A majority of politicians and pundits believe that economic reality is optional. Of course, they don’t express this belief in any manner so direct. But one can logically infer this belief from their policy proposals.

Take, for example, support for rent control. Having the state keep the monetary prices of rental units below the values that would arise in free markets is believed by many pols and pundits – and by nearly all “Progressives” – to effectively keep the actual market values of rental units at whatever low prices the state sets. In this reality-is-optional world, when the state pushes down nominal rental prices, the quantity of rental units supplied not only does not fall, it increases to match the increase in the quantity of rental units demanded.

Want more housing for folks with modest incomes? No problem! We’ll just push the rental prices lower to increase ordinary folks’ access to housing. See, the world is such a simple place!

Similar reality-is-optional “solutions” are minimum-wage statutes (for increasing the pay of low-skilled workers) and mandated paid-leave (for increasing the welfare of all workers).

Pondering this strange notion that the state can make market values be whatever the state wants them to be merely by dictating changes in the names of market values – that is, changes in nominal prices – I wondered what the world would be like if miracles more broadly could be worked merely by changing nominal designations. […]

Of course, all such scenarios are ludicrous. Reality isn’t changed merely by reporting that reality is other than what it is. In fact, reality is made worse by false reports because, unable to learn the truth about reality, people act in ways that are inconsistent with reality, thus worsening their situations.

Yes – but why, then, do so many people believe that economic reality is optional? Why do so many people believe that economic reality can be made to be whatever the state wants it to be merely by having the state order that reports of economic reality lie about that reality? All state-imposed price controls – rent control, minimum wages, you name it – are state-dictated lies about reality.

Don Boudreaux, “What if All Reality Were Optional?”, Café Hayek, 2019-09-13.

April 3, 2024

QotD: Optional economic reality

March 21, 2024

Minneapolis rejects Uber (and economic reality)

Jon Miltimore is upset that he won’t be able to use Uber or Lyft ridesharing services in the Twin Cities after the Minneapolis City Council voted to make the business uneconomical:

“UBER 4U” by afagen is licensed under CC BY-NC-SA 2.0

The ride-hailing services Uber and Lyft announced last week that they are pulling up stakes in the Twin Cities because of a new ordinance designed to raise driver pay.

The Minneapolis City Council voted 10–3 to override the veto of Mayor Jacob Frey, passing a policy that will raise the pay of drivers to the equivalent of $15.57 per hour.

In response to the plan, Uber and Lyft announced that they will cease offering rides beginning May 1 throughout the entire Twin Cities, the 16th largest metro in the United States, saying operations were economically “unsustainable” under the plan.

“We are disappointed the Council chose to ignore the data and kick Uber out of the Twin Cities, putting 10,000 people out of work and leaving many stranded,” Uber said in a statement.

As a resident of the Twin Cities suburbs, I find this news a bit alarming. In fact, I find it infuriating.

City Council supporters say they simply want drivers to earn the minimum wage, but if that’s the case, they passed the wrong ordinance. The Star Tribune reports that council members “seemed oblivious” to a recent Minnesota Department of Labor and Industry study that concluded drivers could be paid $0.49 per minute and $0.89 per mile and make the minimum wage.

“By contrast, the plan approved by the City Council guarantees a floor of $1.40 per mile and 51 cents per minute,” the newspaper reports.

In other words, the wage plan the council passed doesn’t appear remotely close to the minimum wage. But this ignores the larger problem: Neither the Minneapolis City Council nor the state of Minnesota should be setting the wages of Uber or Lyft drivers.

Nobody is forcing drivers to give rides. The arrangement between ride-share companies and drivers is an entirely voluntary one. This is the beauty of gig work. It allows people flexibility and choice about how they’d like to spend their time.

May 1, 2022

QotD: How Thomas Sowell abandoned Marxism

The brilliant Thomas Sowell, when in college, considered himself a Marxist. Asked what changed him, Sowell said, “Evidence.”

After completing undergrad at Harvard and obtaining a master’s in economics, Sowell landed a summer internship with the Department of Labor. While there, he researched the impact of minimum wage law on employment. Sowell learned two things, both of which he found startling. First, minimum wage laws create job loss by pricing the unskilled out of the labor force. Second, Sowell discovered that “the people in the labor department really were not interested in that, because the administration of the minimum wage was supplying one-third of the money that was keeping the labor department going. … I realized that institutions have their own agendas and their own incentives.” In short, Sowell found that the Department of Labor did not care about the real-world effects of the minimum wage law. He credits this experience, this search for evidence, with having the “biggest” impact on his thinking.

Larry Elder, “If $15 Minimum Wage Is Such a Good Idea, Why Did AOC’s Bar Close Down?”, TownHall.com, 2019-03-21.

