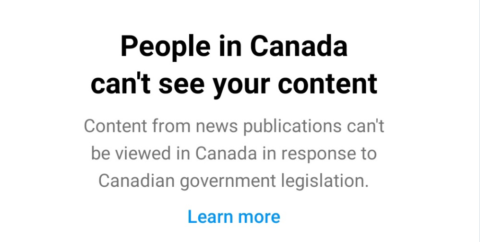

Michael Geist updates us on the Canadian government’s latest blunder in the Online News Act saga:

The government is releasing its draft regulations for Bill C-18 today and the chances that both Google and Meta will stop linking to news in Canada just increased significantly. In fact, with the government setting an astonishing floor of 4% of revenues for linking to news, the global implications could run into the billions for Google alone. No country in the world has come close to setting this standard and the question the Internet companies will face is whether they are comfortable with the global liability that would see many other countries making similar demands. The implications are therefore pretty clear: there is little likelihood that Meta will restore news links in Canada and Google is more likely to follow the same path as the Canadian government establishes what amounts to 4% link tax from Bill C-18 on top of a 3% digital services tax and millions in Bill C-11 payments.

The estimated revenues from Bill C-18 or the Online News Act have always been the subject of some debate. The Parliamentary Budget Officer set the number at $329 million, using a metric of 30% of news costs for all news outlets in Canada. Under that approach, over 75% of the revenues would go to broadcasters such as Bell, Rogers, and the CBC. The Canadian Heritage estimates were considerably lower, with officials telling a House of Commons committee last December that they expected about $150 million in revenue:

I won’t speak to the PBO report which is the source of the numbers that you cited. That was not a department-led initiative. The internal modelling that we did when we tabled the bill and mentioned in our technical briefings was more around $150 million impact. That was based again in terms of how this played out in Australia and making some assumptions about how it might play out here. With respect to the PBO report, any questions about that particular number would have to be directed towards them.

By the time the bill reached the Senate several months after that, the number had grown to $215 million.

With the release of the draft regulations, the government has established a formula with an even bigger estimate. The creation of a formula is presumably designed to provide some cost certainty to the companies and represents a change in approach in Bill C-18, given that the government had previously said it would not get involved private sector deals but it is now setting a minimum value of the agreements. Officials told the media this morning that it believes Google’s contribution would be $172 million and Meta’s would be $62 million, for a total of $234 million. However, that may understate the revenues by focusing on search revenues alone. If based on total revenues, with a 4% minimum floor, the requirement would exceed C$300 million for Google. Either way, the number is more than 50% higher than the $150 million estimate the department gave the Heritage committee just eight months ago.

The draft regulations will also provide some additional clarity on several issues. The standard for a digital news intermediary has been fleshed out to include $1 billion in global revenues and 20 million Canadian users. As for the process, those companies subject to the rules are required to conduct a 60 day open call for negotiations. To meet a fairness standard, the resulting deals must be within 20% of the average and cover a wide range of news outlets. Contributions can include non-monetary items but it seems unlikely the resulting deals would grant links significant value. The CRTC would then pass judgment on the deals and determine whether the companies are exempt from a final offer arbitration process. The timing on this includes a 30 day consultation process on the regulations, before they are finalized prior to the December deadline. But with the CRTC not having established a bargaining framework before 2025, the liability issues start arising well before any deals are concluded or approved.