For beer drinkers outside Ontario, the province’s weird beer retailing rules may seem to be from a different time, but that’s only because they are. Until fairly recently, the only place to buy beer was from one of two quasi-monopoly entities: the provincially owned and operated LCBO or the foreign brewery owned Beer Store. LCBO outlets were limited to single containers and six-packs, while Beer Stores sold larger multipacks and also handled bottle deposits and returns. In the last few weeks, the Ontario government has indicated that long overdue changes are coming:

“The Beer Store” by Like_the_Grand_Canyon is licensed under CC BY-NC 2.0

The only thing we really know at this point (and it’s been reported by the Toronto Star and now CBC, and earlier by this website, all from sources) is the horribly unfair deal The Beer Store has had since 1927 in Ontario is about to come to an end. It’s expected that The Beer Store will be given notice by the end of December under the Master Framework Agreement (MFA) that the deal will be all but dead. They will have two years to wrap things up while a more modern system of booze retailing is fine-tuned and prepared for implementation. There’s a new era dawning in Ontario, one that would seemingly benefit grocery and convenience stores, local brewers, Ontario wineries, and obviously consumers who will get wider selection, more convenience and competitive pricing.

“The MFA has never been about choice, convenience or prices for customers, it has always been about serving the interests of the big brewing conglomerates, and that’s what needs to be addressed,” Michelle Wasylyshen, spokesperson for the Retail Council of Canada, whose board of directors includes members from Loblaw, Sobeys, Metro, Walmart, and Costco, told Mike Crawley of the CBC.

The end of The Beer Store MFA in whatever iteration it will look like will have a cascading impact on local VQA wine. Ontario wineries hope that it’s a positive impact and are cautiously optimistic that wide open beer and wine sales at grocery and convenience stores means more sales and less levies for their products.

As the CBC pointed out in its story, the looming reforms “pit a range of interests against each other, as big supermarket companies, convenience store chains, the giant beer and wine producers, craft brewers and small wineries all vie for the best deal possible when Ontario’s almost $10-billion-a-year retail landscape shifts. And — this is a biggie — the LCBO lobbying efforts to keep its antiquated system of monopoly retailing intact, which seems to be a big ask with what we now know from sources. Something must give.

Some key bullet points from the CBC report:

- Will the government shrink the LCBO’s profit margins, including its take from products that other retailers sell?

- Will retailers such as grocery and convenience stores be required to devote a certain amount of shelf space to Ontario-made beer and wine, or will they have total control over the inventory they stock?

- Will small Ontario wineries get any help in competing against big Ontario wineries whose products can contain as much as 75% imported wine?

The government has been listening to all stakeholders in the booze industry in Ontario for over a year now. Three key associations — Ontario Craft Wineries, Tourism Partnership Niagara, and Wine Growers Ontario — joined together to commission a report titled Uncork Ontario. That report, which concludes that the Ontario wine sector is well positioned to drive sustainable economic growth for the region, the province, and the country and has the potential to drive at least $8 billion in additional real GDP over the next 25 years, launched a campaign to lobby the government for radical changes to reach those lofty goals, or at least put the wheels in motion.

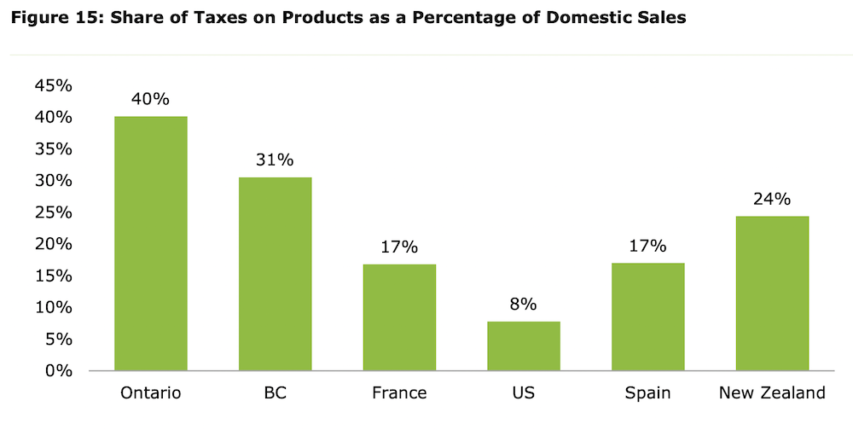

One of the big issues for Ontario wineries is a punishing 6.1% “sin” tax charged on every wine made in Ontario but not foreign wines. It’s a tax that’s been hurting Ontario wineries for years even though a grant was issued to wineries to help pay that tax back. To this date, the tax has not been cancelled and wineries keep remitting the tax owed monthly and can only hope the grant keeps getting extended. Ontario wines are among the highest taxed in the world with up to 73% of every bottle sold going to taxes and severe levies at the LCBO.