The Critical Drinker

Published 6 Feb 2023Disney isn’t looking too healthy these days, with massive financial losses, collapsing stock prices and internal power struggles threatening to tear the House of Mouse apart at the seams. How did this happen? Let’s find out.

(more…)

February 7, 2023

Disney – An Empire In Collapse

November 13, 2022

Corruption in US politics? Where’s the fainting couch?

Elizabeth Nickson looks at several recent books covering political corruption in US politics:

Whitney Webb’s One Nation under Blackmail published late last month, explains in exhaustive detail how the American government was taken over by well-dressed thieves. Webb writes from the left, but she is dispassionate. In 1,000 pages, she explains the history of the turning of democracy, starting post WW2 with the heinous Dulles brothers, moving through Reagan with country club thugs calling themselves The Enterprise, to Jeffrey Epstein’s seduction of Bill and Hillary Clinton. Promising riches beyond their imaginings, the seduction led the couple, by increments, to sell out the country to China and Wall Street.

Webb explains how Epstein set up the Clinton and Gates Foundations promising a new iteration in “charity”, one that made profits, and pushed forward the founders as Saviours. Clinton in her years as Sec State, flew around the world eating brownies and demanding tithes for herself, in return for every beneficence she gave courtesy of the American taxpayer. The ’08 crisis was brought to us by the same crooks, and the same methods, chipping away at regulation. The head Fannie and Freddie Mae bureaucrat, James A Johnson walked away with $100 million leaving the world in crisis. Tens of millions lost everything.

Add this to [Profiles in Corruption] Peter Schweizer’s extraordinary detailing of how Pelosi etc. made their hundreds of millions using taxpayer money, pinpointed deregulation and insider trading.

Schweizer describes how the mega-criminal dealing of the Bidens with China and the Ukraine has walked us into a potential nuclear conflict with both Russia and China. The Lords of Easy Money shows how Wall Street and all the pension funds, all the index funds, have been rolling over corporate debt and taking profits, then borrowing more, selling, borrowing more, selling, and repeat. Which means that every American enterprise that is traded and somehow functional, is laden with corporate debt it cannot possibly pay the interest on, as interest rates rise. Jay Powell made his $50 million that way.

Webb shows how Epstein coached Gates through invading and then purchasing public health both at home and through the UN. Add in the Covid mess, and another bunch of corporate and government thieves walked away with $3 Trillion, in the US alone.

Do you really think they’d allow the endless prosecutions they deserve? Do you really think they want to give back the money they stole?

August 16, 2022

“Penguin Random House is a vampire corporation”

Belatedly, as I was away for the weekend, here’s something from the latest SHuSH newsletter on the Random Penguin court case:

At the beginning of the millennium, Random House (pre-Penguin) had revenues of $2.3 billion (all US figures) and a profit margin of 9 per cent. At the end of the aughts, it had revenues of 2.3 billion and a profit margin of 9 per cent. It was the biggest publishing company on the planet but it had ceased to grow.

Growth matters, especially to Random House’s parent company, Bertelsmann SE, a public company. People buy shares in publicly listed companies because they believe the entity will grow and produce larger profits in the future, making the share price rise and the investor happy. That is the whole game for public companies.

When an asset at a public company does not contribute to growth it is dead weight. It needs to be fixed or jettisoned.

Bertelsmann decided to fix Random House. In 2012, it struck the richest deal in book publishing history, acquiring 53 per cent of Penguin Books, which it then merged with Random House to make the biggest publisher even bigger.

It was said at the time that the two publishers, with combined revenues of $3.9 billion, would be able to share costs, attract better talent, take more risks, offer new products, develop new markets, and otherwise innovate. Together they would have the scale to stand up to bookselling chains like Barnes & Noble and the massive digital players, Amazon and Apple.

It was a lot of hype, of course. Random House had its pick of talent, all the size it needed to negotiate with Barnes & Noble, and it would never be in the same league as Amazon. Markus Dohle, CEO of Penguin Random House, is lucky to get a mid-level account manager on the phone at Amazon.

But the deal went ahead and expectations for the new Penguin Random House were sky high. They had to be. Bertelsmann’s purchase price valued Penguin at $3.5 billion, or more than twenty times its annual profits of $171 million. Penguin Random House would have to be far more than the sum of its parts to justify that price.

Over the next several years, Bertelsmann doubled down on its bet, scooping up the remaining 47 per cent of Penguin in two separate transactions to eventually own it outright.

Did any of the anticipated magic happen?

