Competition turns out not to be so wasteful; it makes a system resilient. That misunderstanding was a symptom of a larger issue called the socialist calculation problem. We think of prices largely in reference to ourselves, or other individuals, which is to say that we mostly see them as the highest barrier to getting something we want. But as we pull back to look at society, or the globe, we see that they are in fact an incredibly elegant way to allocate scarce resources.

This was best explained by Friedrich Hayek in his essay “The Use of Knowledge in Society.” Some good like tin becomes scarce, perhaps because a large tin mine has failed, or perhaps because there is a new and very profitable use for tin that is soaking up much of the supply. The price rises, and all over the world, people begin to economize on tin. Most of them have no idea why the price of tin is rising, and if they did, they wouldn’t care; they just switch to another metal, or start recycling old tin, finding a way to bring global demand closer in line to global supply. A lot of that is possible only because of price competition.

You can think of this as something like a distributed computer network: You get millions of people devoting some portion of their effort to aligning consumption with production. This system is constantly churning, making billions of decisions a day. Communism tried to replace this with a bunch of guys sitting around in offices, who occasionally negotiated with guys sitting around in other offices. It was a doomed effort from the start. Don’t get me wrong; the incentive problems were real and large. But even if they could have been solved, the calculation problem would have remained. And the more complex an economy you are trying to manage, the worse a job you will do.

The socialist calculation problem is not fundamentally an issue of calculating how to produce the most stuff, but of calculating what should be produced. Computers can’t solve that, at least until they develop sufficient intelligence that they’ll probably render the issue moot by ordering our toasters to kill us so that they can use our bodies for mulch.

Megan McArdle, “Yes, Computers Have Improved. No, Communism Hasn’t”, Bloomberg View, 2015-09-02.

August 7, 2017

August 3, 2017

Words & Numbers: Is UBI Better Than Welfare?

Published on 2 Aug 2017

A viewer recently asked us what Words & Numbers thought of Universal Basic Income.

Antony Davies likes the idea of it, provided it’s done well, but doesn’t think it could ever possibly be done well. But what about a theoretical UBI? If we could actually figure out how to implement that well, would that work? And why wouldn’t that work in the real world? This week on Words and Numbers, Antony and James R. Harrigan tackle the issue that’s getting a lot of attention in Silicon Valley.

August 2, 2017

Some troubling early signs from Finland’s UBI experiment

Dan Mitchell says we can’t draw definite conclusions from these early (anecdotal) points, but that it may point toward UBI (universal basic income) not being the panacea it’s been touted to be:

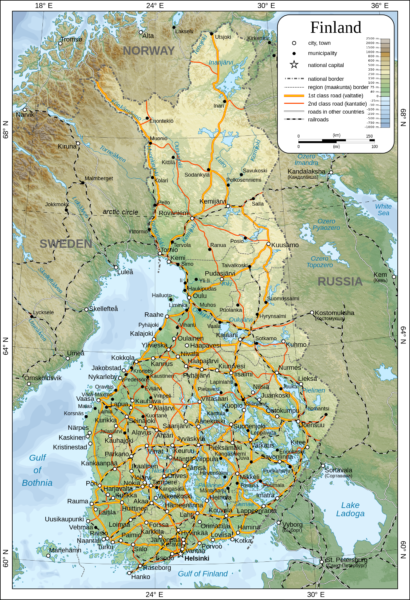

The New York Times published an in-depth preview of Finland’s experiment late last year. Here’s a description of the problem that Finnish policymakers want to solve.Map of Finland (Suomen kartta) by Oona Räisänen. Boundaries, rivers, roads, and railroads are based on a 1996 CIA map, with revisions. (via Wikimedia)

… this city has…thousands of skilled engineers in need of work. Many were laid off by Nokia… While entrepreneurs are eager to put these people to work, the rules of Finland’s generous social safety net effectively discourage this. Jobless people generally cannot earn additional income while collecting unemployment benefits or they risk losing that assistance. For laid-off workers from Nokia, simply collecting a guaranteed unemployment check often presents a better financial proposition than taking a leap with a start-up.

