In most ways […] we can treat rent and taxes together because their economic impacts are actually pretty similar: they force the farmer to farm more in order to supply some of his production to people who are not the farming household.

There are two major ways this can work: in kind and in coin and they have rather different implications. The oldest – and in pre-modern societies, by far the most common – form of rent/tax extraction is extraction in kind, where the farmer pays their rents and taxes with agricultural products directly. Since grain (threshed and winnowed) is a compact, relatively transportable commodity (that is, one sack of grain is as good as the next, in theory), it is ideal for these sorts of transactions, although perusing medieval manorial contacts shows a bewildering array of payments in all sorts of agricultural goods. In some cases, payment in kind might also come in the form of labor, typically called corvée labor, either on public works or even just farming on lands owned by the state.

The advantage of extraction in kind is that it is simple and the initial overhead is low. The state or large landholders can use the agricultural goods they bring in in rents and taxes to directly sustain specialists: soldiers, craftsmen, servants, and so on. Of course the problem is that this system makes the state (or the large landholder) responsible for moving, storing and cataloging all of those agricultural goods. We get some sense of how much of a burden this can be from the prominence of what seem to be records of these sorts of transactions in the surviving writing from the Bronze Age Near East (although I should note that many archaeologists working on the ancient Near Eastern economy are pushing for a somewhat larger, if not very large, space for market interactions outside of the “temple economy” model which has dominated the field for quite some time). This creates a “catch” we’ll get back to: taxation in kind is easy to set up and easier to maintain when infrastructure and administration is poor, but in the long term it involves heavier administrative burdens and makes it harder to move tax revenues over long distances.

Taxation in coin offers potentially greater efficiency, but requires more particular conditions to set up and maintain. First, of course, you have to have coinage. That is not a given! Much of the social interactions and mechanics of farming I’ve presented here stayed fairly constant (but consult your local primary sources for variations!) from the beginnings of written historical records (c. 3,400 BC in Mesopotamia; varies place to place) down to at least the second agricultural revolution (c. 1700 AD in Europe; later elsewhere) if not the industrial revolution (c. 1800 AD). But money (here meaning coinage) only appears in Anatolia in the seventh century BC (and probably independently invented in China in the fourth century BC). Prior to that, we see that big transactions, like long-distance trade in luxuries, might be done with standard weights of bullion, but that was hardly practical for a farmer to be paying their taxes in.

Coinage actually takes even longer to really influence these systems. The first place coinage gets used is where bullion was used – as exchange for big long-distance trade transactions. Indeed, coinage seemed to have started essentially as pre-measured bullion – “here is a hunk of silver, stamped by the king to affirm that it is exactly one shekel of weight”. Which is why, by the by, so many “money words” (pounds, talents, shekels, drachmae, etc.) are actually units of weight. But if you want to collect taxes in money, you need the small farmers to have money. Which means you need markets for them to sell their grain for money and then those merchants need to be able to sell that grain themselves for money, which means you need urban bread-eaters who are buying bread with money, which means those urban workers need to be paid in money. And you can only get any of these people to use money if they can exchange that money for things they want, which creates a nasty first-mover problem.

We refer to that entire process as monetization – when I talk about economies being “monetized” or “incompletely monetized” that’s what I mean: how completely has the use of money penetrated through this society. It isn’t a one-way street, either. Early and High Imperial Rome seem to have been more completely monetized than the Late Roman Western Empire or the early Middle Ages (though monetization increases rapidly in the later Middle Ages).

Extraction, paradoxically, can solve the first mover problem in monetization, by making the state the first mover. If the state insists on raising taxes in money, it forces the farmers to sell their grain for money to pay the tax-man; the state can then take that money and use it to pay soldiers (almost always the largest budget-item in an ancient or medieval state budget), who then use the money to buy the grain the farmers sold to the merchants, creating that self-sustaining feedback loop which steadily monetizes the society. For instance, Alexander the Great’s armies – who expected to be paid in coin – seem to have played a major role in monetizing many of the areas they marched through (along with breaking things and killing people; the image of Alexander the Great’s conquests in popular imagination tend to be a lot more sanitized).

Bret Devereaux, “Collections: Bread, How Did They Make It? Part IV: Markets, Merchants and the Tax Man”, A Collection of Unmitigated Pedantry, 2020-08-21.

September 8, 2023

QotD: Rents and taxes in pre-modern societies

September 2, 2023

September 1, 2023

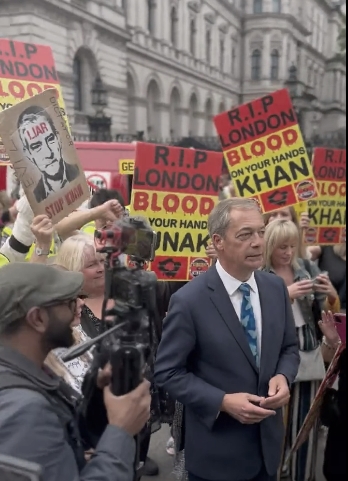

Grassroots protests continue against London’s expanded ULEZ

London mayor Sadiq Khan’s “Ultra Low Emission Zone” expansion is not sitting well with the people who see it as an undemocratic imposition on the poorest Londoners:

This week many Londoners are waking up to the impact of living in an Ultra Low Emission Zone as the £12.50 daily charge for unfashionable cars begins in the outer poorer suburbs.