The first full year of a combined Penguin Random House was 2014. Revenues were about $4 billion, and that’s where they’ve been ever since (leaving aside a nice bump in 2019, the year of Michelle Obama). Profits are up, which might be considered a good sign. But they didn’t grow as a result of the combined firm’s increased scale, new competitive muscle, better talent, new markets, new products, or innovations. As far as I can tell, the improved profitability was achieved the old-fashioned way: the payroll shrunk from a high of 12,800 to 10,800. Also, e-books and audiobooks improved the profitability of all publishers. And the Obamas each knocked one out of the park.

The point is that seven years down the road, Penguin Random House remained exactly the sum of its parts, minus 2000 workers. The acquisition was a big-time bust. Most of the $3.5 billion purchase price was wasted.

May 1, 2022

The Victorian-era “guarantee fund” model for risky enterprises

In the latest Age of Inventions newsletter, Anton Howes wonders why we don’t have a modern equivalent to the funding mechanism that helped create the Great Exhibition of 1851 and other events that provided benefits to the public without government backing:

The Crystal Palace from the northeast during the Great Exhibition of 1851.

Image from the 1852 book Dickinsons’ comprehensive pictures of the Great Exhibition of 1851 via Wikimedia Commons.

As I’ve mentioned before, exhibitions of industry were not just celebrations of technological progress, but could become engines for progress as well. For the inventors, artists, and engineers who exhibited, the events were a direct inducement to improvement. And for the public who visited, the events exposed them to what was possible, encouraging them to raise their demands as both consumers and citizens, ideally inspiring them to become future innovators too.

But how was it all paid for? Unlike its national-level precursors in France, the Great Exhibition was not a state-run event. Even more remarkably, its organisers also failed to raise anywhere near enough private subscriptions to cover their costs. Instead, they used something that called a “guarantee fund”.

Instead of asking for donations from supporters up-front, the organisers asked them to commit to covering the exhibitions potential losses up to certain amounts — to be paid only if the money was required. Based on the security provided by this crowdsourced guarantee fund, the organisers then raised an ordinary bank loan in order to get the cash they needed to actually hold the event. Crucially, the guarantors didn’t actually have to spend anything unless the event made a loss, and if the event broke even or even made a surplus thanks to ticket fees, then they would never spend a penny at all. (Luckily for them, that’s exactly what happened in 1851, and for many later exhibitions too.)

What’s interesting to me about the guarantee fund is that I can’t quite think of anything quite like it today. There are perhaps more individualised versions of it, like when a neighbour or friend acts as a guarantor for a mortgage. And governments sometimes provide guarantees for certain sectors or industries too. There have also been a few profit-making versions of it in certain industries, where the guarantors potentially get some share of the upside too (“Names” at the Lloyds of London insurance and reinsurance market sounds similar, though even these are disappearing). But I’ve not seen anything like what the Victorians did, essentially using a guarantee fund to leverage philanthropy.

This is surprising to me. It seems like it has a lot of major advantages, especially for those who might want to replicate the exhibitions of industry today, or indeed for any kind of capital-intensive philanthropic endeavour that could eventually be expected in some measure to pay for itself. (I can’t help but think it would be useful in efforts to speed up the de-carbonisation of the economy, for example — a potential application that I’ve been exploring in my conversations with the people at Carbon Upcycling.)

Consider that with a guarantee fund anyone able to afford the risk could considerably increase the philanthropic value of their assets. Say that you could afford to donate £100 right away, but could donate three times that amount at a pinch (e.g. by having to liquidate some funds in shares). You could thus guarantee £100 each to three different causes, potentially without ever actually having to donate it, and knowing that in the worst case scenario you would never have to spend more than the £300 you can afford.

After all, those signing up to the guarantee fund essentially chose what their maximum liability would be if the event were to make a loss. If they were confident in the event’s success, then they probably believed that they would not have to pay anything at all. And if not, they had at least named the maximum donation they might eventually be asked to give.

February 8, 2022

QotD: The East India Company’s rise to power

We still talk about the British conquering India, but that phrase disguises a more sinister reality. It was not the British government that seized India at the end of the 18th century, but a dangerously unregulated private company headquartered in one small office, five windows wide, in London, and managed in India by an unstable sociopath – Clive.

In many ways the EIC was a model of corporate efficiency: 100 years into its history, it had only 35 permanent employees in its head office. Nevertheless, that skeleton staff executed a corporate coup unparalleled in history: the military conquest, subjugation and plunder of vast tracts of southern Asia. It almost certainly remains the supreme act of corporate violence in world history. For all the power wielded today by the world’s largest corporations – whether ExxonMobil, Walmart or Google – they are tame beasts compared with the ravaging territorial appetites of the militarised East India Company. Yet if history shows anything, it is that in the intimate dance between the power of the state and that of the corporation, while the latter can be regulated, it will use all the resources in its power to resist.

