Washington’s destructive policies have been dubbed “regime uncertainty” in a strand of innovative analyses pioneered by Robert Higgs of the Independent Institute. Regime uncertainty relates to the likelihood that an investor’s private property — namely, the flows of income and services it yields — will be attenuated by government action. As regime uncertainty is elevated, private investment is notched down from where it would have been. This can result in a business-cycle bust and even economic stagnation. I recommend Higgs’ most recent book for evidence on the negative effects of regime uncertainty: Robert Higgs. Taking a Stand: Reflections on Life Liberty, and the Economy. Oakland, CA: The Independent Institute, 2015.

Steve Hanke, “What’s Killing U.S. Growth?”, Huffington Post, 2016-04-12.

January 11, 2018

QotD: Regime uncertainty

October 5, 2017

Four Reasons Financial Intermediaries Fail

Marginal Revolution University

Published on 26 Jul 2016As we’ve discussed in previous videos, financial intermediaries bridge savers and borrowers. When these bridges crumble, the effects can be disastrous. For businesses, credit shortages can lead to bankruptcy, or layoffs. For individuals, they rely on credit to invest in education or a new home or car. These negative effects show you how crucial intermediaries are to our lives.

Still, what exactly causes failed intermediation? Four answers:

First, insecure property rights. Simply speaking, when you save money at a bank, you expect the ability to pull out your funds when needed. But what if your deposits are frozen? Or confiscated altogether? For instance, in 2013 amidst a financial crisis, the government in Cyprus confiscated bank deposits to help pay down the country’s budget shortfall. You can see how insecure property rights can scare away potential savers.

Second, controls on interest rates. Interest rates are the price of borrowing. Thus, controls on interest rates, often called usury laws, are effectively price ceilings—they set the interest rate lower than the market equilibrium interest rate. With this forced lowering of interest rates, borrowers will want to borrow more, but lenders won’t want to lend. The effect? A lending shortage.

Third, politicized lending. Banks profit by assessing risk, and then loaning, based on that assessment. Banks that excel at assessment succeed. Those poor at it die out. Problems arise when the government intervenes to prop up failing banks, resulting in what we call “zombie banks.” In such cases, intervention undercuts normal competition, and intervention tends to favor banks that are politically connected. In fact, it’s been shown that there’s an inverse correlation between government ownership in banks and a country’s GDP per capita and productivity growth.

Fourth, you have runs, panics, and scandals. Remember, trust is vital to the financial system. When trust erodes, depositors may rush to withdraw their money from banks, causing what is known as a “bank run.” This can cause banks to fail, as we saw during the Great Depression. Scandals can also depress market confidence. Enron, WorldCom and Bernie Madoff may come to mind.

So, which of these four factors contributed to the Great Recession of 2008?

We’ll discuss that in our next video.

April 2, 2017

The (inevitable) failure of the “Revolution in Military Affairs”

In an article about security incident response automation, Bruce Schneier provides a useful thumbnail sketch of a US Army attempt to dispel the fog of war in real time:

While this is a laudable goal, there’s a fundamental problem with doing this in the short term. You can only automate what you’re certain about, and there is still an enormous amount of uncertainty in cybersecurity. Automation has its place in incident response, but the focus needs to be on making the people effective, not on replacing them security orchestration, not automation.

This isn’t just a choice of words — it’s a difference in philosophy. The US military went through this in the 1990s. What was called the Revolution in Military Affairs (RMA) was supposed to change how warfare was fought. Satellites, drones and battlefield sensors were supposed to give commanders unprecedented information about what was going on, while networked soldiers and weaponry would enable troops to coordinate to a degree never before possible. In short, the traditional fog of war would be replaced by perfect information, providing certainty instead of uncertainty. They, too, believed certainty would fuel automation and, in many circumstances, allow technology to replace people.

Of course, it didn’t work out that way. The US learned in Afghanistan and Iraq that there are a lot of holes in both its collection and coordination systems. Drones have their place, but they can’t replace ground troops. The advances from the RMA brought with them some enormous advantages, especially against militaries that didn’t have access to the same technologies, but never resulted in certainty. Uncertainty still rules the battlefield, and soldiers on the ground are still the only effective way to control a region of territory.

