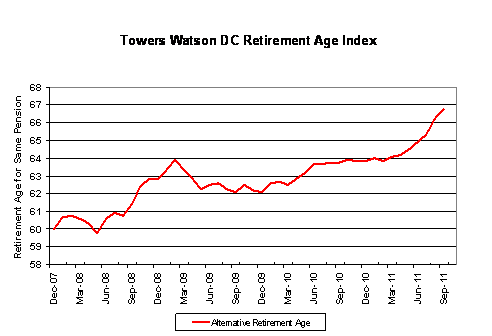

Jonathan Chevreau shows that those of us getting a bit closer to retirement will have to wait longer than the previous generation before retiring:

The “double whammy” of falling stock prices and low interest rates has impacted members of DC pensions and RRSPs, who must cover the deficit through reduced personal spending and/or deferred retirement.

Towers Watson has issued its first quarterly DC Retirement Age Index, which it describes as a pension freedom tracker. It tracks the performance of a balanced portfolio of a DC plan member who has contributed to the plan from age 40 to 60. At that point, an annuity would be purchased but its value and monthly payout would depend on the performance of the plan over those 20 years.

[. . .]

With recession threatening, ongoing market volatility and falling interest rates, Towers Watson expects the Pension Freedom Age could move up to 67, or two years after the traditional retirement age (when Old Age Security and full Canada Pension Plan benefits commence).