When it suited, the EIC made much of its legal separation from the government. It argued forcefully, and successfully, that the document signed by Shah Alam – known as the Diwani – was the legal property of the company, not the Crown, even though the government had spent a massive sum on naval and military operations protecting the EIC’s Indian acquisitions. But the MPs who voted to uphold this legal distinction were not exactly neutral: nearly a quarter of them held company stock, which would have plummeted in value had the Crown taken over. For the same reason, the need to protect the company from foreign competition became a major aim of British foreign policy.

The transaction depicted in the painting [Wiki] was to have catastrophic consequences. As with all such corporations, then as now, the EIC was answerable only to its shareholders. With no stake in the just governance of the region, or its long-term wellbeing, the company’s rule quickly turned into the straightforward pillage of Bengal, and the rapid transfer westwards of its wealth.

Before long the province, already devastated by war, was struck down by the famine of 1769, then further ruined by high taxation. Company tax collectors were guilty of what today would be described as human rights violations. A senior official of the old Mughal regime in Bengal wrote in his diaries: “Indians were tortured to disclose their treasure; cities, towns and villages ransacked; jaghires and provinces purloined: these were the ‘delights’ and ‘religions’ of the directors and their servants.”

Bengal’s wealth rapidly drained into Britain, while its prosperous weavers and artisans were coerced “like so many slaves” by their new masters, and its markets flooded with British products. A proportion of the loot of Bengal went directly into Clive’s pocket. He returned to Britain with a personal fortune – then valued at £234,000 – that made him the richest self-made man in Europe. After the Battle of Plassey in 1757, a victory that owed more to treachery, forged contracts, bankers and bribes than military prowess, he transferred to the EIC treasury no less than £2.5m seized from the defeated rulers of Bengal – in today’s currency, around £23m for Clive and £250m for the company.

William Dalrymple, “The East India Company: The original corporate raiders”, Guardian, 2015-03-04.

January 15, 2022

The futility of “ethical” divestment agitation

In C2C Journal, William McNally explains why activists are demanding that university investments be moved away from fossil fuel companies in favour of “green” investment, and why it won’t work the way they expect:

A recent press release announced that 100 faculty and other staff at three Ontario postsecondary institutions have petitioned the University Pension Plan (UPP) to divest from the fossil fuel sector. The UPP manages the pension funds for over 30,000 employees at the University of Toronto, Queen’s and Guelph. The press release was issued by Shift Action, an organization that helps activist pension members agitate for divestment from what it calls “high-carbon, high-risk fossil fuel investments” such as oil producers and pipeline companies, and shift investments to a “decarbonized” portfolio focused on climate solutions.

I highlighted the UPP petition to draw attention to its activist source, but it is not unique, as it reflects a broader trend of politically driven or, as proponents prefer, “ethical” investing. The motivating claim for divestment in the Shift press release is that we are experiencing a “worsening climate crisis”. That too is a common sentiment nowadays. Because it is a crisis, we have a moral duty to mitigate the threat. The underlying reasoning is that divestment will starve fossil fuel companies of capital and less capital means less production which, in turn, means less CO2 emitted and ultimately slower climate change.

All campaigns of this sort trigger some immediate questions, such as, why choose a strategy as indirect as divestment? Why not reduce fossil fuel use in one’s own backyard, in this case the universities? Looking more broadly, Shift’s argument is more wishful thinking than sound economic analysis. Investors should feel free to hold any portfolio they want, but they should do so without illusions. In particular, they shouldn’t expect divestment to influence climate change by starving oil and natural gas companies of capital.

The first thing wrong is the underlying motivation: there is no climate crisis. As well-known author Bjorn Lomborg states in his most recent book, False Alarm: How Climate Change Panic Costs Us Trillions, Hurts the Poor, and Fails to Fix the Planet: “Climate change is real, but it’s not the apocalyptic threat that we’ve been told it is.” One of the clearest ways to see this is through climate economics. Scenarios set out by the Intergovernmental Panel on Climate Change (IPCC) forecast that over the next 80 years worldwide GDP per capita will likely increase to 450 percent of today’s level.

