In his Substack, Tim Worstall jokingly called this piece “Larry Summers Explains Why Americans Hate Joe Biden”:

As a good Democrat of course Larry Summers would never put things in quite that headline way. But the implication of this latest paper with others is to explain why Americans really aren’t as happy as they should be given the economic numbers. The answer being that the economic numbers we all look at to explain how happy folk are aren’t the right economic numbers to explain how happy people are.

We can also make — possibly rightly, possibly wrongly, this might be me projecting more than is merited — a further claim. That Americans simply aren’t as rich as those standard economic numbers suggest either. Which would also neatly explain the general down in the dumps attitude toward the economy.

So, the new paper:

Unemployment is low and inflation is falling, but consumer sentiment remains depressed. This has confounded economists, who historically rely on these two variables to gauge how consumers feel about the economy. We propose that borrowing costs, which have grown at rates they had not reached in decades, do much to explain this gap. The cost of money is not currently included in traditional price indexes, indicating a disconnect between the measures favored by economists and the effective costs borne by consumers. We show that the lows in US consumer sentiment that cannot be explained by unemployment and official inflation are strongly correlated with borrowing costs and consumer credit supply. Concerns over borrowing costs, which have historically tracked the cost of money, are at their highest levels since the Volcker-era. We then develop alternative measures of inflation that include borrowing costs and can account for almost three quarters of the gap in US consumer sentiment in 2023. Global evidence shows that consumer sentiment gaps across countries are also strongly correlated with changes in interest rates. Proposed U.S.-specific factors do not find much supportive evidence abroad.

OK, or as explained by the Telegraph:

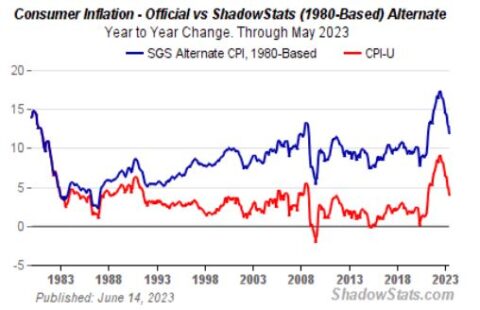

In it, the authors made a shocking claim: if inflation was measured in the same way that it was measured during the last bout of price rises in the 1970s, data showed that it peaked at 18pc in November 2022. This is far higher than the 9.1pc peak inflation shown by the official data.

The reason for this discrepancy is that, since the 1970s, economists have removed the cost of borrowing from the Consumer Price Index (CPI). The motivations here were not nefarious. The reasoning of the statisticians had something to it.

And, OK, if inflation peaked at 18%, not 9%, then that would explain why folk are pissed. Sure it would.

[…]

OK. But that means that if inflation was higher than we’ve been using then the deflation of nominal to real GDP is also wrong. Just that one year of 9% recorded but 18% by this new measure is damn near a 10% difference. That’s how much we’re over-estimating real GDP by right now. Add in a couple of years of lower levels of that and being 20% out wouldn’t surprise.

Which would mean that — if this were true and I might be overegging it — Americans are in fact 20% poorer than the Biden Admin keeps saying they are. And yes, that would piss the voters off, wouldn’t it?

Gaslighting has been a staple of the legacy media for quite some time now, going into high gear during the 2016 US Presidential elections and then into overdrive during the pandemic. They probably don’t even realize they’re doing it any more, because it feels “normal” to them. Yet they wonder why their popularity and public trust in their pronouncements continues to drop.