June 10, 2010

OTF threatens to punish students for ‘sins’ of the university

Spite and malice are the only reasons for this kind of blatant blackmail attempt by the Ontario Teachers’ Federation:

Nipissing University and the Ontario Teachers’ Federation may be headed for a full-blown confrontation over the institution’s decision to confer an honorary degree on former Ontario premier Mike Harris, a polarizing politician largely abhorred by the teaching community for his education reforms.

The federation warned the university in a May 12 letter that it “cannot predict how teachers may demonstrate their displeasure” if the ceremony goes ahead, but university president Leslie Lovett-Doust said on Wednesday Mr. Harris will, indeed, receive the honorary Doctor of Letters on Thursday afternoon.

[. . .]

The teachers’ organization has already hinted some of its members may choose not to place Nipissing students in highly coveted student-teacher positions, and the federation may add teeth to that veiled threat.

“The OTF executive could, as an option, inform Nipissing that we are going to recommend to our members that they not take teachers for practicum placement from Nipissing University,” said Sam Hammond, president of the Elementary Teachers’ Federation of Ontario, one of four affiliate organizations under the OTF.

Mike Harris has been out of politics for (effectively) the entire time the Nipissing students were in high school and university, yet their future careers are now being explicitly threatened by the OTF. What possible way can these young adults be held responsible for the actions of a long-retired politician? Clearly, even the idiots at the OTF don’t think this is reasonable . . . but they do think it’s worth ruining their public image to prevent Mike Harris from being given an honorary degree.

Update: Matt Gurney scrawls his illegible “x” on the dotted line of the protest petition:

Former premier Mike Harris personally and single-handedly destroyed my childhood. Just ask the Ontario Teacher’s Federation and its other, affiliated unions. They will happily confirm that Mr. Harris did indeed, knowingly and willfully, set out to ruin everything in this province that was pure and good. And they will not let that go unpunished.

The article, which must have been dictated and then painstakingly transcribed, is finished with this bio note: “Matt Gurney is a member of the National Post editorial board, even though, having been educated during the Harris years, he is, of course, illiterate.”

Photography: locals versus tourists

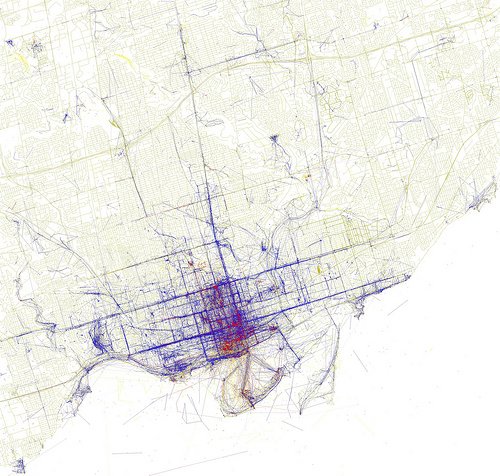

By way of BoingBoing, here’s a Flickr collection showing the different photo locations chosen by locals and tourists for many cities. Toronto doesn’t show as much difference as many other cities do:

Blue dots are by locals, red dots are by tourists, and yellow dots could be by either (not enough information to determine).

June 7, 2010

Suddenly, the decision makes less more sense

Kelly McParland connects the dots on Mayor Miller’s surprising conversion to honouring the fallen (original post here):

As Sun columnist Joe Warmington points out, there’s already a Highway of Heroes: It’s the route along the 401 that leads from CFB Trenton, where the bodies of Canadian soldiers killed in Afghanistan are brought home, to the coroner’s office near Queen’s Park in Toronto. Canadians spontaneously line the route each time a fallen soldier is returned. It’s not officially organized or directed — it’s just patriotic people showing their respect for the men and women who gave their lives to serve their country.

David Miller is about eight years late in recognizing that. Choosing a name that is similar but slightly different from the Highway of Heroes just confuses the issue: why does the route have to change names once it enters Toronto? Toronto is the city that couldn’t bring itself to allow fire trucks and ambulances to carry decals saying “Support our Troops”, and Miller was among those who wanted them taken off, in case someone got the mistaken impression Toronto actually supported the mission in Afghanistan.