But along the way, we learned a lot about how the feeling of certainty affects military thinking. Last month, I attended a lecture on the topic by H.R. McMaster. This was before he became President Trump’s national security advisor-designate. Then, he was the director of the Army Capabilities Integration Center. His lecture touched on many topics, but at one point he talked about the failure of the RMA. He confirmed that military strategists mistakenly believed that data would give them certainty. But he took this change in thinking further, outlining the ways this belief in certainty had repercussions in how military strategists thought about modern conflict.

McMaster’s observations are directly relevant to Internet security incident response. We too have been led to believe that data will give us certainty, and we are making the same mistakes that the military did in the 1990s. In a world of uncertainty, there’s a premium on understanding, because commanders need to figure out what’s going on. In a world of certainty, knowing what’s going on becomes a simple matter of data collection.

July 10, 2016

QotD: Science isn’t something you “believe in”

The arguments about global warming too often sound more like theology than science. Oh, the word “science” gets thrown around a great deal, but it’s cited as a sacred authority, not a fallible process that staggers only awkwardly and unevenly toward the truth, with frequent lurches in the wrong direction. I cannot count the number of times someone has told me that they believe in “the science,” as if that were the name of some omniscient god who had delivered us final answers written in stone. For those people, there can be only two categories in the debate: believers and unbelievers. Apostles and heretics.

This is, of course, not how science works, and people who treat it this way are not showing their scientific bona fides; they are violating the very thing in which they profess such deep belief. One does not believe in “science” as an answer; science is a way of asking questions. At any given time, that method produces a lot of ideas, some of which are correct, and many of which are false, in part or in whole.

Megan McArdle, “Global-Warming Alarmists, You’re Doing It Wrong”, Bloomberg View, 2016-06-01.

June 27, 2015

QotD: The corporate tax game

You can think of corporate taxation as a sort of long chess match: The government makes a move. Corporations move in response — sometimes literally, to another country where the tax burden is less onerous. This upsets the government greatly, and the Barack Obama administration in particular. Treasury Secretary Jack Lew has written a letter to Congress, urging it to make it stop by passing rules that make it harder to execute these “inversions.”

I’ve got a better idea: What if we made our tax system so attractive to corporations that they would have no interest in moving themselves abroad?

The problem with this extended chess game is that every move is very costly. First, it adds to the complexity of the tax code. With every new rule — no matter how earnestly said rule attempts to close a “loophole” — it becomes harder to know whether you are in compliance with the law. This is true on both sides; corporate tax law has now passed well beyond the point where it is possible for a single expert to be familiar with its ins and outs. This makes it harder to plan business expansions, harder to forecast government revenue, and it requires both sides to hire more experts in order to determine whether corporations are compliant. It also means more lawsuits, and longer ones, as both sides wrangle over how this morass of laws should be applied to real-world situations.

You can think of it this way: Every new law has possible intersections with every other tax law in existence. As the number of laws grows, the number of possible intersections grows even faster. And each of those intersections represents both a possible way to avoid taxes and a potential for unintended consequences that inadvertently outlaw something Congress never intended to touch. This growing complexity makes it more and more difficult for either companies or lawmakers to forecast the ultimate effects of new tax laws.

Megan McArdle, “We Don’t Need a Corporate Income Tax”, Bloomberg View, 2014-07-16.

March 11, 2015

December 20, 2014

QotD: When it’s steam engine time

Ridcully poked at his pipe with a pipe cleaner and said, “Ye-es, that is a conundrum. Surely the steam engine cannot happen before it’s steam-engine time? If you saw a pig, you would, I think, say to yourself, well, here’s a pig, so it must be time for pigs. You wouldn’t question its right to be there would you?”

“Certainly not,” said Lu-Tze. “In any case, pork gives me the wind something dreadful. What we know is that the universe is never-ending story that, happily, writes itself continuously. The trouble with my brethren in Oi Dong is that they are fixated on the belief that the universe can be totally understood, in every particular jot and tittle.”