Lomborg estimates that climate damages will reduce this anticipated increase to 434 percent. Climate change is a problem. Accepting all of the assumptions that went into this modelling, climate change is likely to leave us somewhat less well off than we otherwise would be, by modestly slowing humanity’s overall progress. But judging by these figures, it is not a crisis.

H/T to Robert at SDA for the link.

August 23, 2021

QotD: Leaving money in the hands of individuals

Here’s the thing: contrary to what the left thinks, when you leave wealth in the hands of the individuals, they don’t just flush it down the toilet or build gigantic bins that they fill with money, in which they go for a refreshing swim every day.

People do things with that money. And even if all they do is buy stuff (thereby allowing someone else to accumulate wealth) or invest it, that money gets aggregated and finds things to do, as it were. Wealth goes to work on things that seem interesting, might be interesting, or are otherwise likely to make money for the individuals who hold the wealth.

Individuals have money to start new businesses that would never have existed if they’d paid that money in taxes. Or they “invest” in free time and a really nice garden, which in turn lifts the spirits of people who invent something because they feel better than they would otherwise.

The left insists that if they leave money in individual hands, it will just be “wasted”. (Because, you know, no money spent on a vast apparatus, most of it a jobs program for useless paper pushers or power-hungry martinets is ever wasted.)

How do they know? Have they tried leaving enough money in the hands of those who earn it to make a difference?

Not in the twentieth century. Though we can infer from the fact that the most sclerotic, dying countries are the highest taxed ones, that perhaps what government considers “best” and what we consider “best” are not the same.

Not just taxes, but regulations too weigh heavily on possibilities. Sure, the left sees “lands saved” (or created. oop) when say, regulations curtail oil drilling. But what I see is energy taking up an excessive amount of every family’s money, wealth that would otherwise be freed for other investments, for starting businesses, even “just” for fun.

The problem we have is that leftists lack utterly in imagination. They see the “pristine” plots of land, or the things government does with our money and they find it good.

But they’re mind’s-eye blind. They can’t see the wealth that has been consumed for almost 100 years now say on the war on poverty to create chronic poverty having instead been used by individuals to create, to invest, to build, so that, in that parallel world in which money stayed in individual hands, we now have interplanetary travel, colonies all over the solar system, and squid farms on Mars that feed all of humanity.

Their lack of vision, their killing of possibilities without the slightest thought to them: That is a tragedy.

Sara Hoyt, “The Tragedy of the Squid Farms on Mars”, Libertarian Enterprise, 2018-12-05.

August 21, 2021

Indigo in the red

In the latest edition of his SHuSH newsletter, Kenneth Whyte looks at the dire financial situation of Canada’s big box bookstore chain:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

Indigo just released its first-quarter financial results, covering the period April-June 2021, which can be compared to its pre-pandemic results from the same quarter in 2019.

Back then, Indigo had revenues of $193 million and no profit. Seventy percent of its revenue, or $136 million, came from the firm’s eighty-nine Chapters and Indigo superstores. Only $25 million came from its 115 smaller stores (Coles and Indigo Spirit), and another $29 million from online sales at chapters.indigo.ca. Not only did the company book no profit, but all three of those revenue channels were down from the previous year, with online sales falling the most (15%).

This is to say that Indigo, in financial terms, was immunocompromised before COVID-19 hit.

The decline in digital sales was especially alarming. It seemed that CEO Heather Reisman was giving up on the web, an impression reinforced by her frequent renovations of in-store environments and her not terribly successful launch of a so-called cultural department store […] in New Jersey, Indigo’s first international gambit. She was all about bricks and mortar.

One also got the sense that Heather was giving up on books. She was building up the candles and blankets side of the business — it represented almost 40% of 2019’s total revenue. She also launched Thoughtfull.co, an effort to graze on Hallmark grass, and another step away from the book business.

I’d certainly despaired of finding much in the way of actual books at Chapters or Indigo stores … more and more of the floorspace that used to be devoted to books had been given over to housewares, candles, hostess gift items, decorative throw cushions and other such non-book items. Even before the Wuhan Coronavirus shut down the western world, it had been at least a year since the last time I’d found anything worth buying in one of their stores.

Two years and several pandemic waves later, Indigo is down to 88 superstores and 88 small-format stores, a net reduction of twenty-eight. I don’t know the significance of 88. Maybe the company’s new retail guru — Indigo always has a new retail guru — is a pianist, or Chinese, or a white supremacist.

The remaining stores are now open to foot traffic, and the company is wrangling with its various landlords over how much rent it should pay for the pandemic months when most of its outlets were closed. Indigo received almost $3 million in federal emergency rent subsidies, and almost $4 million in payroll subsidies, which seems like a lot but isn’t for a company as big as Indigo. As we noted in an earlier post, Heather also received a $25 million “liquidity enhancement”, or bailout, from billionaire husband Gerry Schwartz.

