Colby Cosh on the recent court decision on the Church of Atheism’s attempt to qualify as a church — and receive the tax benefits — under Revenue Canada’s rules:

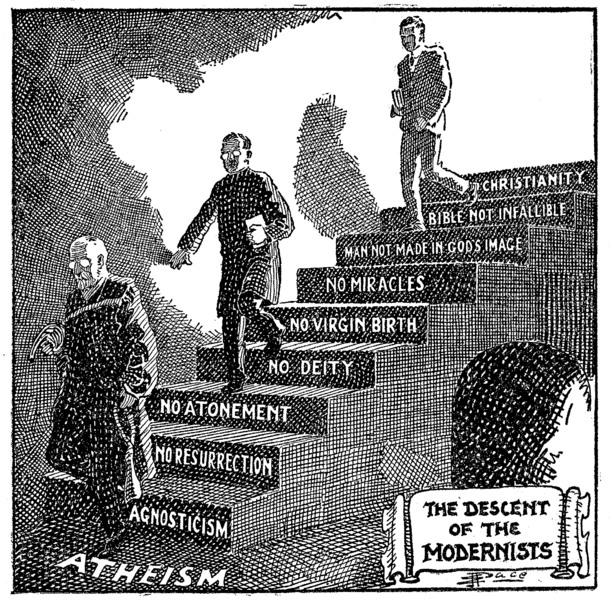

“The Descent of the Modernists”, by E.J. Pace, first appearing in his book Christian Cartoons, published in 1922.

Public domain via Wikimedia Commons.

Last week the Federal Court of Appeal upheld Revenue Canada’s rejection of an application for charitable status made by a “Church of Atheism” tucked away in Ontario’s Lanark Highlands. The idea of making a gesture like this has probably occurred to every atheist who looks around at a world of tax-exempt churches and wonders why his kind is excluded from the gravy train. (Clergymen pay tax on their income, but they have access to a generous residential deduction, and any professional expenses covered by the church go untaxed.)

The fact is that the “Church’s” efforts were a bit amateurish and confused. But they may, like a doomed military reconnaissance, have revealed weaknesses in the anomalous exclusion of atheists from religious tax exemptions.

These weaknesses cannot be any big secret. You probably remember the Supreme Court’s Mouvement laïque québécois v. Saguenay decision of 2015 — that’s the case in which the Quebec Court of Appeal had ruled that a statue of Christ with an electrically illuminated Sacred Heart was “devoid of religious connotation.” The Supreme Court, perhaps suppressing a chuckle or two, proceeded to unanimously overturn the Quebec ruling and expound the concept that the Canadian state has a Charter-based “duty of religious neutrality” (except, of course, where the constitution explicitly specifies otherwise, as with Catholic schools). Government, the SCC insisted, “must neither favour nor hinder any particular belief, and the same holds true for non-belief.”

Given that this is our law, what can be the problem with a “Church of Atheism”? Good question! Justice Marianne Rivoalen, writing on behalf of a three-judge Federal Court panel, confirmed the general point that there is a state duty of religious neutrality; in fact, even Revenue Canada, acting as the respondent, conceded this.

But the court simply ruled, without any logical elucidation, that “the Minister (of Revenue)’s refusal to register the appellant as a charitable organization does not interfere in a manner that is more than trivial or insubstantial with the appellant’s members’ ability to practise their atheistic beliefs. The appellant can continue to carry out its purpose and its activities without charitable registration.”