As you may have noticed, my interest in Argentinian affairs increased a lot with the election of Javier Milei as President. His first six months in office, while turbulent, do seem to have the economic indicators moving in the right direction for ordinary Argentines:

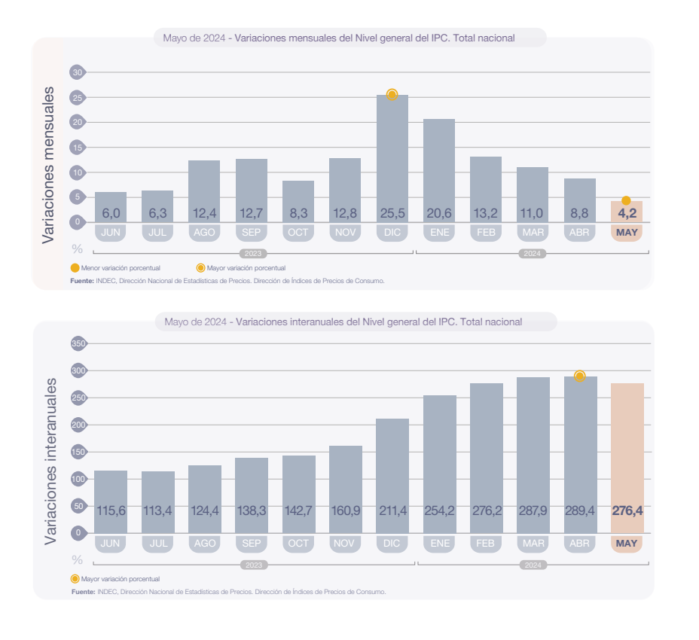

Argentina’s inflation rate has recently dropped to its lowest point since January 2022, registering a monthly increase of 4.2 percent in May according to the National Institute of Statistics and Census (INDEC). Although annual inflation has slowed for the first time since mid-2023, it still stands at 276.4 percent, one of the highest rates globally.

When Javier Milei assumed the presidency in December 2023, monthly inflation had skyrocketed to an unprecedented 25.5 percent. Within five months, Milei’s administration managed to reduce this figure by more than 20 percentage points. Despite the persistently high annual inflation rate, the trend indicates potential stabilization of the Argentine economy.

Javier Milei’s reforms have been described as aggressive. In his inaugural speech, he emphasized the need to clean up the economy before implementing his promises to dollarize and close the central bank.

To achieve a zero deficit, Milei enacted a 35 percent reduction in public spending. He achieved this by closing half of the ministries and secretariats, suspending public works for a year, reducing subsidies for energy and transportation, canceling government advertising, and maintaining the 2023 budget for 2024 despite an inflation rate of 300 percent. Essentially, the government drastically cut its expenditures.

These measures, although unpopular, yielded results. Milei’s government not only avoided a deficit, but achieved a surplus, and most importantly, inflation began to decline.

Following the inflation story in Argentina recently brought to mind Henry Hazlitt’s famous 1978 article “Inflation in One Page“. As the title suggests, Hazlitt summarizes the causes and remedies of inflation in a brief and simple explanation. He argued that inflation is a consequence of government monetary policies, specifically excessive money printing due to unbalanced budgets caused by extravagant government spending.