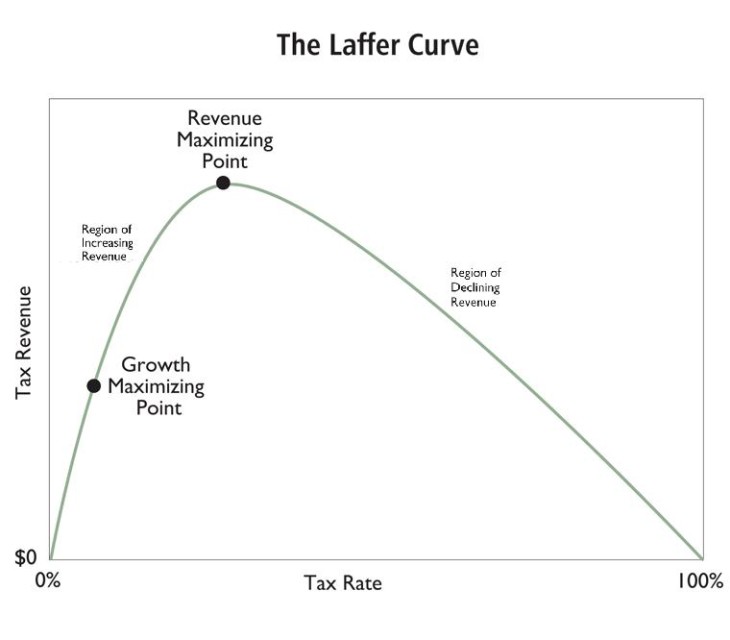

The Laffer Curve is one of those ideas that drives some people mad, because if it’s true (and empirically it appears to hold most of the time), it militates against raising taxes on the wealthy:

That working out where the peak of the Laffer Curve is is difficult is entirely true. That it’s going to be different for each tax in each different legal and societal set up is also true. But that doesn’t excuse drivel like this:

The ends of the curve are basic enough – at a tax rate of 0, the government will raise $0 in revenue, and at a tax rate of 100, the government will still raise $0 in revenue because people won’t work without take-home pay. At the extremes, the Laffer curve is correct, but that doesn’t tell us anything about the points in the middle. Laffer’s idea, however, was that a “tipping point” existed on the continuum in between, where people’s incentives to work and invest decreased because tax rates were too onerous.

If the end points are true – something admitted – then it’s a matter of simple, pure, and true logic that there are one or more revenue maximising points inbetween. For it’s simple enough for us to observe that there are tax rates which do raise revenue. And if we have tax rates which raise no revenue and tax rates which raise some then there are those one or more rates which raise the most.

So, please, can we stop the drivel?

Sure, Art Laffer himself is incorrect when stating that all tax cuts always pay for themselves through increased economic growth. But that doesn’t invalidate the logic of the curve, only the use to which it is put.

Fifty-four percent. That’s approximately it: the tax maximizing point on the curve when you include all of the taxes on income (including the things they often don’t call taxes — social security, unemployment insurance, and other non-tax taxes — but which are still withheld from paycheques or payable at tax deadline time). Go much above that and the government’s take begins to decrease, defeating the purpose of raising the tax rate in the first place. (Unless the real purpose is just to harm the rich … which might be true in a number of cases.)