For anyone who has studied the impact of redistribution programs on incentives to work, this hardly comes as a surprise.

Indeed, the story has both data and anecdotes to illustrate how the Finnish welfare state is subsidizing idleness.

In the five years after suffering a job loss, a Finnish family of four that is eligible for housing assistance receives average benefits equal to 73 percent of previous wages, according to data from the Organization for Economic Cooperation and Development. That is nearly triple the level in the United States. … the social safety net … appears to be impeding the reinvigoration of the economy by discouraging unemployed people from working part time. … Mr. Saloranta has his eyes on a former Nokia employee who is masterly at developing prototypes. He only needs him part time. He could pay 2,000 euros a month (about $2,090). Yet this potential hire is bringing home more than that via his unemployment benefits. “It’s more profitable for him to just wait at home for some ideal job,” Mr. Saloranta complains.

So the Finnish government wants to see if a basic income can solve this problem.

… the Finnish government is exploring how to change that calculus, initiating an experiment in a form of social welfare: universal basic income. Early next year, the government plans to randomly select roughly 2,000 unemployed people — from white-collar coders to blue-collar construction workers. It will give them benefits automatically, absent bureaucratic hassle and minus penalties for amassing extra income. The government is eager to see what happens next. Will more people pursue jobs or start businesses? How many will stop working and squander their money on vodka? Will those liberated from the time-sucking entanglements of the unemployment system use their freedom to gain education, setting themselves up for promising new careers? … The answers — to be determined over a two-year trial — could shape social welfare policy far beyond Nordic terrain.

The results from this experiment will help answer some big questions.

… basic income confronts fundamental disagreements about human reality. If people are released from fears that — absent work — they risk finding themselves sleeping outdoors, will they devolve into freeloaders? “Some people think basic income will solve every problem under the sun, and some people think it’s from the hand of Satan and will destroy our work ethic,” says Olli Kangas, who oversees research at Kela, a Finnish government agency that administers many social welfare programs. “I’m hoping we can create some knowledge on this issue.” … Finland’s concerns are pragmatic. The government has no interest in freeing wage earners to write poetry. It is eager to generate more jobs.

As I noted above, this New York Times report was from late last year. It was a preview of Finland’s experiment.

[…]

Maybe I’m reading between the lines, but it sounds like they are worried that the results ultimately will show that a basic income discourages labor supply.

Which reinforces my concerns about the entire concept.

Yes, the current system is bad for both poor people and taxpayers. But why would anyone think that we’ll get better results if we give generous handouts to everyone?

- We already know that unemployment benefits discourage people from working.

- We already know that food stamps discourage people from working.

- We already know that Obamacare discourages people from working.

- We already know that disability payments discourage people from working.

So if we replace all those handouts with one big universal handout, is there any reason to expect that somehow people will be more likely to find jobs and contribute to the economy?

Again, we need to wait another year or two before we have comprehensive data from Finland. But I’m skeptical that we’ll get a favorable outcome.

August 1, 2017

Ontario adopts voluntary self-surveillance app from CARROT Insights

I often joke about how inexpensive it appears to be to “influence” politicians, but it’s only fair to point out that the voters those easily influenced politicians represent are even more easy to influence:

Ontario announced earlier this month that it will become the fourth Canadian government to fund a behavioral modification application that rewards users for making “good choices” in regards to health, finance, and the environment. The Carrot Rewards smartphone app, which will receive $1.5 million from the Ontario government, credits users’ accounts with points toward the reward program of their choice in exchange for reaching step goals, taking quizzes and surveys, and engaging in government-approved messages.