June 4, 2010

Toronto finally accepts DVP “dual name” proposal

I thought that this proposal was finished when the current Toronto city government turned it down a few years back, but according to this article by Adrian Humphreys, the Don Valley Parkway will also be known as the “Route of Heroes.”

In a sweeping gesture to honour veterans and fallen soldiers, the city of Toronto is designating the Don Valley Parkway — where the flag-draped caskets of all soldiers killed in Afghanistan travel when returning to Canada — as the “Route of Heroes.”

The city-owned, six-lane expressway will be dotted with prominent signs featuring the ceremonial name, other signs reading “Lest We Forget,” and pictures on exit ramps of the red poppy [. . .]

The move comes three years after Mayor David Miller rebuffed veterans who asked to rename the DVP. The new plan, supported by the Mayor, keeps the DVP designation in a “dual name” system.

The ceremonial change is similar to the provincial designation of “Highway of Heroes” to the portion of Highway 401 stretching from the military base in Trenton to the top of the DVP.

Given the strident portion of Toronto’s political class who are against the mission in Afghanistan in particular, and the military in general, I’m surprised and pleased that this gesture is being made.

June 3, 2010

US & Canadian funding for War of 1812 bicentennial events

Colby Cosh floats the notion that one of the reasons for the huge disparity in funding for 1812 bicentennial events between the Canadian and American governments is “Maybe they’re still mad they lost”.

In the eyes of the world, the War of 1812 may always appear insignificant against its Napoleonic backdrop. But it did decide the destiny of a continent, persuading Empire and Union that it was better to have trade crossing the border than troops.

Prime Minister Stephen Harper was in Niagara Falls, Ont., on May 21, opening a new federally funded expansion to the city’s History Museum, which stands on the site of the ferocious July 1814 Battle of Lundy’s Lane. The federal and provincial governments are each giving the museum up to $3.2 million; for the feds, the money is part of a Throne Speech promise to commemorate the bicentennial of the war, “an event that was key to shaping our identity as Canadians and ultimately our existence as a country.”

Another $9 million in 50-50 federal-provincial cash is going to three Niagara Parks Commission sites: Old Fort Erie, McFarland House, and the Laura Secord Homestead. Ottawa has also set aside $12 million for improvements to 1812-related National Historic Sites along the frontier, including Gen. Brock’s monument at Queenston Heights. And Toronto is putting at least $5 million into a new visitors’ centre at Fort York.

But the only corresponding public funding on the other side of the border, as noted by the Buffalo News in April, has been a measly US$5,000 donation from the Niagara County legislature. Why isn’t Uncle Sam pulling his weight?

It’s more likely that the various levels of government are afraid of being seen to spend money on frivolous activities.

May 27, 2010

QotD: This isn’t what we mean by “the invisible hand”

Another Example of Your LCBO Hard at Work, Screwing You . . . If you’re feeling a pained sensation in your rear end, like a sandpaper wrapped glove entering your rectum, don’t worry fellow wine drinkers, that’s just the hand of the LCBO doing what they do best — sticking it to you. The LCBO has decided to take advantage of yet another potential money saving opportunity and has turned it into a money grab at your wallet. A recent article in the Toronto Star (“HST will lower tax on booze, but the price is going up ” – May 13, 2010) uncovered that the LCBO, instead of passing the HST savings on to you, which would have lowered the tax on booze from 12% to 8%, has decided to raise the price all in the name of “social responsibility”. Oh happy day, thank you LCBO for keeping me on the straight and narrow while lighting my pockets and lining yours in the process. Oh thank you — thank you.

Michael Pinkus, Ontario Wine Review, 2010-05-27

May 17, 2010

Ontario: North America’s most weed-friendly jurisdiction

Having spent several hours this weekend gouging dandelion roots out of my lawn, I found this article to be timely, reminding me just who I have to thank for the back-ache I’m feeling today:

It’s been a year and a month since the McGuinty government introduced legislation banning the use of pesticides everywhere except golf courses and farms. As a result weeds, primarily dandelions, have become the dominant ground cover for lawns, parks, school yards and sports fields across the province.