Ridcully burst out laughing. “Oh, my word! You know, my wonderful associate Mister Ponder Stibbins appears to have fallen into the same misapprehension. It seems that even the very wise have neglected to take notice of one rather important goddess … Pippina, the lady with the Apple of Discord. She knows that the universe, while it requires rules and stability, also needs just a tincture of chaos, the unexpected, the surprising. Otherwise it would be a mechanism — a wonderful mechanism, ticking away the centuries, but with nothing different happening. And so we may assume that the loss of balance will be allowed this time and the beneficent lady will decree that this mechanism might yield wonderful things, given a chance.”

“For my part, I would like to give it a chance,” said Lu-Tze. “Serendipity is no stranger to me. I know the monks have been carefully shepherding the world, but I rather think they don’t realize that the sheep sometimes have better ideas. Uncertainty is always uncertain, but the difficulty with people who rely on systems is that they begin to believe that nearly everything is in some way a system and therefore, sooner or later, they become bureaucrats.”

Terry Pratchett, Raising Steam, 2013.

May 14, 2014

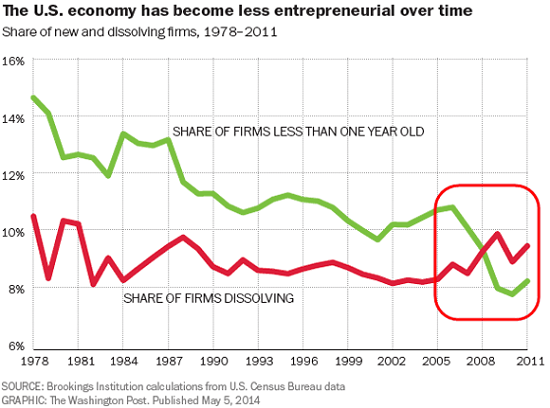

Not fewer entrepreneurs – fewer resources for entrepreneurs

This image showed up in a post at Coyote Blog a couple of days ago, and it’s an indication of the decline in new business formation in the United States:

Increasing bureaucracy — especially at the state level — undoubtedly contributes to that depressing chart, but it’s far from the whole story:

Home equity has historically been an important source of capital for small business formation. My first large investment in my company was funded with a loan that was secured by the equity in my home. What outsiders may not realize about small business banking nowadays is that it is nothing like how banking is taught in high school civics. In that model, the small business person goes to her local banker and presents a business plan, which the banker may fund if they think it is a good risk.

In the real world, trying to get such an unsecured loan from a bank as a small business will at best result in laughter. My company is no longer what many would call “small” — we will do millions in revenue this year. But there is no way in the world that my banker of over 10 years will lend to my business unsecured — they will demand some asset they can put a lien on. So we can get financing of equipment purchases (as a capital lease on the equipment) and on factored receivables and inventory. But without any of that stuff, a new business that just needs cash for startup cash flow is out of luck — unless the owner has a personal asset, typically a house, on which the banker can place a lien.

So, without home equity, one of the two top sources of capital for small business formation disappears (the other top source is loans from friends and family, which one might also expect to dry up in a tough economy).

May 9, 2014

QotD: Real history and economic modelling

I am not an economist. I am an economic historian. The economist seeks to simplify the world into mathematical models — in Krugman’s case models erected upon the intellectual foundations laid by John Maynard Keynes. But to the historian, who is trained to study the world “as it actually is”, the economist’s model, with its smooth curves on two axes, looks like an oversimplification. The historian’s world is a complex system, full of non-linear relationships, feedback loops and tipping points. There is more chaos than simple causation. There is more uncertainty than calculable risk. For that reason, there is simply no way that anyone — even Paul Krugman — can consistently make accurate predictions about the future. There is, indeed, no such thing as the future, just plausible futures, to which we can only attach rough probabilities. This is a caveat I would like ideally to attach to all forward-looking conjectural statements that I make. It is the reason I do not expect always to be right. Indeed, I expect often to be wrong. Success is about having the judgment and luck to be right more often than you are wrong.

Niall Ferguson, “Why Paul Krugman should never be taken seriously again”, The Spectator, 2013-10-13

February 26, 2014

“The Up Side of Down: Why Failing Well Is the Key to Success” (featuring the author, Megan McArdle)

Published on 25 Feb 2014

Featuring the author Megan McArdle, Columnist, Bloomberg View; with comments by Brink Lindsey, Vice President for Research, Cato Institute; moderated by Dalibor Rohac, Policy Analyst, Center for Global Liberty and Prosperity, Cato Institute.

