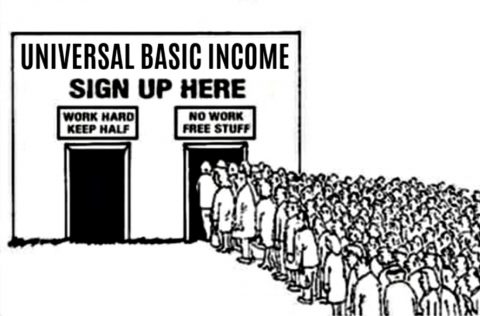

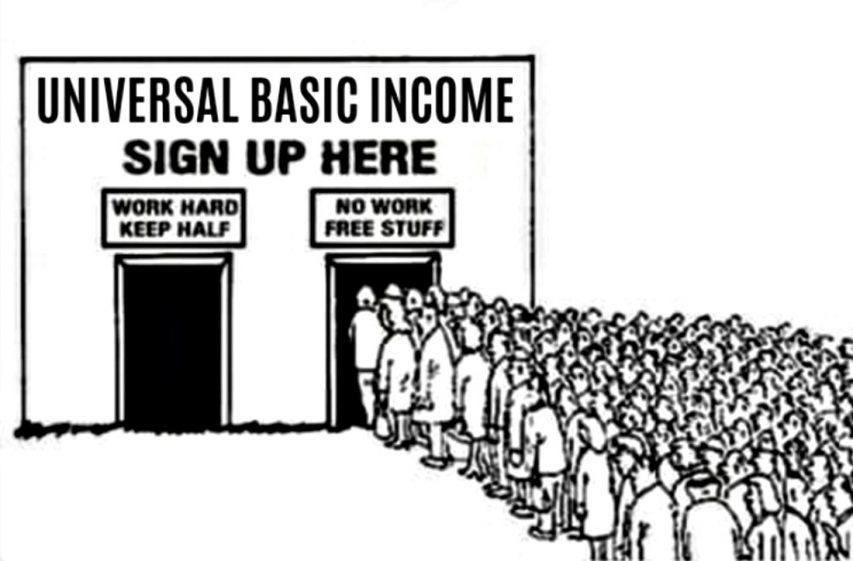

For those that are not familiar with the term, UBI (Universal Basic Income) means, roughly, “the government should guarantee everyone some minimum level of income whether they work or not”.

The notion began simply enough. Some economists observed that there are a myriad of intersecting government programs for the poor (in many countries, dozens) which distort behaviour in horrible ways and which cost a fortune in overhead to administer. This is where the problem of UBI begins, in the hubris of the armchair philosopher. “What if”, these economists asked, “we can’t get rid of the dole entirely (even though that would be better) but we could at least make it efficient by replacing the entire morass with a single program, say a negative income tax?”

Trained to explore ideas (no matter how bad) for a living, said academic economists then vigorously explored this impossible hypothetical world in which they could not get rid of the dole but could somehow get politicians to perfectly implement their hypothetical improved alternative, and proceeded to write lots of papers about it.

Again, this academic musing was already a utopian impossibility, for in the real world, there are interests that would act to block the elimination of existing welfare schemes and insist that the new scheme be added to the current ones rather than replacing them. This sort of thing is routine, of course; originally, VAT schemes were thought of by academic economists as a less distorting replacement for income taxes but ended up added in addition.

The interest groups arrayed against replacement of existing welfare schemes range from the bureaucrats whose job it is to administer said schemes (and who for whom “efficiency” means unemployment), to the vast range of contractors employed in providing benefits of one sort or another, to the politicians who get votes and power in exchange for largesse paid for with other people’s money, to the current recipients of existing benefit schemes who will correctly reason that the notion behind “efficiency” is not to increase their benefits. There’s no advantage in replacement for any member of the existing system, and thus, it was a non-starter to begin with.

This did not, however, prevent many people from falling in love with the idea, as wouldn’t-it-be-ever-so-elegant-if-it-could-happen so often trumps this-is-reality in the minds of those saying “what if” over a pint or seven late in the evening at the pub next to the economics department offices.

Oh, and of course, a form of the negative income tax was created in the United States under the name of the “earned income tax credit”; as might have been predicted in advance, it was added to existing welfare programs rather than in any way replacing them.

From this simple yet benighted beginning as a completely unrealistic thought experiment, the idea of UBI gained traction and then, as most cancers do, developed a mutant and even more virulent cell line, one that allowed it to spread and grow in the minds not only of leftists (who are already inclined towards redistribution of all sorts) but those on the right who are inclined to view ordinary people as useless.

We are now informed that UBI is a solution to a different problem as well. We are informed, in not-so-hushed tones, that the rise of new technologies like Artificial Intelligence will soon automate away most jobs, resulting in a vast class of people who will be unemployable in any trade whatsoever, which will consequently lead to mass unemployment, and that said permanently unemployable people will starve to death if we don’t find ways to provide them with income.

We are told we thus must guarantee a minimum income for all, without regard to whether they are capable of earning a living on their own, or we’ll have riots on our hands once AI based systems become ubiquitous. They claim that we should, nay, must, promise everyone some minimal subsistence income, whether they work or not. This will provide the masses with the ability to survive, and thus society will be preserved.