The app, funded by the Canadian federal government and developed by Toronto-based company CARROT Insights in 2015, is sponsored by a number of companies offering reward points for their services as an incentive to “learn” how to improve wellness and budget finances. According to CARROT Insights, “All offers are designed by sources you can trust like the BC Ministry of Health, Newfoundland and Labrador Government, the Heart and Stroke Foundation, the Canadian Diabetes Association, and YMCA.” Users can choose to receive rewards for companies including SCENE, Aeroplan, Petro-Canada, or More Rewards, a loyalty program that partners with other businesses.

It’ll be interesting if they share the uptake of this new smartphone app … just how many of us are willing to let the government track just about all of our actions in exchange for “rewards”.

In order to use the app, users are giving Carrot Insights and the federal government permission to “access and collect information from your mobile device, including but not limited to, geo-location data, accelerometer/gyroscope data, your mobile device’s camera, microphone, contacts, calendar and Bluetooth connectivity in order to operate additional functionalities of the Services.”

Founder and CEO of CARROT Insights Andreas Souvaliotis launched the app in 2015 “with a focus on health but the company and its partner governments quickly realized it was effective at modifying behavior in other areas as well,” according to CTV News.

July 31, 2017

Patents, Prizes, and Subsidies

Published on 17 May 2016

Growth on the cutting edge is all about the creation of new ideas.

So, we want institutions that incentivize such creation. How do we do this? The answer is somewhat tricky.

The first goal for good ideas is for them to spread as freely as possible. The further the reach, the greater the gains. The problem is, if just anyone can use ideas, then why would we ever pay for them? And without the right incentives, why would innovators create new ideas at all?

Imagine yourself as the creator of a new drug. Typically, it costs about a billion dollars to do this, not counting the time and effort needed to get the drug FDA-approved.

Now, if there were no protections in place, then theoretically, once the formula’s known, everyone could just copy the make-up of your new drug. See, the thing about pharmaceuticals is, once the formula’s known, production is relatively cheap. Given that, let’s assume imitations start flooding the market.

Predictably, the price of your new drug will plummet.

Once prices hit rock-bottom, you’ll have no way to recoup the $1 billion you spent on R&D.

Given that kind of result, we reckon you probably won’t want to develop more good ideas.

The US founding fathers anticipated this problem. Knowing that innovators needed incentives to have good ideas, the founders wrote a protection mechanism into the Constitution.

They gave Congress the ability to grant exclusive rights to inventors — rights to use and sell their inventions, for a limited period of time. This exclusive right, is what we call a patent. Patents grant inventors a temporary monopoly over the use and sale of their intellectual property.

Now, as nice as this is, patents are a thorny subject.

For one, how long should patents last? Also, how much innovation is considered enough to merit a patent grant? Not to mention, are patents the only way to reward good ideas?

The answer is no.

There are two more incentive options here: prizes, and subsidies.

Let’s start with subsidies. University and research subsidies are particularly effective in the basic sciences. Since innovations in this space are rather abstract, subsidies incentivize research without requiring the applications of the research to be explicitly named. The problem is, when we’re incentivizing just research, then researchers might pick directions that are interesting, but not particularly useful.

This is why the third incentive option — prizes — exists.

Prizes reward the output of solving a certain problem. Another plus, is that prizes leave solutions unspecified. They provide a problem to work on, but give quite a lot of leeway as to how the problem is solved.

Now, knowing the complexity inherent in patents, you might think that prizes and subsidies are good enough alternatives. But none of these incentives for ideas, are inherently better than any of the others. Patents, prizes, and subsidies all involve their own tradeoffs and questions.

For example, who decides what gets subsidized? Who decides which goals merit a prize?

It’s hard to determine what mix of institutions, will best incentivize the production of good ideas. Patents, prizes, and subsidies all navigate these conflicting goals, in their own way.

And yes, all this talk of incentives and conflicting goals and tradeoffs might be like walking a tightrope. But, it’s a tightrope we can’t opt out of. Certainly not if we want the economy to keep growing.

In our next release, you’ll watch a TED talk from a certain economist that elaborates further on ideas. And then, we’ll wrap up this course segment with the Idea Equation. Stay tuned!

