Ted Gioia called it over two years ago, and now it’s coming true:

The collapse finally came.

When I analyzed the song buyout mania, led by the Hipgnosis fund, back in June 2021, I predicted that this ultra-hot investment trend would “come to an unhappy end”. And now the collapse has arrived.

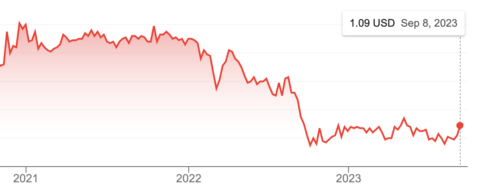

We’ve reached the endgame. The song fund’s share price has dropped 50% since I made that assessment — and now shareholders have voted to dissolve or reorganize the investment trust.

But where do we go from here? What are old songs really worth? And who will end up owning all these old rock and pop tunes?

Below I offer 12 predictions.

Much of what I have to say is harsh. That’s unfortunate — if I were a real judge, I’d err on the side of leniency. It’s never fun issuing such hardass verdicts. But if I claim to be the Honest Broker, I really have to stick with truths, even when (as in this case) they’re painful truths.

(1) Many musicians still want to sell their songs, but it will be hard to find generous buyers.

Bob Dylan got out at the top, but the times are now a-changin’. Musicians won’t get the big payouts available back in 2021. A telltale sign will be more deals with “undisclosed terms” — because nobody will want to brag about these lowball transactions.(2) Professional financiers have finally learned their lesson.

The two big finance outfits promoting song investing, Hipgnosis and Round Hill, have faltered and will now sell the songs they bought. Sophisticated investors no longer believe the hype. So don’t expect to see the launch of new song investment funds any time soon. The remaining buyers will be bottom fishers and the terminally naive (described in more detail below).[…]

(5) Look out for these vultures in all sectors of the music business.

When private equity firms knock on your door, it’s a sign that you’re already half dead. These folks actually enjoy picking on carcasses — which is easier work than hunting for live prey. I tend to avoid name-calling, but there’s a reason why some folks refer to them as vulture capitalists. That’s their specialty and their economic model is built on bottom-feeding. This is why private equity firms bought up lots of failing local newspaper, struggling local radio stations, etc. Guess what’s next on their list? Expect to see these tough hombres play a bigger role in all aspects of the music business over the next decade.[…]

(7) This whole situation is a case study in misallocated investment capital.

There’s a general lesson here too. I realized, early on in my consulting work, that the single biggest mistake large corporations make is investing too much to keep their old business units alive — when they would be wiser putting that cash to work in new opportunities. The major record labels in the current moment are poster children for exactly this mistaken sense of priorities. They will support the “old songs” business model at all costs — it’s a core part of their self image — but return on investment will be dismal.