It took a while for the full impact of this ban to become apparent. Last year, many lawns seemed to retain vestigial protection against weeds due to previous pesticide treatments. Now, however, the weeds are here to stay. Forever. Residential streetscapes have switched from green to yellow. To white and fluffy. And back to yellow again.

It’s important to remember this effort was entirely political. There’s no reliable scientific evidence that regulated pesticides, when used correctly, pose any threat to human health. Ignoring the work of the federal government’s Pest Management Regulatory Agency, McGuinty blithely declared a sweeping ban was necessary for “our childrens’ health.” No other jurisdiction in North America went so far in forbidding chemical weed control.

May 13, 2010

QotD: Because your government cares about your health

If there ever was a reason to get the Ontario government out of the liquor business, this is it. While taxes on booze will drop on July 1, thanks to the introduction of the province’s new Harmonized Sales Tax, the price of your favourite poison will actually increase because — wait for it — the government doesn’t want to turn you into an alcoholic.

[. . .]

Actually, the whole modus operandi of the LCBO is counter-intuitive. At the same time that it preaches social responsibility, the LCBO inundates Ontario households with glossy brochures that take lifestyle advertising to new heights. The latest one cheekily invites customers to take “French lessons”, and features winsome couples in various states of embrace (hey, aren’t the French always making out?). A concurrent radio campaign features a sexy French-accented female voice extolling the virtues of Bordeaux. You get thirsty just listening to her.

Such campaigns are designed to make Ontarians drink more, not less, of course, funneling more cash into LCBO coffers and keeping its employees on the public payroll at juicy union wages. All fuelled by taxes and a staggering mark-up of 71.5% on that latest imported bottle which pairs so well with flank steak and frites.

This kind of hypocrisy is but one reason why the government shouldn’t be in the liquor business. The others include higher prices, less consumer choice, and the general inefficiency inherent in any monopoly business, whether public or private.

Tasha Kheiriddin, “Lower taxes, higher prices, courtesy of your local LCBO”, National Post, 2010-05-13

May 7, 2010

QotD: The HST only looks good on paper

I know all the reasons why sales taxes — i.e. consumption taxes — are to be preferred to income taxes. Every economist I respect believes consumption taxes are better because they let the taxpayer control the amount of tax he pays. Don’t want to pay as much? Don’t buy as much.

But to an ordinary person, this is a silly argument. Everyone has to buy stuff — school clothes for the kids, a new car, a laptop. If your washing machine breaks down, you have to buy a new one or pay for repairs. There is no alternative but to pay the sales tax.

To consumers, a sales tax looks like the least avoidable kind of tax. For most people, the only true way around a consumption tax is to hid their spending by switching to cash, barter or the black market.

On paper, I agree with my economist buds. And if we lived on paper, I might try to convince you to learn to love the HST.

Lorne Gunter, “The HST is fine on paper. It’s only painful in real life”, National Post, 2010-05-07

April 12, 2010

New “green” jobs to pay over $300K

Oh, wait. Sorry, that should be will cost over $300K:

The Government of Ontario recently signed a $7 billion no-bid contract with two Korean companies to supply wind and solar power to the province. Officials claim the backroom deal will boost “green” industry and job creation. But it’s hard to fathom how the additional employment can possibly be beneficial when each new manufacturing job will cost taxpayers a whopping $303,472. Nor do dramatic increases in electricity rates constitute much of a bargain.

Having failed on his pledge to shutter all coal-fired plants in the province by 2007, Ontario Premier Dalton McGuinty evidently has sought a grand green gesture that would appease the global warming alarmists. Executives of Samsung C&T Corp., in concert with the Korean Electric Power Corporation, were understandably eager to cooperate.

The agreement commits the province to buy wind and solar energy from the two companies at artificially high rates. It also extends to Samsung and Korean Power preferential access to the transmission network at the expense of independent wind power producers. As if either provision won’t adequately punish Ontarians, McGuinty also has pledged to override local zoning laws in locating new wind farms and transmission corridors.

Update, 12 February 2011: Even Premier McGuinty can only deny financial reality for so long:

Times of international turmoil are great moments for domestic governments to make important announcements they don’t want to be noticed. Especially if the announcement involves a sudden reversal in policy that could seriously embarrass the government.