July 19, 2017

QotD: Prices in a post-scarcity economy

The most important piece of information that the price system provides is “How much do I want this, given that other people want it too?” That’s the question that millions of people are answering, when they decide to use less tin, or pay more for tin and use less of something else. Computers are not good at answering this question.

How would a computer even get the information to make a good guess, in the absence of a price system? Please do not say surveys. You know what did really well on surveys? New Coke. Also, Donald Trump, who is not going to be president. We are, in fact, back to some version of the incentive problem, which is that when the stakes are low, people don’t put too much thought into their answers.

In many cases, people are interested in getting rid of prices precisely because they don’t like the signal that it is sending — that the best possible medical care is a scarce good that few people are going to get, or that other people do not value your labor very much. People are trying to override that information with a better program.

But even if we decide that the planners know best, we still have to contend with the resistance that will arise to their plan. Just as Communism’s critics need to remember that money is not the only reason people strive, post-capitalists need to remember that they will be dealing with people — cantankerous, willful and capable of all manner of subversions if the plan is not paying sufficient attention to their needs.

It’s possible that we’ll see versions of a “post-scarcity” economy in things like music and writing, since these are basically versions of activities that people have been doing for free for thousands of years. But when it comes to unpleasant labor like slaughtering animals, mining ore and scrubbing floors, even an advanced society needs to figure out exactly how badly it wants those things done. And so far, nothing beats prices for eliciting that information.

Megan McArdle, “Yes, Computers Have Improved. No, Communism Hasn’t”, Bloomberg View, 2015-09-02.

July 14, 2017

The Peltzman Effect

The odd situation where increasing the safety of an activity by adding protective gear is offset by greater risk-taking by the participants:

In the 1960s, the Federal Government — in its infinite wisdom — thought that cars were too unsafe for the general public. In response, it passed automobile safety legislation, requiring that seat belts, padded dashboards, and other safety measures be put in every automobile.

Although well-intended, auto accidents actually increased after the legislation was passed and enforced. Why? As [Professor of Economics Steven E.] Lansburg explains, “the threat of being killed in an accident is a powerful incentive to drive carefully.”

In other words, the high price (certain death from an accident) of an activity (reckless driving) reduced the likelihood of that activity. The safety features reduced the price of reckless driving by making cars safer. For example, seatbelts reduced the likelihood of a driver being hurt if he drove recklessly and got into an accident. Because of this, drivers were more likely to drive recklessly.

The benefit of the policy was that it reduced the number of deaths per accident. The cost of the policy was that it increased the number of accidents, thus canceling the benefit. Or at least, that is the conclusion of University of Chicago’s Sam Peltzman, who found the two effects canceled each other.

His work has led to a theory called “The Peltzman Effect,” also known as risk compensation. Risk compensation says that safety requirements incentivize people to increase risky behavior in response to the lower price of that behavior.

Risk compensation can be applied to almost every behavior involving risk where a choice must be made. Economics tells us that individuals make choices at the margin. This means that the incentive in question may lead the individual to do a little more or a little less of something.

[…]

The fact that incentives reduce or increase behavior is an economic law: Landsburg posits that “the literature of economics contains tens of thousands of empirical studies verifying this proposition and not one that convincingly refutes it.” Incentives change the effectiveness of government policy and shape day-to-day life.

June 28, 2017

Concert-goers rejoice, for the government is here to help you!

Of course, if you have any experience of the utility of “government help”, you shouldn’t get your hopes up too high, as Chris Selley explains:

The results of an online public consultation were clear, said Naqvi. “One: the current system clearly is not working for fans; and two: Ontarians expect the government to take action.” We should have expected nothing less: ticket rage is a real thing among concertgoers in particular — a mind-boggling 35,000 people completed the online consultation — and besides, the survey didn’t include an option to suggest the government do nothing.