Which brings us to the present. Revenues for Indigo’s most recent quarter are $172 million (down $21 million from two years ago), and it lost $15 million (before depreciation, amortization, etc.).

Indigo doesn’t release enough detail on its operations to give us a clear idea of how the company lost only $15 million when its revenue fell $21 million, but costs were down across the board, probably reflecting the closed stores, reduced staffing levels, and fewer books on the shelves, among other savings.

July 5, 2021

QotD: Robert Walpole, the first Prime Minister

This month marks exactly 300 years since the Whig statesman Robert Walpole officially became our first prime minister. Not only was the country squire and landowner the first politician to occupy 10 Downing Street, he has also served the longest time at the top: an unbroken 20-year reign dubbed the “Robinocracy”.

Most historians rate Walpole as one of our more successful prime ministers: he stabilised the nation’s finances, saw off Jacobite sedition, and kept the country out of foreign wars, proudly boasting: “There are 50,000 slain in Europe this year and not one Englishman.” But inevitably, there was a downside to Walpole: he was charged by his enemies with corruption.

In fact, considering the spectacular eighteenth-century standards of sleaze, Walpole was — to borrow a phrase coined by Tony Blair — “a pretty straight kind of guy”. True, he spent six months in the Tower of London accused by his political foes of all sorts of malpractice; but he was eventually cleared. True, too, that he built a magnificent mansion, Houghton Hall, in his native Norfolk — but he had legitimately made a fortune in the South Sea Bubble financial crash that ruined so many others (by buying shares when they were low and selling them when they were high). Nevertheless, Walpole was not above sailing close to the wind of propriety, cynically remarking: “Every man has his price.”

Nigel Jones, “Scandal, corruption and collusion: 300 years of British prime ministers”, The Critic, 2021-04-03.

February 1, 2021

In the wake of l’affaire GameStop, frantic regulators call for more power to intervene in the market

“Regulatory capture” is the term for situations where the regulators and the regulated begin to get too close and the regulated industries or organizations begin to indirectly control the actions of the regulator for their own benefit. A topical example would be the sudden, agonized cries of politicians and market regulators for new powers to clamp down on disruptive players like the Redditors or other small investors who triggered the rise in GameStop share prices causing potentially ruinous financial losses for regulated hedge funds.

“GameStop” by JeepersMedia is licensed under CC BY 2.0

Although the story has garnered the attention of regulators and even the White House, the wrong takeaway is to suggest options for retail investors should be restricted more than they already are. Yet this is precisely what William Gavin, Secretary of the Commonwealth of Massachusetts, has called for. Gavin argued that there should be a 30-day trading suspension on GameStop to protect “small and unsophisticated investors.”

Gavin’s suggestion would have serious extended consequences. First, consider the knowledge problem that is involved in constructing such a restrictive regulation. When exactly would a rally become unacceptable? Despite years of decline, Kodak experienced a rally after its announcement that it would move into pharmaceuticals. Would this be permissible? If so, one could simply point to GameStop’s decision to appoint three new directors in an effort to turn the company around. If this is not enough, regulators must clearly state what identified the investments as unacceptable.

It is unclear if there is a perfect benchmark to distinguish rallies. But without such a measure, the suspension proposal would put every rally at risk of wrongful closure — potentially halting the growth of companies and industries, alike. Worse yet, the fear of missing out on a rising stock may push some investors to rush in with less information than they would otherwise acquire. Even if it is in a traditional rally, an uninformed decision could cause more harm than good.

Yet suppose the knowledge problem is solved and there is a perfect measure in place. Should other protections be put in place? One could make the case for a law against allowing “unsophisticated” gamblers from going to Las Vegas and losing money. And although this may seem like a leap, Gavin himself told Reuters, “This isn’t investing, this is gambling,” when he spoke of the GameStop rally.

The rally has attracted the world’s attention, but it does not require it. Rallies are a normal part of financial market activity. The only difference here is that it was Main Street that pulled one over on Wall Street.

January 30, 2021

“The only thing ‘dangerous’ about a gang of Reddit investors blowing up hedge funds is that some of us reading about it might die of laughter”

Matt Taibbi says “Suck it, Wall Street!”