Normally “climate change” costs are secretly buried in bills, hidden in rising costs and blamed on “old unreliable coal plants”, inflation or foreign wars. Your electricity bill does not have a category for “subsidies for your neighbors’ solar panels”. But the immense pain of NetZero can’t be disguised.

For a pensioner on £186 a week it could be as much as an £87 a week penalty for driving their car — or £4,500 a year. The Daily Mail is full of stories of livid and dismayed people who served in the Navy or worked fifty years, who can’t afford to look after older frail Aunts or shop in their usual stores now, or who will have to give up their cars. People are talking about the “end of Democracy”. The cameras are expected to bring in £2.5 million a day in ULEZ charges to City Hall. But shops inside the zone may also lose customers, and everyone, with and without cars will have to pay more for tradespeople and deliveries to cover the cost of their new car or Ulez fee.

Protests have reached a new level of anger and hooded vigilantes in masks carry long gardening clippers, or spray cans and lasers to disable cameras that record number plates for Ulez. In one photo the whole metal camera pole has been sheared by an electric saw of some sort. There chaos.

Interactive maps have sprung up to report where the cameras are, and help people “plan their trips”. The vigilante group called Blade Runners have vowed to remove or disable every ULEZ camera in London. Nearly nine out of ten cameras have been vandalized in South-east London.

The Transport for London website was overwhelmed with searches from people wondering if their car was compliant and they would have to pay just to drive on the roads their taxes and fees built. Some people have bought old historic cars to get around the fee, but apparently a lot of people hadn’t thought much about what was coming. Sadiq Khan probably didn’t mention this in his election campaign. Presumably there are others in London who will get a nasty surprise bill in the mail.

As Nigel Farage says: “I’ve never seen people so angry about this new tax on working people. “And people are not just furious at Sadiq Khan, the Mayor of London, they’re angry at the Prime Minister and the Conservatives for not stopping the scheme.

August 23, 2023

QotD: “Megacorporations” of the Roman era

The definition of a megacorp differs a bit, work to work. They are, of course, megacorporations in the literal sense; massive, vertically integrated companies that often have monopolistic control over multiple markets. But more fundamental to the definition of the megacorp is that they typically employ their own armed forces and either enforce their own law or are at least able to ignore the law more generally. It is not enough for a company to be big, it has to generate the sort of wealth to which M. Licinius Crassus famously quipped “no one was truly rich who could not support an army at his own expense” (Plut. Cras. 2.7).

Which is to say that what really defines a megacorporation is that it trespasses into domains usually occupied by the state: military, police and judicial functions – the use of force. A megacorporation is, simply put, a corporation so large and powerful that it begins to act as a state, be that in the form of the private armies of Cyberpunk 2077, the privatized police force of the Robocop franchise, or the straight-up corporate governments of Stellaris (which in turn channel things like the Spacer’s Guild or the Ferengi Alliance) And that is core to the generally dystopian leaning of megacorporations – they are meant to reflect capitalism and corporate empire building taken to an extreme, to the point where it has swallowed the entire rest of the society.

Taking that definition to history, we can actually see a fair number of megacorporations; they are by no means common, but they do exist. Going very far back, the Roman societates (lit: “fellowships”, but “business association” or “company” is an accurate enough rendering) of the publicani (businessmen who filled public contracts) exercised close to this sort of power in some of Rome’s early provinces. During the Middle and Late Roman Republic, the job of extracting tax revenue from the provinces was too administratively complex for the limited machinery of the Republic, so instead the senate directed the censors to auction the right to collect taxes. Groups of Roman businessmen (and often silent patrician partners) would group resources together to bid for the right to collect taxes from a province – any taxes they took in excess of that figure would be their profit.

These companies could be very large indeed. For instance, parts of the lex portorii Asiae (the customs laws for the Roman province of Asia) survive and include regulations for the relevant company including a slew of customs houses and guard posts (the law is incomplete, but mentions more than 30 collection points – all major ports – to which would also need to be added posts along the land routes into the province). From other evidence we know that the staff at customs posts included armed guards along with the expected tax collectors and bookkeepers. And we know that publicani were sometimes delegated local or Roman forces to do their work (e.g. Cic. Ad Att. 114, using Shackleton Bailey’s numbering). They also maintained the closest thing the Roman Republic had to a postal service (Cic. Ad Att. 108). It’s not clear exactly how many employees one of the larger tax collection companies might have had (and those for the province of Asia – equivalent to the west coast of Anatolia – would have been some of the largest), but it was clearly considerable, as were the sums of money involved.

To the cities and towns of a province, such Roman companies must have seemed like megacorporations, especially if they were in with the governor (which they generally were) and thus could call down the forces of Rome on recalcitrant taxpayers. And we certainly know that these publicani often collected substantially far more than was due to them under the law (the reason why “tax collector” and “sinner” seem to be nearly synonymous in the New Testament, a fact that gave Ernst Badian’s study of them, Publicans and Sinners, its title). At the same time, we see the clear limitations too: such companies were clearly subservient to the governor and to the Roman state. Administrative changes beginning under Julius Caesar and brought to completion under Augustus did away with some of the largest tax contracts and the influence of the societates publicanorum with them.

Bret Devereaux, “Fireside Friday: January 1, 2021”, A Collection of Unmitigated Pedantry, 2021-01-01.

