In 2020, as Jay Currie suggests, the warning sign might be robinhood.com:

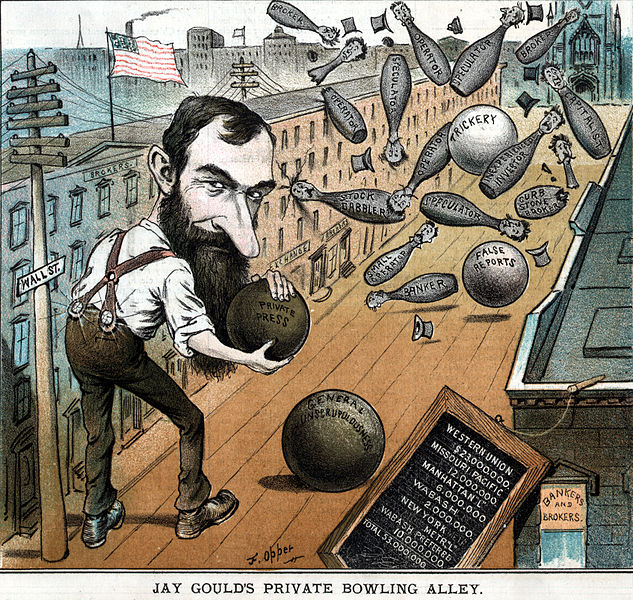

“Jay Gould’s Private Bowling Alley.” Financier and stock speculator Jay Gould is depicted on Wall Street, using bowling balls titled “trickery,” “false reports,” “private press” and “general unscrupulousness” to knock down bowling pins labeled as “operator,” “broker,” “banker,” “inexperienced investor,” etc. A slate shows Gould’s controlling holdings in various corporations, including Western Union, Missouri Pacific Railroad, and the Wabash Railroad.

From the cover of Puck magazine Vol. XI, No 264 via Wikimedia Commons.

In the winter of 1928 Joe Kennedy, father of JFK and major stock market player, stopped to get his shoes shined. The shoeshine boy leaned in and said, “Buy Hindenburg”. Kennedy began unwinding his positions saying, “You know it’s time to sell when shoeshine boys give you stock tips. This bull market is over.”

I had a similar experience in late 1999 when a friend took out a mortgage on her condo to buy shares in the billion dollar online copy paper empire. She had a perfectly good job in retail garden supplies. Remembering Kennedy, I advised another friend that her Nortel was looking a bit overbought. As it happened she sold quite near the peak.

The 2020 equivalent of the shoeshine boy is the perfect storm is the free trading platform, robinhood.com. This is a nicely designed site where you can trade shares on your computer or phone. It has become very, very popular with younger, new investors. My late 1990’s day trading pals would have killed for this sort of interface and no brokers fees. It has spawned a whole host of reddit chats, twitter streams and countless YouTube videos on the excitement of swing trading. (One fun spot to watch Robinhood is the https://robintrack.net/leaderboard which shows which stocks the people on Robinhood are buying. It is a bit slow and buggy but a great front row seat.)

What is striking about the robinhood.com world is that it revolves around trading rather than any sort of “investing”. You hop into APPL in the morning, see if you can make a couple of bucks by noon and move onto the next thing. And Apple is a real, solvent, company.

Robinhood has been in the news recently because the herd has charged into the shares of a number of companies which are either in or near bankruptcy. Hertz Rent-a-Car dropped from $20 to $0.50 in three months as the market realized that with no travelers there would be no car rentals. Interestingly, we learn from robintrack.net that at $20 there were a little over 1000 users holding, as Hertz crashed the Robinhood users piled in, at $0.55 there were 44,000 and there are now 158,000. And many will have made money, lots of money, trading the gyrating price from $0.50 to back up to $5.00.

In the run up to the crash of October 1929, long after Joe Kennedy had pulled his money from the market, retail traders were coining it trading the “swings” on margin accounts. It didn’t matter what the company actually did, it was going up. The same “irrational exuberance” was a big feature in the dot com bubble.

The lessons of the 1929 crash and the 2000 dot com bust were simple – get out early and be in no hurry to get back in. Right now the dinosaurs like Buffet and Ichan are sitting on stacks of cash. Just like Joe Kennedy was when Wall Street swan dived in October 1929. They got that cash by selling their shares to shoeshine boys and the bright lights at Robinhood.