The press conveyed panic and moral disgust. “I didn’t realize it was this cultlike,” said short-seller Andrew Left of Citron Research, without irony denouncing the campaign against firms like his as “just a get rich quick scheme.” Massachusetts Secretary of State Bill Galvin said the Redditor campaign had “no basis in reality,” while Dr. Michael Burry, the hedge funder whose bets against subprime mortgages were lionized in The Big Short, called the amateur squeeze “unnatural, insane, and dangerous.”

The episode prompted calls to regulate Reddit and, finally, halt action on the disputed stocks. As I write this, word has come out that platforms like Robinhood and TD Ameritrade are curbing trading in GameStop and several other companies, including Nokia and AMC Entertainment holdings.

Meaning: just like 2008, trading was shut down to save the hides of erstwhile high priests of “creative destruction.” Also just like 2008, there are calls for the government to investigate the people deemed responsible for unapproved market losses.

The acting head of the SEC said the agency was “monitoring” the situation, while the former head of its office of Internet enforcement, John Stark, said, “I can’t imagine there isn’t an open investigation and probably a formal order to find out who’s on these message boards.” Georgetown finance professor James Angel lamented, “it’s going to be hard for the SEC to find blatant manipulation,” but they “owe it to look.” The Washington Post elaborated:

To establish manipulation that runs afoul of securities laws, Angel said regulators would need to prove traders engaged in “an intentional act to push a price away from its fundamental value to seek a profit.” In market parlance, this is typically known as a pump-and-dump scheme …

Even Nancy Pelosi, when asked about “manipulation” and “what’s going on on Wall Street right now,” said “we’ll all be reviewing it,” as if it were the business of congress to worry about a bunch of day traders cashing in for once.

The only thing “dangerous” about a gang of Reddit investors blowing up hedge funds is that some of us reading about it might die of laughter. That bit about investigating this as a “pump and dump scheme” to push prices away from their “fundamental value” is particularly hilarious. What does the Washington Post think the entire stock market is, in the bailout age?

H/T to Larry Correia for the link.

January 28, 2021

GameStop in a very different kind of game

In the NP Platformed newsletter, Colby Cosh looks at the fascinating gyrations of GameStop’s share price in the grip of an unexpected group of players in the market:

“GameStop” by JeepersMedia is licensed under CC BY 2.0

GameStop has long been seen by institutional investors as following down the road of Blockbuster Video: it’s a bricks-and-mortar retailer whose main product is downloadable from your sofa. For that reason, it is heavily shorted by professional funds who normally eschew short-selling, which does have the risky feature of potentially infinite negative downside.

Enter Reddit, the website for special-interest user forums of all kinds. A Reddit “Wall Street bets” board uncovered evidence in regulatory filings that some hedge funds had legitimately dangerous large short positions representing bets against GameStop’s flaccid share price. A few hobby investors began to buy GameStop out of a sense of adventure and perhaps nostalgic loyalty. More importantly, they began to preach the gospel to others.

This is explicit “market manipulation,” but done in the open; it is surely as legal as any other conversation. GameStop’s price (NYSE symbol: GME) surged upward as word spread amongst day traders and other amateur investors. And as the random-looking rise in price got noticed, the whole scheme, itself rather reminiscent of a video game, went viral.

As of Jan. 12, GME was below $20, which is about where most analysts thought it belonged on merit, or lack thereof. The price as I type this particular sentence is $328.81. The backs of some funds with heavy short positions have been broken.

High finance seems somewhat terrified, as amateur investing websites — ones pioneered by the financial industry itself — begin to throw roadblocks in front of late-arriving GME buyers. For itself, Wall Street will invest billions replacing copper wire with fiber optics to gain microsecond arbitrage advantages in the market; for you and I, the good old portfolio can get conveniently 404ed for an afternoon.

This suggests that Wall Street may not have reckoned with the full possibilities of a world of proletarian shareholders. The stock market has proverbially been a playground of “animal spirits” since long before John Maynard Keynes used that phrase in 1936. What happens to an ecosystem when new animals show up? One can surely count on at least a minimum of chaos; maybe the surprise is that it took so long to take this game-like, combative form.

June 28, 2020

Why is the British government buying part of OneWeb?

As Tim Worstall points out, the British government’s decision to buy 20% of the satellite company OneWeb doesn’t actually make any economic sense:

… OneWeb – in which the UK will own a 20% stake following the investment – currently operates a completely different type of satellite network from that typically used to run such navigation systems.

“The fundamental starting point is, yes, we’ve bought the wrong satellites,” said Dr Bleddyn Bowen, a space policy expert at the University of Leicester. “OneWeb is working on basically the same idea as Elon Musk’s Starlink: a mega-constellation of satellites in low Earth orbit, which are used to connect people on the ground to the internet.