August 2, 2023

QotD: The Coolidge years

I washed my car this morning and it rained this afternoon. Therefore, washing cars causes rain.

So-called “progressives” tell us that Calvin Coolidge was a bad president because the Great Depression started just months after he left office.

This is precisely the same, lame argument expressed in two different contexts.

In five years (August 2023), we will mark the 100th anniversary of the day that Silent Cal became America’s 30th President. I intend to celebrate it along with others who believe in small government, but you can bet there’ll be plenty of progressives trying to rain on our parade. So let’s get those umbrellas ready.

Let’s remember that the eight years of Woodrow Wilson (1913-1921) were economically disastrous. Taxes soared, the dollar plummeted, and the economy soured. A sharp, corrective recession in 1921 ended quickly because the new Harding-Coolidge administration responded to it by reducing the burden of government. When Harding died suddenly in 1923, Coolidge became President and for the next six years, America enjoyed the unprecedented growth of “the Roaring ’20s.” Historian Burton Folsom elaborates:

One measure of prosperity is the misery index, which combines unemployment and inflation. During Coolidge’s six years as president, his misery index was 4.3 percent — the lowest of any president during the twentieth century. Unemployment, which had stood at 11.7 percent in 1921, was slashed to 3.3 percent from 1923 to 1929. What’s more, [Coolidge’s Treasury Secretary] Andrew Mellon was correct on the effects of the tax-rate cuts — revenue from income taxes steadily increased from $719 million in 1921 to over $1 billion by 1929. Finally, the United States had budget surpluses every year of Coolidge’s presidency, which cut about one-fourth of the national debt.

That’s a record “progressives” can only dream about but never deliver. Yet when they rank U.S. presidents, Coolidge gets the shaft. If you can get your hands on a copy of the out-of-print 1983 book, Coolidge and the Historians by Thomas Silver, buy it! You’ll be delighted at what Coolidge actually said, and simultaneously incensed at the shameless distortions of his words at the hands of progressives like Arthur Schlesinger.

Lawrence W. Reed, “Cal and the Big Cal-Amity”, Foundation for Economic Education, 2018-07-25.

June 29, 2023

QotD: The costs of taxation

What now seems like a lifetime ago, back in the early 1970s, I asked a colleague (who knew about such things) a somewhat complicated question.

Assuming that:

- the average individual (in those days) is forced to give a third of what he earns to government (which will do nothing productive with it, but turn it straight into trash of one kind or another), and that

- whenever three such individuals are taxed at that rate, in effect, one whole human being — including all his or her potential accomplishments, his creations, his ability to raise the standard of living for himself, for his family and friends, for everyone around him, and for society in general — has been economically obliterated, then

- how many human lives in total have been obliterated in that way since the Constitution, with its taxing powers, was ratified in 1789?

It turns out to be a very difficult question to answer. Tax rates have varied over the years, and so has the number of Americans subject to taxation. In the end, my colleage estimated that it had consumed the productive capacity of some fifty million (50,000,000) innocent human lives. That’s roughly four times the number of victims claimed by Adolf Hitler. It almost equals the number of individuals killed in all of the Second World War. It fits in somewhere between the number of Russians slaughtered by Josef Stalin and Chinese killed by Mao Zedong.

And according to political scientist R.J. Rummel, it’s properly called “democide”, since, for this purpose, everybody gets to be the Jews.

So now you finally know where your flying car went, and why there’s no cure yet for cancer. You know why there’s no luxury hotel aboard a Big Wheel space station, no vacation resort on the Moon, and no scientific base on Mars or Titan. All of those things, and many more that we expected to have (or still haven’t imagined) by now, were devoured, sometimes quite literally, by grants to investigate the territoriality of tree frogs, programs to feed individuals who can’t — or won’t — work (which is properly the job of churches), programs to keep people from smoking the wrong vegetable or (to quote the late Saint George Carlin) shooting, snorting, or rubbing it into their bellies), not to mention enforcing laws against licking the wrong toad.

Not the ones squatting in the White House.

L. Neil Smith, “Economic Genocide”, Libertarian Enterprise, 2014-06-29.

June 11, 2023

Minimum alcohol pricing fails utterly in reducing “problem” drinking, but it’s aces for padding the state’s coffers

Christopher Snowden counts coup on Scotland’s utterly failed “minimum pricing model” for alcohol which has cost Scots additional hundreds of millions of pounds for no discernable improvement in any measurable:

This study was published yesterday and got no attention whatsoever from the media despite it being written by a team in Sheffield who used to get blanket coverage for their every pronouncement. What changed? Well, they used to produce models showing that minimum alcohol pricing would work and now they’ve produced a study showing that their model didn’t work.

The results above suggest the introduction of MUP in Scotland did not lead to a decline in the proportion of adult drinkers consuming alcohol at harmful levels. It also did not lead to any change in the types of alcoholic beverage consumed by this group, their drinking patterns, the extent to which they consumed alcohol while on their own or the prevalence of harmful drinking in key subgroups.

Oof! So much for the “exquisitely targeted” policy of minimum pricing being an “almost perfect alcohol policy because it targets cheap booze bought by very heavy drinkers“.

