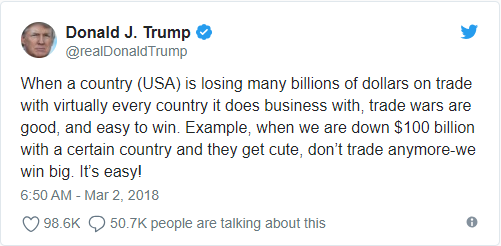

Robert Higgs on what he describes its supporters as “waging the trade war to end all trade wars”:

… even as Trump spouts venerable fallacies to justify and seek support for his destructive trade policies and related ad hoc actions, he and his supporters have sometimes offered a strange defense of their tactics: they purport to be seeking, at the end of the game, universal free trade, a world in which all countries have abandoned tariffs, quotas, subsidies, and other government intrusions in international exchange. In Wilsonian terms, they claim to be waging the trade war to end all trade wars. The idea is that by raising U.S. tariffs, they will induce other governments to lower and ultimately eliminate their own.

Of course, this rationale may be nothing more than wily claptrap, tossed out as a rhetorical bone to Republicans who favor freer trade. The administration’s actions to date certainly give no indication that it is aiming at global free trade. On the contrary. So the Wilsonian gambit may consist of nothing but hot air.

But if Trump and his trade advisers actually take this tactic seriously, they are deluding themselves.

First, and surely obviously, U.S. tariff increases will not induce other governments to lower their own, but to raise them, as the EU, China, Mexico, Canada, and other trading partners have already demonstrated. That’s why it’s called a trade war — because the “enemy” shoots back. History has shown repeatedly, most notably in the early 1930s, in the wake of the Smoot-Hawley Tariff Act of 1930, that such trade wars only spiral downward, choking off more and more trade, despoiling the international division of labor in accordance with comparative advantage, and thereby diminishing real income in all the trading countries.

Second, the prospect of the U.S. government’s ever abandoning tariffs is slim to none. Tariffs are the classic example of government interventions with concentrated benefits and dispersed costs. This character makes them attract great support from protected special interests and little opposition from the general public — including other producers — when they are enacted or extended. They are easy for politicians to put in place and diabolically difficult for anyone to eliminate. Although the costs are great — much greater than the benefits for the economy as a whole — hardly anyone’s costs are great enough to justify mounting a potent political attack on the tariffs.

People who get tariffs put in place to protect them in the first place are well positioned to marshal strong opposition to any political attempt to eliminate these taxes on consumers who buy from competing, foreign suppliers. Consumers rarely know anything about why foreign goods are priced as they are, and producers, in general, are usually not affected enough by tariffs on imported raw materials and components to justify well-funded politicking against them.