At International Liberty, Dan Mitchell points out an example of leftists who genuinely want higher taxes on “the rich” even when the higher rate will return less money to the government:

Every so often, I’ll assert that some statists are so consumed by envy and spite that they favor high tax rates on the “rich” even if the net effect (because of diminished economic output) is less revenue for government.

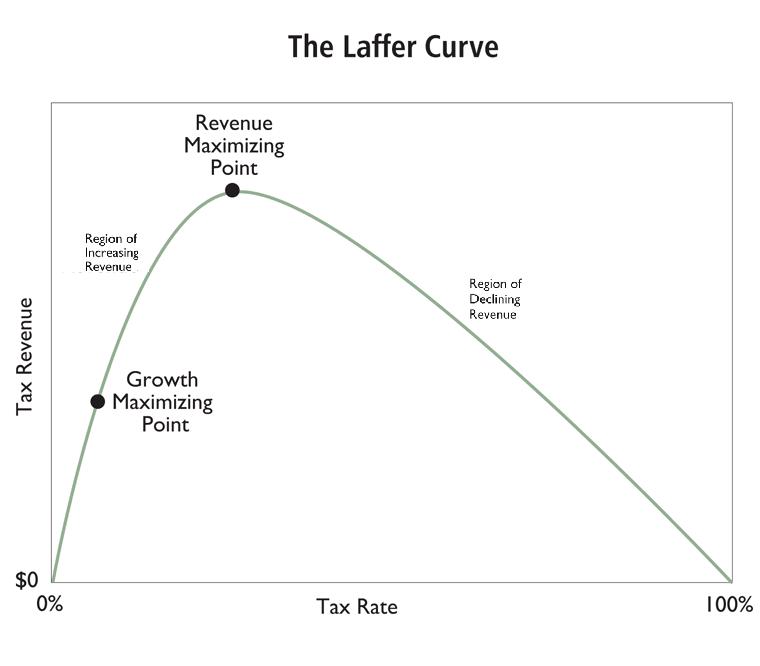

In other words, they deliberately and openly want to be on the right side (which is definitely the wrong side) of the Laffer Curve.

Critics sometimes accuse me of misrepresenting the left’s ideology, to which I respond by pointing to a poll of left-wing voters who strongly favored soak-the-rich tax hikes even if there was no extra tax collected.

But now I have an even better example.

Writing for Vox, Matthew Yglesias openly argues that we should be on the downward-sloping portion of the Laffer Curve. Just in case you think I’m exaggerating, “the case for confiscatory taxation” is part of the title for his article.

Here’s some of what he wrote.

Maybe at least some taxes should be really high. Maybe even really really high. So high as to useless for revenue-raising purposes — but powerful for achieving other ends. We already accept this principle for tobacco taxes. If all we wanted to do was raise revenue, we might want to slightly cut cigarette taxes. …But we don’t do that because we care about public health. We tax tobacco not to make money but to discourage smoking.

The tobacco tax analogy is very appropriate.