After building your entire reputation on modelling minimum pricing, it must have been painful for them to write this …

… the lack of evidence for a decline in the prevalence of harmful drinking arising from MUP is contrary to model-based evidence that informed the introduction of the policy.

Hey-ho. I guess the model was garbage, as I said from the start. Never mind. It’s only cost drinkers in Scotland a few hundred million pounds. Will the Supreme Court be taking another look at that court case that was won off the back of an incorrect model?

The lack of change in the prevalence of harmful drinking may arise for several reasons. First, people drinking at harmful levels may be less responsive to price changes than lighter drinkers.

You don’t say! If only someone had mentioned this earlier!

Previous qualitative research and studies of purchasing behaviour among people with alcohol dependence (i.e. a group that comprises approximately 20% of those drinking harmfully in the United Kingdom and thus 1% of the overall population) supports this view. However, the very large price increases imposed by MUP on people drinking harmfully, their inability to switch to cheaper products and clear evidence of successful policy implementation and compliance, mean their price responsiveness would need to be extremely low to negate any impact on consumption.

But it is extremely low! I explained this over a decade ago when I took the model to task for making the plainly daft assumption that heavy drinkers are more price sensitive than moderate drinkers. I wrote:

“The model assumes that minimum pricing will have more effect on the consumption patterns of heavy drinkers than on moderate drinkers because heavy drinkers are more price-sensitive. This is a convenient belief since it is heavy drinkers who cause and suffer the most alcohol-related harm, but can we really assume that someone with an alcohol dependency is more likely to be deterred by price rises than a more casual consumer? The SAPM model says that they are, and yet there is ample evidence to support the common sense view that heavy drinkers and alcoholics are less price-sensitive than the general population (eg. Gallet, 2007; Wagenaar, 2009). Indeed, research has shown that price elasticity for the heaviest drinkers is ‘not significantly different from zero’ — they will, in other words, purchase alcohol at almost any cost.”

You don’t need an encyclopaedic knowledge of the price elasticity literature to work this out. For most people, it falls under the umbrella of the bleeding obvious. Here we are 11 years later and the penny still hasn’t quite dropped at Sheffield, but we’re getting closer.

April 13, 2023

A Brief History of Gin

No Nonsense Gin Drinking

Published 21 Jul 2019Pay attention class! No running, shouting or talking at the back! It’s time to learn all about gin!

(more…)

March 30, 2023

“Food insecurity” – one of the neat new benefits of our over-regulated economy

Elizabeth Nickson on how western governments (in her case, the provincial government of British Columbia) are working hand-in-glove with environmental non-governmental organizations to create “food insecurity”:

In Canada, the British Columbia government in order to increase “food security” is handing out $200,000,000 to farmers in the province. Food insecurity, which means crazy high food prices, comes to us courtesy of the sequestration of the vast amounts of oil and gas in the province and the ever increasing carbon tax, which (like a VAT in Europe), as you probably know, is levied at every single step in food production. Add the hand-over-fist borrowing in which the government has indulged for the last 20 years, and you have created your own mini-disaster.

Ever since multinational environmental non-governmental organizations (ENGOs) took over public opinion in the province, our economy has been wrenched from resource extraction to tourism. Tourism is, supposedly, low-impact. The fact that it pays $15 an hour instead of $50 an hour and contributes very much less to the public purse than forestry, mining, farming, ranching, oil and gas, means we have had borrow to pay for health care and schooling. This madness spiked during Covid, and, as in every “post-industrial” state, has contributed to making food very, very much more expensive, despite the fact that British Columbia where I live, is anything but a food desert. We could feed all of Canada and throw in Washington State.

Inflation comes from a real place, it has a source, it is not mysterious and arcane. Regionally, it comes from “green” government decisions. I pay almost 70 percent more for food now than I did five years ago. Of course one cannot know with any confidence how much the real increase is. The Canadian government was caught last week hiding food price statistics and well they might. The Liberal government leads with its “compassion”, blandishing the weak and foolish, hiding the fact that in this vast freezing country they are trying to make it even colder by starving and freezing the lower 50 percent of the population.

Even the Wasp hegemony that ran this country pre-Pierre Elliot Trudeau knew not to try that. But not this crew! It doesn’t touch them. They don’t see and wouldn’t care if they did, about the single mother working in a truck stop on the Trans-Canada Highway, who steals food for her kids because all her money is going towards keeping them warm.

[…]

The region in which I live used to grow all the fruit for the province, now, well good luck with that buddy. Last year under the U.N. 2050 Plan, local government tried to ban farming and even horticulture. That was defeated so hard that the planner who introduced it was fired and the plan scrubbed from the website. Inevitably it will come again in the hopes that citizens or subjects, as we in Canada properly are, have gone back to sleep. U.N. 2050, an advance on 2030, locks down every living organism, and all the other elements that make up life, assigns those elements to multinationals, advised by ENGOs, which can “best decide” how to use them.

If the only tool you have is a hammer, it’s tempting to treat everything as if it were a nail. It is only the most arcane and numerate think tanks who bang on and on about over-regulation and how destructive it is. Regulation is so complex that most people would rather do anything than think about it, much less deconstruct it.

