That’s Kevin Milligan in the Globe and Mail talking about the Canadian tax structure:

Here are five nuggets of information Canadians should keep in mind as the high income taxation discussion unfolds. [. . .]

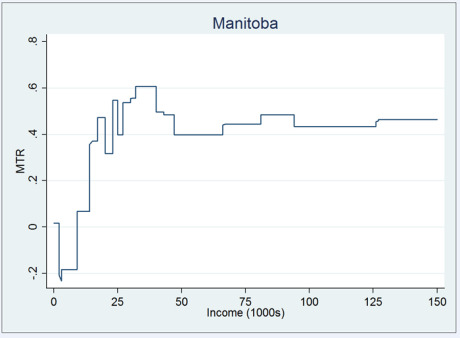

Second, our existing income tax structure is nothing short of crazy. The graph shows the marginal tax rate (the tax owed on the last dollar earned) across different income levels for a two-child family in Manitoba in 2010, the clawback of both federal and provincial refundable tax credits. (Similar graphs for more provinces are here.) What redistributive goal is such a bizarre tax structure designed to achieve? A strong argument can be made that we should improve and reform our existing income tax structure before slapping more confusion on top of it.

Third, the threshold at which one reaches the highest tax bracket is exceedingly low in Canada compared to other countries. In the United Kingdom, one reaches the highest tax bracket of 50 per cent at the Canadian dollar equivalent of $234,000. In the United States, currently the highest federal rate of 35 per cent is reached at incomes of $379,150 (U.S.). In Canada, the highest federal rate is 29 per cent, reached only at $128,800. Just to reach the level of income tax progressivity observed in the United States under President George W. Bush, Canada would need to increase this high income threshold dramatically.