Antony Davies and James R. Harrigan consider the frequently issued campaign promise by Joe Biden and what it will cost to implement:

Given the results of the recent election, it should come as no surprise that we’re poised for the next big expansion: student debt forgiveness, a promise Joe Biden made frequently as he campaigned for the presidency. Like the big ideas that came before it, this idea will cost us more than we can afford from day one, and far more than its proponents will admit. Biden’s plan as currently envisioned would cost over $300 billion. But that’s just this year. The plan will set in motion unintended consequences that will doubtlessly persist for generations.

First, next year’s crop of new students will — understandably — demand that their loans be forgiven too. And so will those of the year after that, and so on. This program will quickly become a sort of college UBI, where the government just hands out $10,000 to every college student. Some argue that if this results in a better educated populace, then it’s worth the cost. But it won’t result in a better educated populace; it will result in a whole bunch of students majoring in things the market doesn’t value, and another batch simply taking a four-year vacation on the taxpayer’s dime. Heretofore, graduates knew they needed marketable skills in order to repay their college loans. But when student loans are forgiven as a matter of course, graduates bear no cost for wasting our collective resources by studying things the market doesn’t value, or by not studying at all.

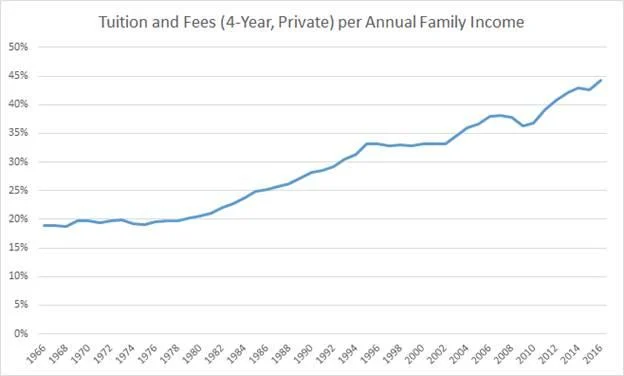

Second, colleges and universities will respond to this new reality by raising tuition commensurately. Tuition and fees were a pretty constant 18 to 19 percent of family income from the 1960s until 1978. In 1965, the federal government started guaranteeing student loans. In 1973, Congress established Sallie Mae and charged it with providing subsidized students loans. And by 1978, tuition and fees had started a steady march to 45 percent of family income today. When the government makes it less painful for students to borrow, whether by guaranteeing, subsidizing, or forgiving loans, it takes away some of the pain of student borrowing, which makes it easier for colleges and universities to raise tuition.

Third, expect many taxpayers to cry foul. Homeowners will quite sensibly wonder why the government is not forgiving their mortgages. After all, student loans add up to about $1.4 trillion, while American mortgages total more than $16 trillion. If relieving students from the burden of their debts is a good idea, it should be an even better idea to relieve homeowners of theirs.

What about students who worked multiple jobs or attended less prestigious schools so they could avoid going into debt? Why aren’t they being rewarded? What about students who diligently paid off their debt and are now debt free? Will they receive nothing? What about, fantastically, people in the trades? Is it reasonable to charge people — via the higher taxes loan forgiveness will bring — who did not go to college to subsidize those who do? Regardless of the answers to these questions, implementing this plan will be fraught with difficulty.