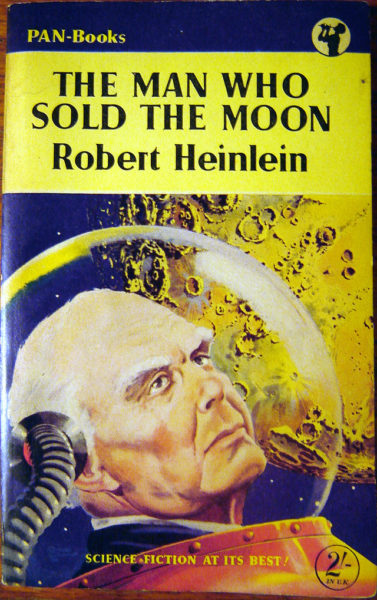

I suspect I’d recognize a lot of the books in Colby Cosh‘s collection, as we’re both clearly Robert Heinlein fans. In a column yesterday, he pointed out the strong parallels between Heinlein’s fictional “Man Who Sold the Moon” and his closest counterpart in our timeline, Elon Musk:

Written between 1939 and 1950 for quickie publication in pulp magazines, the Future History is a series of snapshots of what is now an alternate human future — one that features atomic energy, solar system imperialism, and the first steps to deep space, all within a Spenglerian choreography of social progress and occasional resurgent barbarity. It stands with Isaac Asimov’s Foundation trilogy as a monument of golden-age science fiction.

[…]

The result, in the key story of the Future History, is an uncannily accurate description of the design and launch of a Saturn V rocket. (Written before 1950, remember.) But because Heinlein happened not to be interested in electronic computers, all the spacefaring in his books is done with the aid of slide rules or Marchant-style mechanical calculators (which, in non-Heinlein history, had to become obsolete before humans could go to Luna at all). Heinlein sends people to colonize the moon, but nobody there has internet, or is conscious of its absence.

Given that his ideas about computers were from the pre-computer era and even the head of IBM thought there’d be a worldwide demand for a very small number of his company’s devices, that’s not surprising at all. In one of his best novels, a single computer runs almost all of the life support, heat, light, transportation and communication systems on Luna … and is self-aware, but lonely. In later works where computers appear, they tend to be individual personalities or even minor characters, but they’re anything but ubiquitous: powerful, but rare.

I suspect the lack of an internet-equivalent derives both from the nature of his conception of how computing would progress and a form of the Star Trek transporter problem – it solves too many plot issues that could otherwise be usefully woven into stories.

The “key story” I just mentioned is called “The Man Who Sold The Moon.” And if you’re one of the people who has been polarized by the promotional legerdemain of Elon Musk — whether you have been antagonized into loathing him, or lured into his explorer-hero cult — you probably need to make a special point of reading that story.

The shock of recognition will, I promise, flip your lid. The story is, inarguably, Musk’s playbook. Its protagonist, the idealistic business tycoon D.D. Harriman, is what Musk sees when he looks in the mirror.

“The Man Who Sold The Moon” is the story of how Harriman makes the first moon landing happen. Engineers and astronauts are present as peripheral characters, but it is a business romance. Harriman is a sophisticated sort of “Mary Sue” — an older chap whose backstory encompasses the youthful interests of the creators of classic pulp science fiction, but who is given a great fortune, built on terrestrial transport and housing, for the purposes of the story.