Tim Worstall explains how to quickly raise the living standards of everyone in Britain earning the minimum wage, without costing employers any more:

“Palace of Westminster”by michaelhenley is licensed under CC BY-NC-SA 2.0

I – Tim Worstall that is – then started pointing out that the difference between this living wage and the minimum wage was the amount of tax that we – shamefully – charge to the low paid. Tax being both income tax and national insurance contributions. In fact, I rather shouted about it around the place, at the ASI, and here in The Times in 2012.

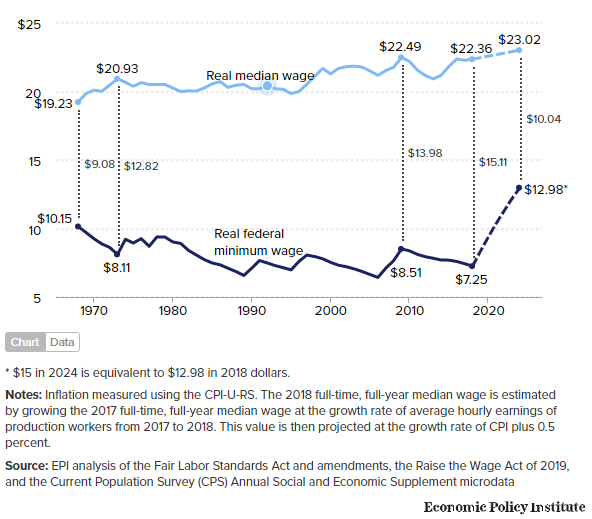

The gross annual salary of a full-time worker on the minimum wage is £12,070.50. We could come close to lifting every low-paid worker out of poverty if we simply increased the personal tax allowance from £8,105 to that sum. Not a penny of income tax or NICs should leave their pay packet. A full-time worker, however, on the living wage would be taking home £12,410.74, after the taxman has taken a cut — that’s only £340 more. And before the Foundation uprated the living wage yesterday, the annual difference was just £8.74.

There are problems. Raising the personal allowance gives everyone a tax cut — which I’ll admit doesn’t break my heart. But we could lower the amount at which the higher rates of tax kick in to make up for that lost revenue. And won’t these workers lose their right to unemployment benefit and a pension, if they don’t pay NICs? No, they qualify already, as the system treats the very low paid as if they had made NI contributions. We should go farther. The link between the full-year minimum wage and the personal allowance for tax and NI should be made explicit. Change one and the government of the day must change the other. If the minimum wage is the minimum moral amount that someone’s labour is worth, then that is what they should get, not the amount after Denis MacShane’s European wanderings have been paid for.

Which leaves us with two competing visions of how everyone can be free of poverty pay. The Living Wage Campaign’s vision is to shout at every employer in the country until they give in. The Worstall Way is to increase the incomes of the working poor by stopping taxing them.