So Friday afternoon was an ideal time for Ontario’s Liberal government to take a big chunk of its alternative energy program and chuck it overboard. Attention was riveted on Egypt, where spectacular events were unfolding. The perfect opportunity for Premier Dalton McGuinty to engineer yet another major reversal, while paying a minimal price among voters.

After years of touting wind projects as a critical piece of the alternative energy puzzle, the government let slip — very quietly — that offshore wind projects are no longer part of the game plan. Turns out there just isn’t enough scientific evidence that offshore wind projects do a lick of good, said Brad Duguid, the energy minister.

April 2, 2010

QotD: The KGBO, er, I mean LCBO

Because we live under a monopoly regime that has no intention of loosening restrictive laws, we will never see “wine bar/stores” like this. Americans are jaded to these luxuries of free market access to wine and loads of selection. You read magazines where they tell you to talk with your retailer about finding the best wines from out of theway places and dedicated small producers, and the knowledgeable Ontarian’s reaction is “Yeah, right not in my lifetime will I see that.” While in the U.S. the ‘little guy’ whose passion for wine you can feel the moment you walk in the door and engage in a “which wine should I get” conversation. A recent discussion with an ex-pat American wine collector and drinker (just recently moved north of the 49th parallel) elicited disgust about the LCBO and its selection. “I’m from Chicago,” he tells me, “and I can’t find a decent bottle of wine up here and the selection is . . .” he trails off and shakes his head. Ontarians are used to it. We’ve grown up with Big Brother’s iron fist clamped firmly around our throat and his sweaty palm covering our eyes to what the world outside our borders is doing with booze (wine in particular).

I usually urge you to take a trip to wine country, but this year I want you to take a trip abroad, not to a wine country or region, but to a U.S. wine retailer or specialty shop, a grocery store will do in a pinch (yes I did say a grocery store). Check out, not only the selection but the price, what’s on sale and for how much, wines for under $4, 2 for 1, 3 for 1 or sometimes more for one low price. Discounts for multiple purchases, sale prices that actually seem like you are saving money and not just a dollar or two off. Pay attention to what you see, then ask yourself, “why don’t we have that here in Ontario?” You know the answer, it stares at you with big white letters on a big green background and they go by a four-letter acronym (do I really have to spell it out?) How about this, their first letters are L.C., although they should be K.G. If you are any kind of oenophile, be it novice or pro, you’ll realize that a trip across the border is enthralling and liberating — but then it’s back to the oppressive world of Ontario with Big Brother’s hands shielding you and stopping you and then you tell me honestly, which system would you like to live under?

Michael Pinkus, “Is it a Shop or is it a Bar? Whichever it is, I want one here”, Ontario Wine Review, 2010-04-01

March 30, 2010

I guess I can’t complain

According to the latest figures, my commute is only a bit longer than average for Toronto:

After more than six years of enlightened, environmentally-conscious left-wing government under a pro-transit mayor with a compliant anti-auto city council, Toronto has been told its gridlock is among ther worst in the world.

The Toronto Board of Trade surveyed 19 cities and found that commuting times in Toronto are the longest of the lot. Worse than London. Worse than New York. Worse than Los Angeles. Worse than Berlin or Milan. The average beleaguered Torontonian spends 80 minutes a day trying to get to and from work.

Imagine what it would be like without an enlightened, activist, pro-transit city government.

Well over half of my commuting time is spent inside the city boundaries, even though it constitutes a bit less than half the total distance. I’m fortunate that I don’t have to do my commute every day of the week . . .

March 22, 2010

After MPAC?

Lorne Cutler looks at one of the proposals to replace the Municipal Property Tax Corporation (MPAC), which sets the property tax levels for Ontario towns and cities:

As the Ontario government grapples with ways of cutting their $25-billion deficit, they should note that there is one agency that that could be virtually eliminated overnight and few would shed a tear. It is the vast Orwellian bureaucracy known as the Municipal Property Tax Corporation (MPAC), which has the role of determining the value of Ontarians’ property every four years so that municipal taxes can either increase or decrease depending on how MPAC’s valuation of the property has changed relative to other properties in your municipality.

