I was vaguely aware that Canada Post has been in financial difficulties for a while, but I had no idea things were quite this dire:

You’d better believe that the Canada Post Corporation is in very deep trouble. Here’s how they phrased it in their 2023 annual report:

Canada Post’s financial situation is unsustainable.

“Unsustainable”. Well that doesn’t sound good. Think they’re just putting on a show to carve out a better negotiating position? Well, besides for the fact that they’re not currently negotiating with anyone, the numbers do bear out the concern:

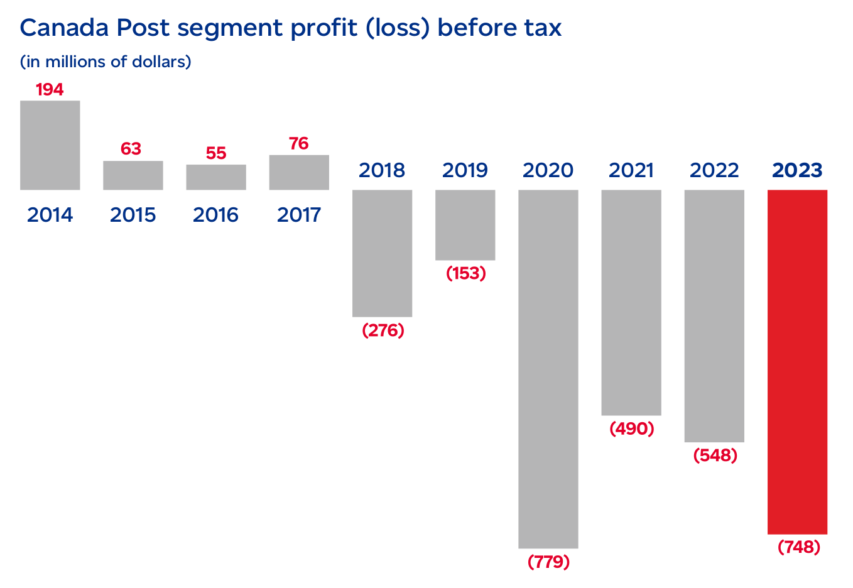

For 2023, the Corporation recorded a loss before tax of $748 million, compared to a loss before tax of $548 million in 2022. From 2018 to 2023, Canada Post lost $3 billion before taxes. Without changes and new operating parameters to address our challenges, we forecast larger and increasingly unsustainable losses in future years.

In other words, it’s madly-off-in-all-directions panic time.

Hey! You know I can hear your condescending sniff: “I’m sure this is just a temporary disruption. They’ll figure out how to fix the leak and get themselves back on the road like always. They’re too big to fail.”

Yeah … not this time. The competition from digital communications (i.e., the internet), FedEx, and UPS isn’t going anywhere. Letter delivery nosedived from nearly 5.5 billion pieces in 2006 to just 2.2 billion in 2022. And vague references to “major strategic changes to transform our information technology model” don’t sound much like magic bullets for reversing the decline.

But Canada Post’s labour and pension costs sure are marching bravely forward. In fact, if it wasn’t for Parliamentary relief in the form of Canada Post Corporation Pension Plan Funding Regulations, the Corporation would have had to pay $354 million into the pension plan in 2023 alone. But that $354 million — plus whatever additional amounts show up in 2024 and besides the $998 million in existing general debt — are still liabilities that’ll eventually need paying.