Among other things, Naqvi said, it will be illegal to resell tickets for more than 150 per cent of face value, and it will be illegal to use bots. Soon, he promised, “everyone (will have) a fair shot at getting the tickets they want.” Ontario, he said, will become “a world leader in ticket sales regulation.”

You’re supposed to think that’s both plausible and desirable. You should instead be very, very skeptical. So long as U2, the Tragically Hip and other artists insist on pricing their tickets vastly below what people are willing to pay for them, there will be an enormous incentive to circumvent whatever laws are in place to prevent third parties from reaping those foregone profits. A 150-per-cent cap would reduce the incentive, as Naqvi says — but only if the entire scalping community decided to respect it.

It won’t. It doesn’t. Scalping is illegal in Arkansas. Tickets for the University of Arkansas Razorbacks’ Nov. 24 game against Missouri are going on Stubhub for well over twice face value. Scalping is illegal in Quebec. Stubhub will put you in the third row for Bob Dylan’s show at the Montreal Jazz Festival next month for US$275; face value is $137.50 Canadian. The experiment works in every scalping-restrictive North American jurisdiction I tried. Heck, scalping used to be illegal in Ontario. That sure didn’t deter the gentlemen who prowled around outside Maple Leaf Gardens and SkyDome.

Many Stubhub users aren’t even in Ontario — that’s even more true for the people with the bots. Is the Attorney General really going to prosecute people for the crime of selling tickets at prices people are perfectly willing to pay? People in other countries? That would get awfully old in an awful hurry.

As he points out in the article, this is yet another instance of the Ontario government pandering to the demands of economic illiterates (recent examples include slapping on new rent controls in the middle of a housing crunch and significant increases in the minimum wage as new workforce entrants are already finding it tough to get hired). It’s as though the government is reading the economic textbook upside down … bringing in exactly the wrong “solutions” to every problem they see.

May 26, 2017

Puzzle of Growth: Rich Countries and Poor Countries

Published on 16 Feb 2016

Throughout this section of the course, we’ve been trying to solve a complicated economic puzzle — why are some countries rich and others poor?

There are various factors at play, interacting in a dynamic, and changing environment. And the final answer to the puzzle differs depending on the perspective you’re looking from. In this video, you’ll examine different pieces of the wealth puzzle, and learn about how they fit.

The first piece of the puzzle, is about productivity.

You’ll learn how physical capital, human capital, technological knowledge, and entrepreneurs all fit together to spur higher productivity in a population. From this perspective, you’ll see economic growth as a function of a country’s factors of production. You’ll also learn what investments can be made to improve and increase these production factors.

Still, even that is too simplistic to explain everything.

So we’ll also introduce you to another piece of the puzzle: incentives.

In previous videos, you learned about the incentives presented by different economic, cultural, and political models. In this video, we’ll stay on that track, showing how different incentives produce different results.

As an example, you’ll learn why something as simple as agriculture isn’t nearly so simple at all. We’ll put you in the shoes of a hypothetical farmer, for a bit. In those shoes, you’ll see how incentives can mean the difference between getting to keep a whole bag of potatoes from your farm, or just a hundredth of a bag from a collective farm.

(Trust us, the potatoes explain a lot.)

Potatoes aside, you’re also going to see how different incentives shaped China’s economic landscape during the “Great Leap Forward” of the 1950s and 60s. With incentives as a lens, you’ll see why China’s supposed leap forward ended in starvation for tens of millions.

Hold on — incentives still aren’t the end of it. After all, incentives have to come from somewhere.

That “somewhere” is institutions.

As we showed you before, institutions dictate incentives. Things like property rights, cultural norms, honest governments, dependable laws, and political stability, all create incentives of different kinds. Remember our hypothetical farmer? Through that farmer, you’ll learn how different institutions affect all of us. You’ll see how institutions help dictate how hard a person works, and how likely he or she is to invest in the economy, beyond that work.

Then, once you understand the full effect of institutions, you’ll go beyond that, to the final piece of the wealth puzzle. And it’s the most mysterious piece, too.

Why?

