Lars Christensen explains why — economically speaking — Finland is suffering through an economic phenomena even worse than the Great Depression:

In my post from Friday — Italy’s Greater Depression — Eerie memories of the 1930s — I inspired by the recent political unrest in Italy compared the development in real GDP in Italy during the recent crisis with the development in the 1920s and 1930s.The graph in that blog post showed two things. First, Italy’s real GDP lose in the recent crisis has been bigger than during 1930s and second that monetary easing (a 41% devaluation) brought Italy out of the crisis in 1936.

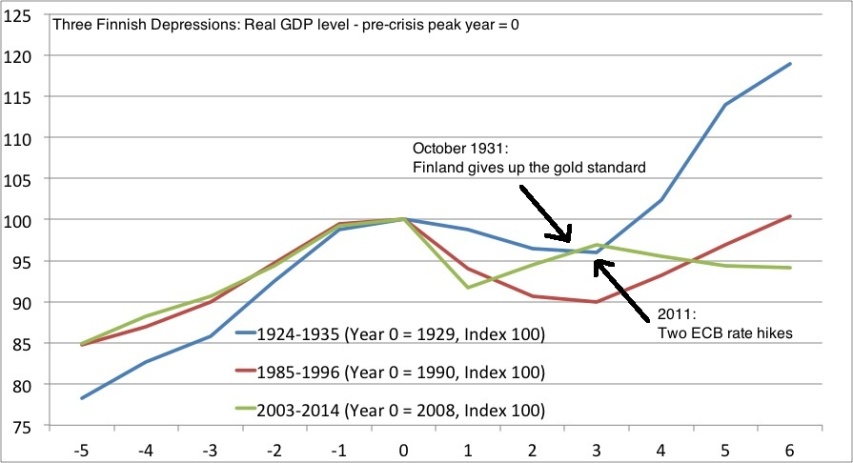

I have been asked if I could do a similar graph on Finland. I have done so — but I have also added the a third Finnish “Depression” and that is the crisis in the early 1990s related to the collapse of the Soviet Union and the Nordic banking crisis. The graph below shows the three periods.

[…]

The most interesting story in the graph undoubtedly is the difference in the monetary response during the 1930s and during the present crisis.

In October 1931 the Finnish government decided to follow the example of the other Nordic countries and the UK and give up (or officially suspend) the gold standard.

The economic impact was significant and is very clearly illustrate in the graph (look at the blue line from year 2-3).

We have nearly imitate take off. I am not claiming the devaluation was the only driver of this economic recovery, but it surely looks like monetary easing played a very significant part in the Finnish economic recovery from 1931-32.