Nobody likes to fail, yet failure is a ubiquitous element of our lives. According to Megan McArdle, failing often — and well — is an important source of learning for individuals, organizations, and governments. Although failure is critical in coping with complex environments, our cognitive biases often keep us from drawing the correct lessons and adjusting our behavior. Our psychological aversion to failure can compound its undesirable effects, McArdle argues, and transform failures into catastrophes.

Video produced by Blair Gwaltney.

September 20, 2013

The IPCC’s new, more cautious tone

In The Spectator, a muted tone of “we told you so” about the upcoming IPCC report:

Next week, those who made dire predictions of ruinous climate change face their own inconvenient truth. The summary of the fifth assessment report by the Intergovernmental Panel on Climate Change (IPCC) will be published, showing that global temperatures are refusing to follow the path which was predicted for them by almost all climatic models. Since its first report in 1990, the IPCC has been predicting that global temperatures would be rising at an average of 0.2° Celsius per decade. Now, the IPCC acknowledges that there has been no statistically significant rise at all over the past 16 years.

It is difficult to over-emphasise the significance of this report. The IPCC is not simply a research body making reports and declarations which are merely absorbed into political debate. Its word has been taken as gospel, and its research has been used to justify all manner of schemes to make carbon-based energy more expensive while subsidising renewable energy.

The failure of its predictions undermines the certainties which have been placed upon the science of climate change. Previous IPCC reports — and much of the debate over how to react to them — have appeared to treat the Earth’s climate as if it were a domestic central heating system, with carbon emissions analogous to the dial on the thermostat: a small tweak here will result in a temperature rise of precisely 0.2°C and so on. What is clear from the new IPCC report is that the science is not nearly advanced enough to make useful predictions on the future rise of global temperatures. Perhaps it never will be.

Some climate scientists themselves, to give them credit, have admitted as much. Their papers now incorporate a degree of caution, as you would expect from genuine scientists. The problems arise when the non-scientists leap upon the climate change bandwagon and assume that anything marked ‘science’ must be the final word. As the chemist and novelist C.P. Snow once warned in his lecture about the ‘two cultures’, you end up in a situation where non-scientists use half-understood reports to silence debate — not realising that proper science welcomes refutation and is wary of the notion of absolute truths.

September 6, 2013

QotD: Risk-taking

This necessity for taking risks had previously been stressed by a passage in a letter written by James Wolfe when a colonel on the staff in 1757, a passage that has become justly famous:

Experience shows me that … pushing on smartly is the road to success; that nothing is to be reckoned an obstacle to your undertaking which is not found really so upon trial; that in war something must be allowed to chance and fortune, seeing it is in its nature hazardous and on option of difficulties; that the greatness of an object should come under consideration as opposed to the impediments that lie in the way; that the honour of one’s country is to have some weight; and that in particular circumstances and times the loss of a thousand men is rather an advantage to a nation than otherwise, seeing that gallant attempts raise its reputation and make it respected; whereas the contrary appearance sink the credit of a country, ruin the troops, and create infinite uneasiness and discontent at home.

General Robert E. Lee puts it in fewer words:

There is always hazard in military movements, but we must decide between the possible loss from inaction and the risk of action.

Napoleon laconically brings out the same basic idea:

Shuffling half-measures lose everything in war.

Lt. Colonel Alfred H. Burne, “The Strands of War”, The Art of War on Land, 1966.

July 30, 2013

July 27, 2013

Municipal bonds and the economic law of gravity

In the US, municipal bonds — bonds issued by city or other municipal governments — have been widely viewed as “safe” investments. Detroit may cause that view to change drastically. Reggie Middleton has been sounding the alarm for a few years:

Following up on my timely post “Here Come Those Municipal Defaults That Everyone Said Couldn’t Happen, Pt 2“, I comment on Meredith Whitney’s OpEd in the Financial Times. If you remember, she — like I — warned of municipal defaults years ago and was ridiculed for such. Ms. Whitney is quoted as saying:

“As jarring as the reality may be to accept, Detroit’s decision last week to declare bankruptcy should not be regarded as a one-off in the U.S. municipal market.” she said.

