Ted Gioia enjoys a little bit of schadenfreude here because he was highly skeptical of the investments in the first place, although the geriatric rockers who “sold out” seem to have generally made out like bandits this time around:

Back in 2021, investors spent more than $5 billion buying the rights to old songs. Never before in history had musicians over the age of 75 received such big paydays.

I watched in amazement as artists who would never sell out actually sold out. And they made this the sale of a lifetime, like a WalMart in El Paso on Black Friday.

Bob Dylan sold out his entire song catalog ($400 million — ka-ching!). Paul Simon sold out ($250 million). Neil Young sold out ($150 million). Stevie Nicks sold out ($100 million). Dozens of others sold out.

As a result, rock songs have now entered their Madison Avenue stage of life.

Twisted Sister once sang “We’re Not Gonna Take It”. But even they took it — a very large payout, to be specific. A few months ago, the song showed up in a commercial for Discover Card.

Bob Dylan’s song “Shelter from the Storm” got turned into a theme for Airbnb. Neil Young’s “Old Man” was rejuvenated as a marketing jingle for the NFL (touting old man quarterback Tom Brady).

Fans mocked this move. Even Neil Young, now officially a grumpy old man himself, expressed irritation at the move. After all, the head of the Hipgnosis, the leading song investment fund, had promised that the rock star’s “Heart of Gold” would never get turned into “Burger of Gold”.

That hasn’t happened (yet). But where do you draw the line?

I was skeptical of these song buyouts from the start — but not just as a curmudgeonly purist. My view was much simpler. I didn’t think old songs were a good investment. […] But even I didn’t anticipate how badly these deals would turn out.

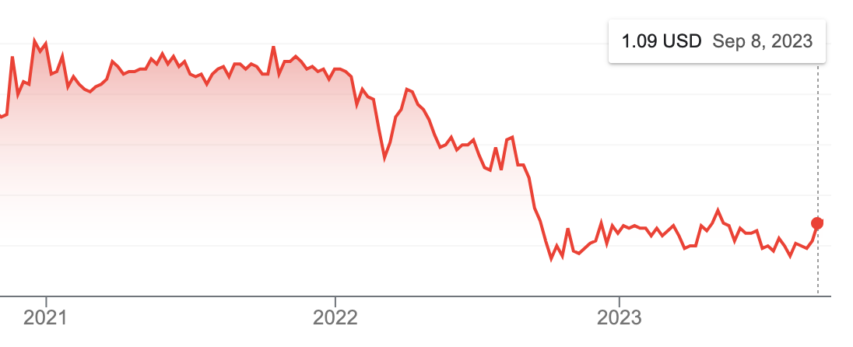

The more songs Hipgnosis bought, the more its share price dropped. The stock is currently down almost 40% from where it was at the start of 2021.

Things have gotten so bad, that the company is now selling songs.

On Thursday, Hipgnosis announced a plan to sell almost a half billion dollars of its song portfolio. They need to do this to pay down debt. That’s an ominous sign, because the songs Hipgnosis bought were supposed to generate lots of cash. Why can’t they handle their debt load with that cash flow?

But there was even worse news. Hipgnosis admitted that they sold these songs at 17.5% below their estimated “fair market value”. This added to the already widespread suspicion that current claims of song value are inflated.