Because the final piece of the puzzle is the amorphous combination of a country’s history, ideas, culture, geography, and even a little luck. These things aren’t as direct as the previous pieces, but they matter all the same.

You’ll see why the US constitution is the way it is, and you’ll learn about people like Adam Smith and John Locke, whose ideas helped inform it.

And if all this talk of pieces makes you think that the wealth puzzle is a complex one, you’d be right.

Because the truth is, the question of “what creates wealth?” really is complex. Even the puzzle pieces you’ll learn about don’t constitute every variable at play. And as we mentioned earlier, not only are the factors complex, but they’re also constantly changing as they bump against each other.

Luckily, while the quest to finish the wealth puzzle isn’t over, at least we have some of the pieces in hand.

So take the time to dive in and listen to this video and let us know if you have questions along the way. After that, we’ll soon head into a new section of the course: we’ll tackle the factors of production so we can further explore what leads to economic growth.

April 18, 2017

QotD: Rent control

To someone ignorant of economic reasoning, rent control seems like a great policy. It appears instantly to provide “affordable housing” to poor tenants, while the only apparent downside is a reduction in the income flowing to the fat-cat landlords, people who literally own buildings in major cities and who thus aren’t going to miss that money much. Who could object to such a policy?

First, we should define our terms. When a city government imposes rent control, it means the city makes it illegal for landlords to charge tenants rent above a ceiling price. Sometimes that price can vary, but only on specified factors. For the law to have any teeth — and for the politicians who passed it to curry favor with the public — the maximum rent-controlled price will be significantly lower than the free-market price.

The most obvious problem is that rent control immediately leads to a shortage of apartments, meaning that there are potential tenants who would love to move into a new place at the going (rent-controlled) rate, but they can’t find any vacancies. At a lower rental price, more tenants will try to rent apartment units, and at a higher rental price, landlords will try to rent out more apartment units. These two claims are specific instances of the law of demand and law of supply, respectively.

[…]

In the long run, a permanent policy of rent control restricts the construction of new apartment buildings, because potential investors realize that their revenues on such projects will be artificially capped. Building a movie theater or shopping center is more attractive on the margin.

There are further, more insidious problems with rent control. With a long line of potential tenants eager to move in at the official ceiling price, landlords do not have much incentive to maintain the building. They don’t need to put on new coats of paint, change the light bulbs in the hallways, keep the elevator in working order, or get out of bed at 5:00 a.m. when a tenant complains that the water heater is busted. If there is a rash of robberies in and around the building, the owner won’t feel a financial motivation to install lights, cameras, buzz-in gates, a guard, or other (costly) measures to protect his customers. Furthermore, if a tenant falls behind on the rent, there is less incentive for the landlord to cut her some slack, because he knows he can replace her right away after eviction. In other words, all of the behavior we associate with the term “slumlord” is due to the government’s policy of rent control; it is not the “free market in action.”

Robert P. Murphy, “The Case Against Rent Control: Bad housing policy harms lower-income people most”, The Freeman, 2014-11-12

January 29, 2017

QotD: Perverse incentives for journalists

Unfortunately, the incentives of both academic journals and the media mean that dubious research often gets more widely known than more carefully done studies, precisely because the shoddy statistics and wild outliers suggest something new and interesting about the world. If I tell you that more than half of all bankruptcies are caused by medical problems, you will be alarmed and wish to know more. If I show you more carefully done research suggesting that it is a real but comparatively modest problem, you will just be wondering what time Game of Thrones is on.

Megan McArdle, “The Myth of the Medical Bankruptcy”, Bloomberg View, 2017-01-17.

December 24, 2016

QotD: Getting NATO nations’ attention

How to make some NATO members move in the right direction? Here’s an idea. Let me pull one of my “NATO Motivator” concepts out of my goodie-bag.

You learn quickly in NATO that one of the most critical and important things to many in the alliance is a thing called Flags-to-Post.

