Jon, my former virtual landlord, sent along this link which should pour cold water on the notion that China will step in to save the economies of other countries:

China’s economy has a reputation for being strong and prosperous, but according to a well-known Chinese television personality the country’s Gross Domestic Product is going in reverse.

Larry Lang, chair professor of Finance at the Chinese University of Hong Kong, said in a lecture that he didn’t think was being recorded that the Chinese regime is in a serious economic crisis — on the brink of bankruptcy. In his memorable formulation: every province in China is Greece.

The restrictions Lang placed on the Oct. 22 speech in Shenyang City, in northern China’s Liaoning Province, included no audio or video recording, and no media. He can be heard saying that people should not post his speech online, or “everyone will look bad,” in the audio that is now on Youtube.

In the unusual, closed-door lecture, Lang gave a frank analysis of the Chinese economy and the censorship that is placed on intellectuals and public figures. “What I’m about to say is all true. But under this system, we are not allowed to speak the truth,” he said.

Despite Lang’s polished appearance on his high-profile TV shows, he said: “Don’t think that we are living in a peaceful time now. Actually the media cannot report anything at all. Those of us who do TV shows are so miserable and frustrated, because we cannot do any programs. As long as something is related to the government, we cannot report about it.”

China, for all its amazing growth and rising economic prospects for (some of) its population, is still not a modern economy. The government — specifically the military — is too deeply involved at far deeper levels than other governments and the reported economic figures may or may not have any relationship with reality. When your boss is a general, he has ways of ensuring that you report the “right” results that a civilian CEO cannot match. It’s not just your job you risk by reporting unwelcome results.

I’ve ridden this hobby horse, as Jon calls it, many times over the years.

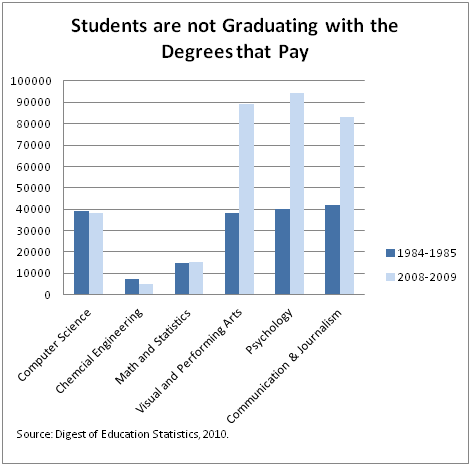

Over the past 25 years the total number of students in college has increased by about 50 percent. But the number of students graduating with degrees in science, technology, engineering and math (the so-called STEM fields) has remained more or less constant. Moreover, many of today’s STEM graduates are foreign born and are taking their knowledge and skills back to their native countries.

Over the past 25 years the total number of students in college has increased by about 50 percent. But the number of students graduating with degrees in science, technology, engineering and math (the so-called STEM fields) has remained more or less constant. Moreover, many of today’s STEM graduates are foreign born and are taking their knowledge and skills back to their native countries.