March 27, 2023

The vicious – not virtuous – circle of green

Elizabeth Nickson thinks that our societal pursuit of green technology will be the undoing of everything we have built:

Some of us have been saying this for a very long time: green will bring down the world. Green creates a vicious circle, a term you may remember from Economics 101. It is when the serpent eats itself, no wealth is created and collapse results. That is what we are doing with ESG, with carbon taxes, with the forced adoption of unreliable vertiginously expensive green energy. It has skewed every single market. No one is investing in sound enterprise, and anything once sound is a Jenga tower, unstable, rotting from within. This. This is what threatens to bring down the world.

Green is built on subsidies. And not just government subsidy. Every mutual fund, every hedge fund, every multinational and every local or national corporation has a green monster within preventing innovative investments, sucking profits and growth. Every local, regional and state government leaks millions to green morons promising to “bring sustainable prosperity”. The only prosperity is theirs. They fiddle around in lakes and watercourses, producing “studies”, all of which are hysterical and exaggerated. They muck around in forests, buying as much as possible, shut them down, never visit again, leaving them to desertify. They buy farms and ranches, leaving them to rot. They are termites, eating us alive.

These outfits have burrowed into every level of government and every ministry. They are purely extractive. They do not produce anything of value. They leech. They move in and out of government. When in government, they identify sources of funds to plunder once out of government. In 2015, I did a cross-ministry analysis of just how much money these folks take from the government annually. It is in the hundreds of billions in the US alone. From private foundations they take more billions. All this money is used to shut down economic activity.

[…]

Here is the nasty little secret that lies at the heart of environmentalism. It has been long captured by plutocrats and WEFers, who use it to take resources once thought to belong to the people, to everyone, to use in order to innovate and develop. This freedom and access, and only this was the source of prosperity in the United States. It powered the entire world. It made America the beacon, the lighthouse of the world. It produced strong healthy brilliant young people who performed one feat of innovation, athleticism, and creation after another. All those kids today are working on ever more vicious ways to surveil, control and supress via AI.

And the interior is being cleared of people, businesses, farms, ranches, working forests, mines, and oil and gas installations.

In pursuit of 2030 goals, Biden’s agents are busily acquiring hundreds of millions of acres from private owners, from state and regional land banks, which they will then lock down. Many ranchers, including the heroic Wayne Hage, believe that government is taking that land to use as collateral for its massive debt to the Bank for International Settlements. The only people who will be able to use those resources are multinationals who pay a fee to government and to the BIS to pay down the loans. No citizens will be able to access those resources to make money for themselves, to build families and businesses and towns and cities. The environmental movement has, within 40 years, returned us to serfdom, where we eat what we are told to eat, go where we are told to go, take whatever medicine they want to give us, and eventually, fight when we are told to fight.

The environmental movement is so evil, it has twisted ethical standards to the point where we are able to kill each other with impunity. Their PR is so strong, so invasive, that every school child now believes there are too many people (this is nonsense), and population must be drastically drawn down (a genocide unrivalled in history). Every adult secretly fears this is true. This appalling lie has created a culture of death. What are the effects of this thinking, that life is no longer sacred, but a threat?

March 17, 2023

QotD: The unique nature of Roman Egypt

I’ve mentioned quite a few times here that Roman Egypt is a perplexing part of understanding the Roman Empire because on the one hand it provides a lot of really valuable evidence for daily life concerns (mortality, nuptiality, military pay, customs and tax systems, etc.) but on the other hand it is always very difficult to know to what degree that information can be generalized because Roman Egypt is such an atypical Roman province. So this week we’re going to look in quite general terms at what makes Egypt such an unusual place in the Roman world. As we’ll see, some of the ways in which Egypt is unusual are Roman creations, but many of them stretch back before the Roman period in Egypt or indeed before the Roman period anywhere.

[…]

… what makes Roman Egypt’s uniqueness so important is one of the unique things about it: Roman Egypt preserves a much larger slice of our evidence than any other place in the ancient world. This comes down to climate (as do most things); Egypt is a climatically extreme place. On the one hand, most of the country is desert and here I mean hard desert, with absolutely minuscule amounts of precipitation. On the other hand, the Nile River creates a fertile, at points almost lush, band cutting through the country running to the coast. The change between these two environments is extremely stark; it is, I have been told (I haven’t yet been to Egypt), entirely possible in many places to stand with one foot in the “green” and another foot in the hard desert.

That in turn matters because while Egypt was hardly the only arid region Rome controlled, it was the only place you were likely to find very many large settlements and lots of people living in such close proximity to such extremely arid environments (other large North African settlements tend to be coastal). And that in turn matters for preservation. When objects are deposited – lost, thrown away, carefully placed in a sanctuary, whatever – they begin to degrade. Organic objects (textile, leather, paper, wood) rot as microorganisms use them as food, while metal objects oxidize (that is, rust). Aridity arrests (at least somewhat) both processes. Consequently things survive from the Roman period (or indeed, from even more ancient periods) in Egypt that simply wouldn’t survive almost anywhere else.

By far the most important of those things is paper, particularly papyrus paper. The Romans actually had a number of writing solutions. For short-term documents, they used wax writing tablets, an ancient sort of “dry erase board” which could be scraped smooth to write a new text when needed; these only survive under very unusual circumstances. For more permanent documents, wood and papyrus were used. Wood tablets, such as those famously recovered from the Roman fort at Vindolanda, are fairly simple: thin wooden slats are smoothed so they can be written on with ink and a pen, creating a rigid but workable and cheap writing surface; when we find these tablets they have tended to be short documents like letters or temporary lists, presumably in part because storing lots of wood tablets would be hard so more serious records would go on the easier to store papyrus paper.

