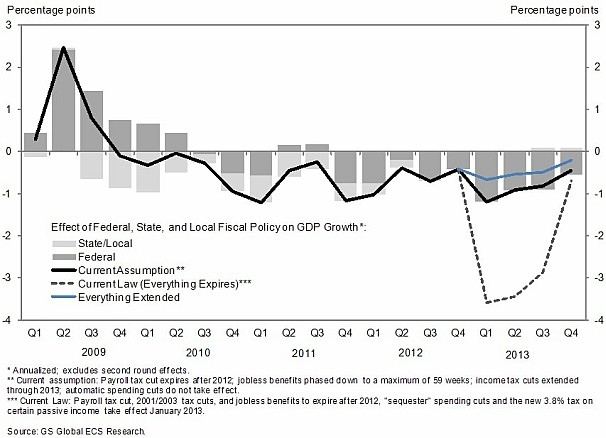

Here it is in one easy-to-understand graph:

Brad Plumer explains:

What will the economy look like in 2013? A great deal depends on what Congress decides to do at the end of this year. Remember, the Bush tax cuts are expiring, the payroll tax holiday will sunset, and a bunch of new spending cuts under the debt-deal “sequester” are scheduled to kick in. Coming all at once, that’s a potentially big drag on growth.

[. . .]

To put this in perspective, the Federal Reserve expects the economy to grow at a roughly 2.9 percent pace in 2013. If Congress does nothing at the end of this year, much of that growth could be wiped out, and there’s a strong possibility that the United States could lurch back into recession. (Granted, a lot could depend on how the Fed reacts in this situation.)

On the flip side, as Ezra discussed in Thursday’s Wonkbook, letting all of the tax cuts expire and spending cuts kick in would also cut the U.S. deficit considerably: “Public debt falls from 75.8 percent in 2013 to 61.3 percent in 2022.”

H/T to Doug Mataconis for the link.