The actual answer is that we don’t need to buy into anyone’s system at all. Just as we shouldn’t have into [EU satellite system] Galileo in the first place.

For, d’ye see, GPS is a public good. The US allows anyone to use the signals. Not that they can really stop people doing so either. Not unless they take the whole system down.

So, there’s the US system, free for all to use. A global public good – this means it doesn’t matter who provides it, it is there. It also means we don’t need our own. Which, in turn, means we don’t and didn’t need the Galileo system, let alone another one after we’ve left that.

As I said, politics not even asking the right question. They’re asking “which new system should we have?” when the correct questions is “why do we need a new system?” and given that the answer to the second is we don’t therefore the first is entirely moot.

Even setting aside the question of what the satellite system will be capable of, as the market is already in the process of developing and deploying the equipment, why does the British government think its investment is necessary?

June 11, 2020

June 4, 2020

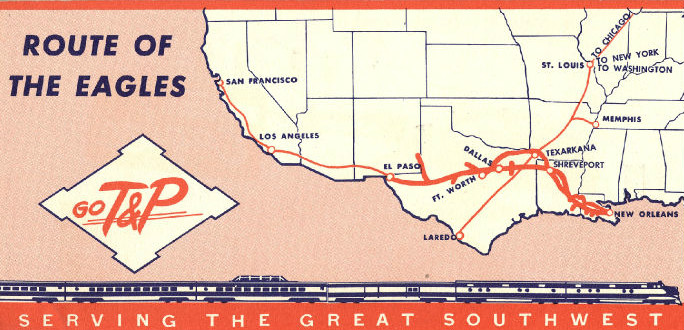

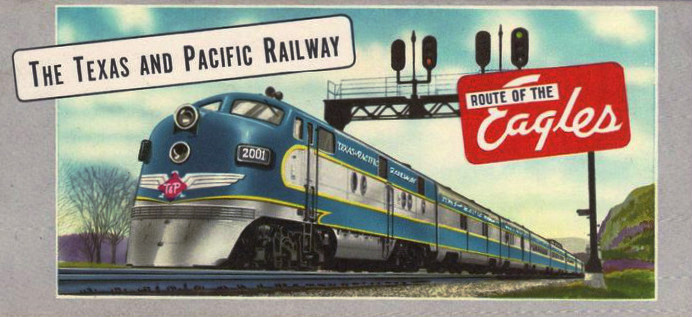

Fallen flag — the Texas & Pacific Railway

This month’s fallen flag article for Classic Trains is the story of the Texas & Pacific Railway by J. Parker Lamb:

Decorative ticket cover for a Texas & Pacific passenger train. T&P passenger trains were called “Eagles”, as in the Texas Eagle.

Image via Wikimedia Commons.

What grew to become the 20th century’s Texas & Pacific Railway sprouted from some of Texas’s earliest railroads. The Lone Star State’s pre-Civil War network included 11 operating companies. One of the earliest was the Texas Western Railroad, chartered in 1850 and soon renamed Vicksburg & El Paso. In 1856 its name changed again, to Southern Pacific Railroad Company. Of course, this SP had no relation to the Southern Pacific incorporated in 1865 in California, although the convoluted histories of their successors later would intersect.

Backers of this railroad envisioned it as part of a southern transcontinental route from the Mississippi River to San Diego. By 1860, construction of 27 miles was completed between Waskom, on the Louisiana border, and Marshall. The eastern connection was planned as the Vicksburg, Shreveport & Pacific, which already stretched from Waskom across Louisiana to the west bank of the Mississippi at Vicksburg (later part of Illinois Central, it is now part of Kansas City Southern’s “Meridian Speedway”).

The Memphis, El Paso & Pacific, chartered in 1856, planned to start at the Red River near Texarkana and build to a connection with the SP near Dallas, thereby bringing Midwestern traffic into the transcontinental route. Little progress was made before the Civil War, however, with only 5 miles of track built, near Jefferson.Within a decade after the war, these two lines would be fused into one company. In 1870 the Memphis road was renamed Southern Transcontinental Railroad, and in 1872 Congress issued a charter for the Texas & Pacific Railway, which soon acquired both the ST and SP. The new charter approved a route from Marshall to El Paso and San Diego, and required 100 consecutive miles of construction by 1882. Backers hired Gen. Grenville Dodge, who had been chief engineer of Union Pacific’s recently completed transcontinental line to Utah.

