Rebecca Zeines and Jon Miltimore explain why newspaper headlines and TV anchors always seem to decry any tax cut as being disproportionally beneficial to the wealthy:

But crucial facts are often missing in these articles. As a recent Bloomberg piece explained, two key points tend to be overlooked in articles written by media outlets and progressive tax proponents:

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

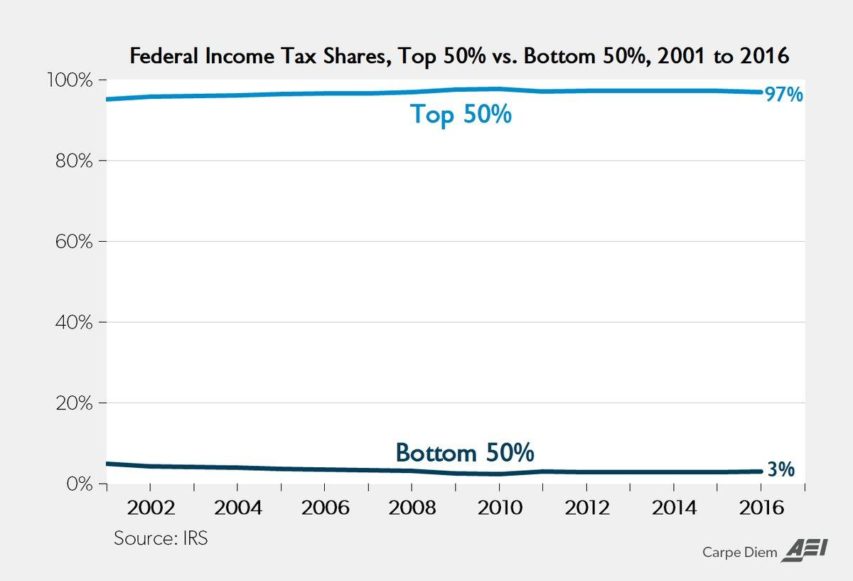

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes.

These numbers date back to 2016 but remain applicable in 2018.

These data show that the bottom 50 percent of US taxpayers paid just 3 percent of total income taxes in 2016, while the top 50 percent accounted for 97 percent.

Here is a wonderful visual representation of this dynamic, courtesy of Mark Perry of the American Enterprise Institute:

There is a clear correlation between economic freedom and prosperity, and tax climate is a key component of economic freedom.

Economist Dan Mitchell explains it best: Heavy taxation destroys entrepreneurship. The more money is taxed out of the private sector, the less is available for investment, development, and worker compensation (recall that after Trump’s tax bill was enacted, many businesses raised workers’ wages and offered bonuses).

Efforts to improve America’s tax climate are consistently and predictably derided as tax cuts for “the rich.” But, as the above diagram shows, it’s quite impossible to offer people a comparatively huge tax cut when they’re paying a comparatively tiny percentage of income taxes.