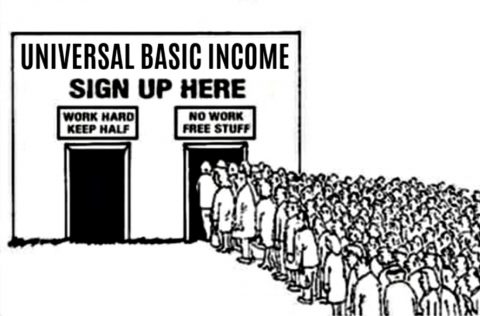

Ted Campbell comes out in favour of some form of negative income tax for Canada:

Cartoon that appeared with Michael K. Spencer’s article “Is Universal Basic Income really a solution?” at https://medium.com/@Michael_Spencer/is-universal-basic-income-really-a-solution-c0d6d95f100e

My first and, I believe, the most important thing to understand about taxes is: there is only one taxpayer; it is you and me and individuals like us. Corporations do not pay taxes ~ they pass every single penny of the taxes assessed to them on to us, their customers. You and I and your and my family and friends pay 100% of all corporate taxes.

A tax on income is a tax on savings which is, in turn, a tax on investment which means it is a tax on jobs.

Flate rate taxes are unfair to the poor, but progressive income taxes, while fairer, take money away from investment in jobs.

Consumption taxes (sales taxes and the HST/GST) are, to some extent, voluntary: consume less and you pay less in taxes. Where consumption is not discretionary ~ say on food ~ the tax system may be used to make consumption taxes at least somewhat progressive.

Corporate taxes ~ ALL corporate taxes ~ are just consumption taxes that are collected in an inefficient and expensive manner. It would be much, much better tax policy to raise the federal GST by 1 or 2 points and cancel ALL corporate taxes. Having a zero federal corporate tax rate would make Canada a much, much more attractive place in which to do business; companies would want to open plants and offices here ~ meaning more, new, good jobs for Canadians.

Income taxes have far too many exceptions and exemptions and deductions and so on. Federal income taxes should be clear and simple and the Canada Revenue Agency should be able to automatically provide a tax bill to about 98% of Canadians. That may mean a thorough (and time-consuming and politically unpopular) overhaul of the complete tax system.