Papyrus paper was lighter, more portable, more storeable option. Papyrus paper is produced by taking the pith of the papyrus plant, which is sticky, and placing it in two layers at right angles to each other, before compressing (or crushing) those layers together to produce a single sheet, which is then dried, creating a sheet of paper (albeit a very fibery sort of paper). Papyrus paper originated in Egypt and the papyrus plant is native to Egypt, but by the Roman period we generally suppose papyrus paper to have been used widely over much of the Roman Empire; it is sometimes supposed that papyrus was cheaper and more commonly used in Egypt than elsewhere, but it is hard to be sure.

Now within the typical European and Mediterranean humidity, papyrus doesn’t last forever (unlike the parchment paper produced in the Middle Ages which was far more expensive but also lasts much longer); papyrus paper will degrade over anything from a few decades to a couple hundred years – the more humidity, the faster decay. Of course wood tablets and wax tablets fare no better. What that means is that in most parts of the Roman Empire, very little casual writing survives; what does survive were the sorts of important official documents which might be inscribed on stone (along with the literary works that were worth painstakingly copying over and over again by hand through the Middle Ages). But letters, receipts, tax returns, census records, shopping lists, school assignments – these sorts of documents were all written on less durable materials which don’t survive except in a few exceptional sites like Vindolanda.

Or Egypt. Not individual places in Egypt; pretty much the whole province.

In the extremely dry conditions of the Egyptian desert, papyrus can survive (albeit typically in damaged scraps rather than complete scrolls) from antiquity to the present. Now the coverage of these surviving papyri is not even. The Roman period is far better represented in the surviving papyri than the Ptolemaic period (much less the proceeding “late” period or the New Kingdom before that). It’s also not evenly distributed geographically; the Arsinoite nome (what is today el-Fayyum, an oasis basin to the West of the Nile) and the Oxyrhynchus nome (roughly in the middle of Egypt, on the Nile) are both substantially overrepresented, while the Nile Delta itself has fewer (but by no means zero) finds. Consequently, we need to be worried not only about the degree to which Egypt might be representative of the larger Roman world, but also the degree to which these two nomes (a nome is an administrative district within Egypt, we’ll talk about them more in a bit) are representative of Egypt. That’s complicated in turn by the fact that the Arsinoite nome is not a normal nome; extensive cultivation there only really begins under Ptolemaic rule, which raises questions about how typical it was. It also means we lack a really good trove of papyri from a nome in Lower Egypt proper (the northern part of the country, covering the delta of the Nile) which, because of its different terrain, we might imagine was in some ways different.

Nevertheless, it is difficult to overstate the value of the papyri we do recover from Egypt. Documents containing census and tax information can give us important clues about the structure of ancient households (revealing, for instance, a lot of complex composite households). Tax receipts (particularly for customs taxes) can illuminate a lot about how Roman customs taxes (portoria) were assessed and conducted. Military pay stubs from Roman Egypt also provide the foundation for our understanding of how Roman soldiers were paid, recording for instance, pay deductions for rations, clothes and gear. We also occasionally recover fragments of literary works that we know existed but which otherwise did not survive to the present. And there is so much of this material. Whereas new additions to the corpus of ancient literary texts are extremely infrequent (the last very long such text was the recovery of the Athenaion Polteia or Constitution of the Athenians, from a papyrus discovered in the Fayyum (of course), published in 1891), the quantity of unpublished papyri from Egypt remains vast and there is frankly a real shortage of trained Egyptologists who can work through and publish this material (to the point that the vast troves of unpublished material has created deeply unfortunate opportunities for theft and fraud).

And so that is the first way in which Egypt is unusual: we know a lot more about daily life in Roman Egypt, especially when it comes to affairs below the upper-tier of society. Recovered papyrological evidence makes petty government officials, regular soldiers, small farming households, affluent “middle class” families and so on much more visible to us. But of course that immediately raises debates over how typical those people we can see are, because we’d like to be able to generalize information we learn about small farmers or petty government officials more broadly around the empire, to use that information to “fill in” regions where the evidence just does not survive. But of course the rejoinder is natural to point out the ways in which Egypt may be unusual beyond merely the survival of evidence (to include the possibility that cheaper papyrus in Egypt may have meant that more things were committed to paper here than elsewhere).

Consequently the debate about how strange a place Roman Egypt was is also a fairly important and active area of scholarship. We can divide those arguments into two large categories: the way in which Roman rule itself in Egypt was unusual and the ways in which Egypt was a potentially unusual place in comparison to the rest of Roman world already.

Bret Devereaux, “Collections: Why Roman Egypt Was Such a Strange Province”, A Collection of Unmitigated Pedantry, 2022-12-02.

February 25, 2023

QotD: Feudalism versus “Manorialism”

… the economic system in much of medieval Europe is better understood under this term, manorialism, rather than “feudalism”. Feudalism, as a term, has been generally going out of style among medievalists for a long time, but it is especially inapt here. In a lot of popular discourse (and high school classrooms), feudalism gets used as a catch-all to mean both the political relationships between aristocrats and other aristocrats, and the economic relationships between peasants and aristocrats, but these were very different relationships. Peasants did not have fiefs, they did not enter into vassalage agreements (the feodum of feudalism). Thus in practice my impression is that the experts in medieval European economics and politics tend to eschew “feudalism” as an unhelpful term, preferring “manoralism” to describe the economic system (including the political subordination of the peasantry) and “vassalage” to describe the system of aristocratic political relationships.