It is when NATO decides which nations will get which senior uniformed and senior civilian adviser billets. Trust me on this; the conflict in AFG, refugee crisis, etc – none of that stuff goes in front of anything related to Flags to Post.

If you’d like to bring attention to the “Press allies on defense spending” point, do this; the minute an Estonian General (pop. 1.3 million, percent of GDP on defense, 2.04%) take a position usually held by say, a Belgian General (pop. 11.2 million, percent of GDP on defense, 1.05%), then you will get people’s attention.

Just an idea.

CDR Salamander, “Make NATO Great Again”, CDR Salamander, 2016-11-14.

December 6, 2016

Alex & Tyler’s Economist’s Christmas

Published on 5 Dec 2016

This week: Let’s get in the holiday spirit! What would an economist do about Christmas gifts?

What do you really want for the holidays? And how can you be sure you’re giving the perfect gift to someone else?

Of course, you want to get your loved ones something they will appreciate, but you face a knowledge problem: you don’t know everything about their wants and needs. You also have an incentive problem: oftentimes people aren’t quite as careful choosing a gift for others as they would be if buying something for themselves.

We’ve all received a present that we didn’t really want. When that happens, the value that we place on the gift can be less than its cost. According to research by economist Joel Waldfogel, gift givers spend an average of $50 on gifts that recipients only value at $40. Given that Americans spend around $100 billion on Christmas gifts, we’re wasting $18-20 billion every holiday season!

Is there a solution to this costly problem? Well, you can always give cold, hard cash! Many gift recipients would prefer it. But if you know the recipient’s tastes very well, you do have the opportunity to give them a non-cash present that they’ll love and that creates value by lowering their search costs.

There are, of course, occasions where the gift of money doesn’t make sense. Perhaps you want to signal that you care in a different way, or maybe there’s a custom you want to follow. You’ll just have to risk it in these situations.

Around the holidays, there’s also a spike in charitable giving. If you face knowledge and incentive problems in giving gifts to loved ones, you can imagine that these issues increase when you’re giving to someone you’ve never met. To combat this problem, some charities, such as GiveDirectly, give cash to people in need so that they spend charitable donations however meets their needs.

The efficiency of an economist’s Christmas may feel less warm and fuzzy, but the value creation is no less generous!

November 24, 2016

Solutions to Moral Hazard

Published on 23 Sep 2015

What are some solutions to moral hazard? We could try to make information less asymmetric — meaning both parties have similar information, making it harder for one party to exploit the other. We could also try to reduce the incentive of the agent to exploit their information advantage. Online ratings and reviews on Yelp, Angie’s List, or Amazon, for instance, incorporate both of these solutions. The reviews give you more information about a product or service and close the information gap between buyers and sellers. In addition, sellers’ incentives change, as they now have to think about their reputation. They likely won’t want to exploit you if they know it will result in a negative online review.

What are some other approaches to modifying the incentives of those with an information advantage? One approach is to split the diagnosis of a problem from the actual work that needs to be done — for instance, home inspectors don’t fix the problems they identify during their inspection. Another approach is to alter the payment structure to change incentives. For instance, a lawyer is less likely to run up their hours when payment is contingent on winning your case as opposed to the number of hours they work on the case. Ethics also plays a role. Doctors swear to the Hippocratic Oath, which provides them an incentive to not exploit their information advantage. As you can see, there are many solutions to addressing moral hazard.

November 16, 2016

Moral Hazard

Published on 23 Sep 2015

Imagine you take your car in to the shop for routine service and the mechanic says you need a number of repairs. Do you really need them? The mechanic certainly knows more about car repair than you do, but it’s hard to tell whether he’s correct or even telling the truth. You certainly don’t want to pay for repairs you don’t need. Sometimes, when one party has an information advantage, they may have an incentive to exploit the other party. This type of exploitation is called moral hazard, and can happen in many situations — a taxi driver who takes the “long route” to get a higher fare from a tourist, for example. In this video, we cover moral hazard and what is known as the principal-agent problem.