Although Tim Worstall is talking specifically about commercial properties in the UK, I suspect the same basic mechanism is in place here in Canada, the US, and many other countries and the outcomes will be broadly similar: declining retail sales intersecting with rising rents do not result in healthy retail markets.

The specific point is something that has become common to near universal in commercial property leases in the decades since the War. This is that rents can only ever be revised upwards.

So, the standard thing about commercial property is that it’s not so much rented as leased. The difference is not wholly clear but, roughly enough, you can leave a rental and you can’t leave a lease. That is, if you’ve a 21 year lease and you want to leave before the 21 years are up then it’s up to you to find another tenant. Not the landlord — and if that tenant that you do find then leaves/goes bust/doesn’t pay the rent then you have to. At least a rental you can leave.

OK — but that’s all pretty standard. The UK has one more thing. Obviously, there are rent reviews during the period of the lease. Inflation taught landlords that this was something they needed to do after all. OK — but the standard, and it really is standard in UK commercial leases, rent review is upwards only. Now, for most of this past 70 years this hasn’t been a problem. The country has been getting richer, inflation has persisted, retail’s been ever more of the economy, rents have been going up.

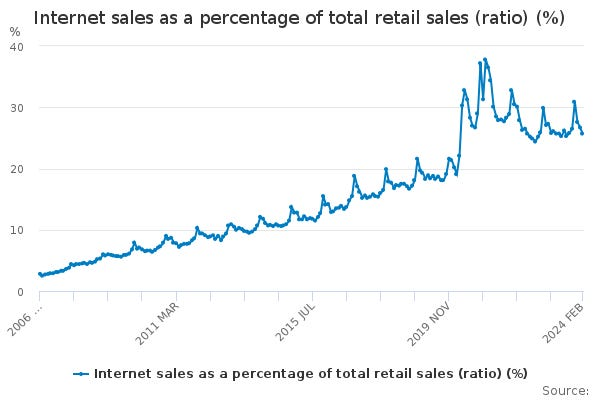

Ah, but now, eh? Firstly, we’ve the internet eating retail.

About, and roughly, 1% of the total market each year moves online. We all thought that the lockdown boom was going to persist and it didn’t. This caused all sorts of problems for all sorts of people — Boohoo ended up terribly overstocked. Made.com was able to come to market and then went bust as the right hand end of that chart happened and we returned to trend after the blip. Revolution Beauty had its own problems but the overvaluation was at least partly to do with this and so on.

But this had already been happening — Intu went bust well before the pandemic, as we know. It’s now about true that 15% or more of UK retail space is empty. Because sales are moving online. This — naturally enough — means that prices, rents, of retail are falling. Well, OK.

But now this meets upwards-only rent reviews. If you’re a new retailer looking for space then the High Streets are your mollusc of choice. You can probably get in on low rents, substantial rent-free periods and even get the landlord to pay your fitting out costs (landlords would much rather give rent-free periods, pay costs of moving in, than let at low rents. Because the terms of their own mortgages and loans make it better for them to keep headline rents stable whatever the hell the truth of the real value is). But if you’re a long established retailer paying high street rents then you’re screwed.

Your new competition might be able to get in by paying half the rent you are. And yes, rent is a really, really, big part of retail in the UK. You are, in fact, fucked and right royally.