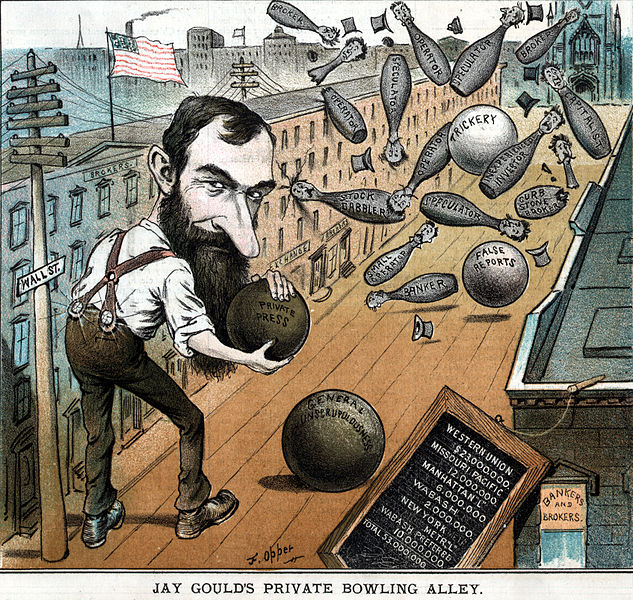

In 1880, the infamous “Robber Baron” Jay Gould joined the board and quickly became the president, and the T&P became a key part of his corporate empire (he already controlled the Union Pacific after 1873 and the Missouri Pacific from 1879):

“Jay Gould’s Private Bowling Alley.” Financier and stock speculator Jay Gould is depicted on Wall Street, using bowling balls titled “trickery,” “false reports,” “private press” and “general unscrupulousness” to knock down bowling pins labeled as “operator,” “broker,” “banker,” “inexperienced investor,” etc. A slate shows Gould’s controlling holdings in various corporations, including Western Union, Missouri Pacific Railroad, and the Wabash Railroad.

From the cover of Puck magazine Vol. XI, No 264 via Wikimedia Commons.

Meantime, Gould directed Chief Engineer Dodge to begin an all-out effort to lay rails through the vast and nearly uninhabited desert of west Texas. Construction crews reached Big Spring, 267 miles, in April 1881 and Sierra Blanca (522) on December 16, 1881. However, it was at Sierra Blanca where Gould’s dream of a transcontinental railroad evaporated. He had been bested by Collis P. Huntington, another determined and ruthless railroad tycoon. Huntington’s eastward construction crews had passed through Sierra Blanca three weeks earlier, on November 25, en route to their own “last spike” ceremony of the Sunset Route at the Pecos River (west of Del Rio) in January 1883.

Under the banner of the Galveston, Harrisburg & San Antonio, controlled by Huntington and T. W. Pierce, construction crews had left El Paso in June 1881. When it was clear that Huntington was winning the race for a transcontinental line, a series of court battles ensued, followed by nefarious delaying tactics (including sabotage) by each construction crew, and finally by personal negotiation between the two principals. Gould’s legal case was based on T&P’s 1870 charter to build to San Diego, whereas Huntington’s Southern Pacific charter allowed him to meet the T&P at the Colorado River (between California and Arizona).

Wikipedia provides this sketch of Gould’s railway activities after his involvement in the Erie War:

After being forced out of the Erie Railroad, Gould started to build up a system of railroads in the midwest and west. He took control of the Union Pacific in 1873 when its stock was depressed by the Panic of 1873, and he built a viable railroad that depended on shipments from farmers and ranchers. He immersed himself in every operational and financial detail of the Union Pacific system, building an encyclopedic knowledge and acting decisively to shape its destiny. Biographer Maury Klein states that “he revised its financial structure, waged its competitive struggles, captained its political battles, revamped its administration, formulated its rate policies, and promoted the development of resources along its lines.”

By 1879, Gould gained control of three more important western railroads, including the Missouri Pacific Railroad. He controlled 10,000 miles (16,000 km) of railway, about one-ninth of the rail in the United States at that time, and he had controlling interest in 15 percent of the country’s railway tracks by 1882. The railroads were making profits and set their own rates, and his wealth increased dramatically. He withdrew from management of the Union Pacific in 1883 amid political controversy over its debts to the federal government, but he realized a large profit for himself. He obtained a controlling interest in the Western Union telegraph company and in the elevated railways in New York City after 1881. In 1889, he organized the Terminal Railroad Association of St. Louis which acquired a bottleneck in east–west railroad traffic at St. Louis, but the government brought an antitrust suit to eliminate the bottleneck control after Gould died.