so long that locomotive-operators, also known as engineers, often have time to contemplate their fate before an impact. “Your life races before you,” says a former operator who, years ago in Alabama, helplessly watched as his freight train, its emergency brakes screeching, headed towards a stalled truck that ultimately managed to pull off the tracks in time. Stopping a train pulling a hundred cars at 80kph can require 2km of track. Road accidents take far more lives, but 1,239 people were killed in more than 2,300 railway accidents in 2011 in the European Union alone.

Much of the problem is that the faster a train’s wheels are spinning, the hotter its brake shoes get when engaged. This reduces friction and hence braking power, a predicament known as “heat fade”. Moreover, nearly all trains power their brakes with compressed air. When switched on, air brakes activate car by car, from the locomotive to the back of the train. It can take more than two minutes for the signal to travel via air tubes to the last car.

Again, it’s not physically or financially possible to switch over all existing cars to newer technology in one fell swoop, so any updated brake technology must be 100% compatible with what is already in use, or you risk creating more dangerous situations because some brakes may operate out of sequence which will increase the chances of accidents.

Norfolk Southern, an American rail operator, now pulls roughly one-sixth of its freight using locomotives equipped with “route optimisation” software. By crunching numbers on a train’s weight distribution and a route’s curves, grades and speed limits, the software, called Leader, can instruct operators on optimum accelerating and braking to minimise fuel costs. Installing the software and linking it wirelessly to back-office computers is expensive, says Coleman Lawrence, head of the company’s 4,000-strong locomotive fleet. But the software cuts costs dramatically, reducing fuel consumption by about 5%. That is a big deal for a firm that spent $1.6 billion on diesel in 2012. Mr Lawrence reckons that by 2016 Norfolk Southern may be pulling half its freight with Leader-upgraded locomotives. A competing system sold by GE, Trip Optimizer, goes further and operates the throttle and brakes automatically.

This is a good use of computer technology: you add the software on top of the existing infrastructure and use it to detect operational gains without needing to make system-wide changes to all freight cars.