“There are five more towns like Detroit in Michigan alone. There are many more municipalities across the country in similar positions.”

“The bill for promises past is now so large for some cities and towns that it is crowding out money for the most basic of services — in the case of Detroit, it could not even afford to run its traffic lights,” she said.

“Will [lawmakers] side with taxpayers, unions or the municipal bondholders? If they back residents, money will be directed to underfunded public services at the expense of pensions and bondholders. If they side with the unions, social services will continue to be cut and the risk to bondholders will increase considerably. If they side with bondholders, social services and pensions are at risk.”

In the case of Detroit, elected officials, for the first time in a very long time, are siding with residents, Whitney said. This is a new precedent that boils down to the straightforward reality of the survival and sustainability of a town or city, she said.

“After decades of near-third-world conditions in the richest country in the world, the city finally stood up and said enough was enough,”

Well, this is the problem. Defaulting on revenue bonds where the underlying asset (ex. a housing project, utility, or infrastructure project) is not generating the sufficient cash flows is part and parcel of the risk of investing in said class of bonds. This is widely accepted and understood, which is likely why those bonds have a slightly higher yield.

For some obscene reason, defaulting on the general obligation bonds which purportedly carry the “full faith and credit’ of the municipality as a back stop is deemed as wholly different affair. The reason? Who the hell knows? This is a point I tried to drive home in the original “Here Come Those Municipal Defaults That Everyone Said Couldn’t Happen” article in 2011. Backing by the full faith and credit of a public entity does not make an investment risk free. To the contrary, if said entity is fundamentally insolvent, the investment is actually “riskful” as opposed to risk free.

Treating these bonds as unsecured in the bankruptcy is essentially the way to go. If you don’t want to do that, well you can still consider them backed by the full faith and credit of the insolvent municipality, which is essentially unsecured — and move on anyway — particularly as many potential collateral assets of value would have likely been encumbered by agreements with a little more prejudicial foresight.

July 14, 2013

Signs of an economic Sharknado

Feeling positive about the economy? Michael Snyder has ten reasons to change your mind:

Have you ever seen a disaster movie that is so bad that it is actually good? Well, that is exactly what Syfy’s new television movie entitled Sharknado is. In the movie, wild weather patterns actually cause man-eating sharks to come flying out of the sky. It sounds absolutely ridiculous, and it is. You can view the trailer for the movie right here. Unfortunately, we are witnessing something just as ridiculous in the real world right now. In the United States, the mainstream media is breathlessly proclaiming that the U.S. economy is in great shape because job growth is “accelerating” (even though we actually lost 240,000 full-time jobs last month) and because the U.S. stock market set new all-time highs this week. The mainstream media seems to be absolutely oblivious to all of the financial storm clouds that are gathering on the horizon. The conditions for a “perfect storm” are rapidly developing, and by the time this is all over we may be wishing that flying sharks were all that we had to deal with. The following are 10 reasons why the global economy is about to experience its own version of Sharknado…

#1 The financial situation in Portugal continues to deteriorate thanks to an emerging political crisis. […]

#2 The economic depression in Greece continues to deepen, and it is being reported that Greece will not even come close to hitting the austerity targets that it was supposed to hit this year […]

#3 The economic crisis in the third largest country in the eurozone, Italy, has taken another turn for the worse. […]

#4 There are rumors that some of the biggest banks in the world are in very serious trouble. […]

#5 Just before the financial crisis of 2008, the price of oil spiked dramatically. […]

#6 Mortgage rates are absolutely skyrocketing right now […]

#7 This upcoming corporate earnings season is shaping up to be an extremely disappointing one. […]

#8 U.S. stocks are massively overextended right now. […]

#9 Rapidly rising interest rates are causing the bond market to begin to come apart at the seams. […]

#10 Rapidly rising interest rates could cause an implosion of the derivatives market at any moment. […]

Most Americans don’t realize that Wall Street has been transformed into the largest casino in the history of the world. Most Americans don’t realize that the major banks are literally walking a financial tightrope each and every day.

All it is going to take is one false step and we will be looking at a financial crisis even worse than what happened back in 2008.

So enjoy this little bubble of false prosperity while you can.

It is not going to last for too much longer.