Bret Devereaux, “Collections: Bread, How Did They Make It? Part IV: Markets, Merchants and the Tax Man”, A Collection of Unmitigated Pedantry, 2020-08-21.

February 20, 2023

Thirteen reasons the Dutch did better financially than the English in the Seventeenth Century

In the latest Age of Invention newsletter, Anton Howes investigates the huge differences between the rival English and Dutch financial markets in the 17th century:

The courtyard of the exchange in Amsterdam (De binnenplaats van de beurs te Amsterdam), 1653.

Oil painting by Emanuel de Witte (1617-1692) from the Museum Boijmans Van Beuningen collection via Wikimedia Commons.

One of the weird things about Britain, despite its being the birthplace of the Industrial Revolution, is that its financial infrastructure was for a long time remarkably backward. Its “Financial Revolution”, by which both people and the state began to borrow at ever lower interest rates, only really took off in the early eighteenth century — long after London’s extraordinary growth in 1550-1650, when it had suddenly expanded eightfold to become one of Europe’s most important commercial hubs. Indeed, even for much of the late seventeenth century, England lacked many of the most basic financial institutions that had been used for decades and decades by their most important rival and trading partner, the Dutch Republic.

I was especially intrigued when I stumbled across a discussion of Dutch policies and customs, written up in around 1665 by the young merchant Josiah Child, and published a few years later: a kind of wishlist of many of the things that made the Dutch so wealthy, and which the English continually failed to emulate:

- The Dutch councils of state and war always included merchants who had experience of trading and living abroad — Child was perhaps just angling for some influence here, but for all that merchants were getting more influential, in England they were not actually in charge.

- Gavel-kind succession laws, whereby all children got an equal share of their parents’ estates, rather than it all going to the eldest. English primogeniture, by contrast, apparently left a lot of gentlemen’s younger sons having to become apprenticed to merchants.

- High regulatory standards for goods. A barrel of Dutch-packed herring or cod would apparently be accepted by buyers just by viewing the marks, without having to open them up to check. English-packed goods, by contrast, were rarely trusted because the fish would turn out to be rotten or even missing — the English regulators’ stamps of approval were reputedly given to anyone who would pay.

- Encouragement for inventors of new products, techniques, and import trades, who received rewards from the state, and not just temporary monopoly patents.

- Ships, called fluyt, which were cheaper to build, required fewer sailors, and were easier to handle. Despite being only very lightly armed, they sailed in fleets for protection, when necessary being convoyed by ships of war. English trading ships, by contrast, were each heavily armed, but with those cannon taking up room and weight that could have been used for carrying merchandise.

- Education of all children, even girls, in arithmetic and keeping accounts. As Child put it, this infused in the Dutch “a strong aptitude, love, and delight” for commerce. It also meant that husbands and wives were real partners in many businesses — something that impressed almost all foreign visitors to the Netherlands.

- Low customs duties, but high consumption taxes. Very low customs duties, on both imports and exports, meant that it was often very profitable to trade with the Netherlands. The Dutch were famed for their many ships, and for their granaries bursting with grain, despite growing hardly any trees or crops themselves. To fund their state, they instead overwhelmingly relied on the gemene middelen — taxes on the sale of wine, beer, meat, fuel, candles, salt, soap, flour, cloth, and a host of other goods, with many of the higher rates reserved for expensive luxuries. Much like modern value-added taxes, these taxes on consumption raised revenue while preserving the all-important incentive to save and invest.

- Thrifty living — which, come to think of it, was probably related to the high consumption taxes, although Childs doesn’t seem to have noticed the connection. Dutch thrift was thought by the English to be especially useful because it allowed wage costs to be kept low — essential for maintaining competitiveness in international markets — while preventing the country having a trade deficit. The English always worried they were sending too much of their silver abroad to pay for French wines and other luxuries, but the Dutch appeared to have prevented this without resorting to import tariffs that might annoy trading partners and prompt retaliation.

- Religious toleration, which attracted all sorts of industrious immigrants to bring their families and wealth. (Incidentally, as I’ve mentioned before, this was also one of the key attractions of Livorno, set up by the Medici Dukes of Tuscany to be a major trading hub.)

- The use of the Law-Merchant, which meant that all controversies between merchants and tradesmen were decided in just 3 or 4 days’ time. England, rather strangely for such an increasingly commercial nation, did not develop merchant courts with a specific jurisdiction or a distinct body of merchant law — disputes instead had to be resolved in the royal common-law or equity courts, in the Admiralty court, or else abroad. The English courts, however, were often slow. Child complained that cases often took half a year, and often much longer. (Incidentally, slow and rotten justice in the Court of Chancery, the key equity court used by merchants in England, was one of the reasons Francis Bacon was impeached by Parliament and sacked as Lord Chancellor.)