If MPAC determines that a property’s value went up less than the average for the community, the municipal taxes will drop (before any tax increases implemented by the municipality) and if the property went up more than the average, the taxes will increase. It is a capital gains tax without the capital gains!

Not content to actually use the market to determine property values, every few years, MPAC’s army of 1,500 civil servants assesses what they think each property is worth. Even if you just bought your house last year, MPAC can decide you really didn’t pay the true value. In order to determine the value of over 4 million properties and fight assessment challenges, the agency spent over $180-million in 2008, an 11% increase from 2007. This cost doesn’t even include the millions in subsidies that the government has to provide to seniors so they don’t lose their homes because of rising property taxes due to MPAC.

Elizabeth and I had our day in “court” with MPAC back in 2004, when we were handed an assessment claiming that our house was worth (for tax purposes) 25% more than we paid for it — in the same month we took it over from the builder:

Now it was our turn, and we already knew that our ace had been trumped: we couldn’t use the builder’s sale price as part of our evidence. We tried anyway, and to our astonishment, it was allowed. In fact, we seem to have unwittingly wrong-footed the representative from MPAC, because we mentioned that we’d received two separate assessment notices for different values (the first was about 5% more than we’d paid, the second nearly 25% more).

Because we’re in a pretty fast-moving market area, we could certainly believe that the house would be worth 5% more within a couple of months of buying it, but 25%? Come on. There was no way that we could have sold the house for 125% of list price that quickly. After a few years, sure, that’d be possible, but not that soon.

We were treated to a long-ish lecture about how our builder had owned the land for such a long time that they weren’t selling the houses for what they would really be worth on the open market, because they didn’t need to make a profit on the land . . . or something equally economically unlikely. I rather lost the thread at that point. Anyway, during our respective summations, it became clear that he didn’t think we had a leg to stand on (he wasn’t openly gloating, but it was edging in that direction).

The final act was a bit of a Scrooge-to-Bob-Cratchit moment, as the adjudicator turned to us and said “. . . and in summary, I will be lowering your assessment to $XXX,XXX” — about 5% less than the lowest assessment figure we’d got. I was so sure that I’d misheard him that it was only as the MPAC rep started whining that I believed what I’d heard. The observer from the town suddenly went into a huddle with the MPAC guy, because the lowered assessment for us might have a domino effect in our entire subdivision.

March 13, 2010

Privatization? Let’s not be ideological!

Robert Fulford on the problems with unions in the public service:

Unions hate the very word “privatization.” And no wonder. Their present system is close to perfect: Their workers can’t be fired but can strike, as they do from time to time, demonstrating their power. They win most of their struggles with politicians, who throw billions at them just to keep them quiet. (After all, it’s not as if the politicians were spending their own money.)

This arrangement became commonplace in Canada about half a century ago, turning public-sector employees into princes of the working class who make more money than other people doing the same jobs, and receive more generous benefits.

Union members passionately believe this is no more than their due. The unions and their friends believe public ownership is fundamentally good, private ownership at best dubious. In 1994, when it seemed possible that Ontario would privatize liquor sales, the Ontario Liquor Boards Employees’ Union commissioned a study by a York University economist, Nuri Jazairi. He found, no surprise, that this was a bad idea and that the provincial government should continue to control every ounce of liquor sold within provincial boundaries, presumably for eternity.

But his report was most revealing when he turned to the motives of those who favour privatization. He suggested the idea sprang from “purely political and ideological reasons,” among which he listed “the control of public expenditures” and “limiting the role of government in managing the economy.”

It’s no surprise that the folks who benefit disproportionally from the current arrangement are the most vocally opposed to any changes which would reduce their advantages. If the government did get enough political will to go ahead and privatize, there’s no way (unless the government tied their hands in advance) that private enterprise would give — or could afford to give — their employees the same pay and benefits they currently enjoy under public ownership.

Update: Speaking of situations which could only arise under public ownership, here’s a perfect example:

More than 1,250 Ontario Ministry of Revenue employees will soon be receiving severance packages of up to $45,000 each — but they won’t be out of work. Most of them aren’t even switching desks. They’re simply being transferred from the provincial payroll to the federal payroll when the province moves to a federal harmonized sales tax this summer.