- Transferrable bills of exchange — in other words, the circulation of credit notes as a currency. These were not properly supported by English laws, but allowed Dutch merchants to trade a lot more frequently. English merchants often had to wait some six months to a year before receiving all the coin from selling their foreign goods in London, so as to purchase goods again to make fresh trades. They spent much of their time chasing shopkeepers for payment. But the Dutch, by being able to easily buy and sell their credit notes, could “turn their stocks twice or thrice in trade”, immediately settling their accounts and making fresh purchases. (I intend to look into this in a lot more detail soon, as finding a way to bills of exchange transferrable in England appears to have been a major project for many of the mid-seventeenth-century inventors and improvers — after just a cursory glance, transferability was only secured in law as late as 1704.)

- Banks. Or rather, as Child actually put it, “BANKS”. In England many of the functions of banks gradually evolved from the practices of individual goldsmiths and the scriveners — legal clerks who specialised in property transfers and mortgages. There was certainly nothing so secure as the municipal Wisselbank of Amsterdam, established in 1609, which had various monopoly powers as a clearing-house for bills of exchange and was backed by a vault full of bullion. Nor the municipal Bank van Lening, established in 1614, which was a pawnbroker modelled on the Italian Monte di Pietà, or mounts of piety, designed to make small and low-cost loans to the poor.

- “PUBLIC REGISTERS” — again capitalised by Child — of all lands and houses sold or mortgaged. This item on the policy wishlist would not be ticked off for England until two centuries later, but the key advantage was to prevent lawsuits over land titles — still cited as a major problem even in the 1690s — and so make land more genuinely secure for mortgages.

Finally, the result of many of these policies was the Dutch had significantly lower interest rates — often just 3-4% when the English were still lending and borrowing at 6-8%. Indeed, this list was made because of a long-standing English policy debate I’ve been researching, on whether to lower the legal maximum rate of interest.

February 9, 2023

QotD: Collecting taxes, Medieval-style

I want to begin with an observation, obvious but frequently ignored: states are complex things. The apparatus by which a state gathers revenue, raises armies (with that revenue), administers justice and tries to organize society – that apparatus requires people. Not just any people: they need to be people of the educated, literate sort to be able to record taxes, read the laws and transmit (written) royal orders and decrees.

(Note: for a more detailed primer on what this kind of apparatus can look like, check out Wayne Lee’s (@MilHist_Lee) talk “Reaping the Rewards: How the Governor, the Priest, the Taxman, and the Garrison Secure Victory in World History” here. He’s got some specific points he’s driving at, but the first half of the talk is a broad overview of the problems you face as a suddenly successful king. Also, the whole thing is fascinating.)

In a pre-modern society, this task – assembling and organizing the literate bureaucrats you need to run a state – is very difficult. Literacy is often very low, so the number of individuals with the necessary skills is minuscule. Training new literate bureaucrats is expensive, as is paying the ones you have, creating a catch-22 where the king has no money because he has no tax collectors and he has no tax collectors because he has no money. Looking at how states form is thus often a question of looking at how this low-administration equilibrium is broken. The administrators you need might be found in civic elites who are persuaded to do the job in exchange for power, or in a co-opted religious hierarchy of educated priests, for instance.

Vassalage represents another response to the problem, which is the attempt to – as much as possible – do without. Let’s specify terms: I am using “vassalage” here because it is specific in a way that the more commonly used “feudalism” is not. I am not (yet) referring to how peasants (in Westeros the “smallfolk”) interact with lords (which is better termed “manorialism” than as part of feudalism anyway), but rather how military aristocrats (knights, lords, etc) interact with each other.

So let us say you are a king who has suddenly come into a lot of land, probably by bloody conquest. You need to extract revenue from that land in order to pay for the armies you used to conquer it, but you don’t have a pile of literate bureaucrats to collect those taxes and no easy way to get some. By handing out that land to your military retainers as fiefs (they become your vassals), you can solve a bunch of problems at once. First, you pay off your military retainers for their service with something you have that is valuable (land). Second, by extracting certain promises (called “homage”) from them, you ensure that they will continue to fight for you. And third, you are partitioning your land into smaller and smaller chunks until you get them in chunks small enough to be administered directly, with only a very, very minimal bureaucratic apparatus. Your new vassals, of course, may do the same with their new land, further fragmenting the political system.

This is the system in Westeros, albeit after generations of inheritance (such that families, rather than individuals, serve as the chief political unit). The Westerosi term for a vassal is a “bannerman”. Greater military aristocrats with larger holding are lords, while lesser ones are landed knights. Landed knights often hold significant lands and a keep (fortified manner house), which would make them something more akin to European castellans or barons than, say, a 14th century English Knight Banneret (who is unlikely to have been given permission to fortify his home, known as a license to crenellate). What is missing from this system are the vast majority of knights, who would not have had any kind of fortified dwelling or castle, but would have instead been maintained as part of the household of some more senior member of the aristocracy. A handful of landless knights show up in Game of Thrones, but they should be by far the majority and make up most of the armies.

There’s one final missing ingredient here, which is castles, something Westeros has in abundance. Castles – in the absence of castle-breaking cannon – shift power downward in this system, because they allow vassals to effectively resist their lieges. That may not manifest in open rebellion so much as a refusal to go on campaign or supply troops. This is important, because it makes lieges as dependent on their vassals as vassals are on their lieges.

Bret Devereaux, “New Acquisitions: How It Wasn’t: Game of Thrones and the Middle Ages, Part III”, A Collection of Unmitigated Pedantry, 2019-06-12.