January 28, 2021

The economic impact of a US national minimum wage of $15 per hour

I missed this post by Warren Meyer last week, but it’s still very topical:

I have talked a lot about the negative effects of higher minimum wages on low-skill workers. Two good example background posts are here and here. I covered how a broad range of labor regulation hurts unskilled workers in a cover story for Regulation magazine a few years back. Unfortunately, in a country where the average American buys about $1000 in lottery tickets each year, the willingness to believe we can get something for nothing is strong.

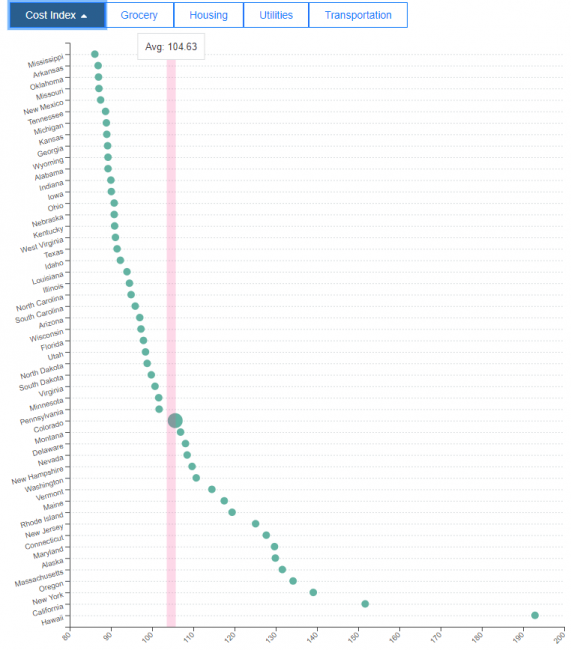

But I want to talk specifically about a Federal minimum wage increase, where one other problem emerges. The best way to state this is — how can one possibly set the same minimum wage for San Francisco at the same rate as one does for rural Mississippi? Here is one source for comparative state cost of living. Doing this by county would make the curve even wider.

Cost of living in Hawaii is more than 2x that of Mississippi. CA and NY are not far behind. A minimum wage that might comfortably be accommodated in San Francisco (and note even there the rise to $15 was ending service jobs in that city long before COVID), would be an economic disaster for rural Alabama. I don’t tend to think primarily along racial lines as seems to be the case on the Left today, but basically this is a policy driven by rich white tech guys in San Francisco that is going to devastate the employment prospects of rural blacks.

Whatever one’s misgivings about minimum wages, it is certainly true that allowing states to take the lead on setting minimum wages (counties would make even more sense) makes a lot more sense that trying to take action at the national level. Even with state action there are disparities.

November 9, 2020

Maine conducts brave and daring experiment with an $18 per hour minimum wage

It’s a bold move, says Jon Miltimore, let’s see if it pays off:

While Florida, which on Tuesday passed a $15 an hour minimum wage referendum, was the only state to have the minimum wage on the ballot in 2020, some localities also voted on the issue.

One of those cities was Portland, the largest city in Maine. The referendum sought to increase the minimum wage from $12 an hour to $15 by 2024. The measure also mandated that workers receive time and a half during a civil emergency (like, say, a pandemic).

Despite opposition from the city’s mayor, seven members of the city council, and dozens of Portland businesses, the measure passed with 60 percent of the vote. That means as early as next month the minimum wage will be $18 an hour, since Maine has declared a civil emergency. (The time-and-a-half will kick in on the $12 minimum wage.)

Businesses already ravaged by stay-at-home orders from the coronavirus have expressed worry about how they will manage to stay in the black.

“In the last 7 months business has dropped from 30 to 50 percent and food costs have skyrocketed. This added increase on a business already depressed due to the pandemic is tough,” one Portland business owner who declined to speak on camera told WCSH, an NBC-affiliate. “We may have to either cut employee hours or cut back on business hours.”

Cutting employee hours is just one of the ways employers negatively respond to laws that artificially raise the price of labor. Other responses include cutting other forms of compensation, such as health care or 401k benefits, replacing workers with robots, and simply assigning employees to do more work.

These are hardly the only unintended consequences. For example, economists David Neumark and William Wascher found that higher minimum wages decrease the number of teens enrolled in high school because they encourage high-skilled teens to drop out; this in turn displaces low-skilled workers.

September 15, 2020

QotD: Racism and the minimum wage

During South Africa’s apartheid era, racist unions, which would never accept a black member, were the major supporters of minimum wages for blacks. In 1925, the South African Economic and Wage Commission said, “The method would be to fix a minimum rate for an occupation or craft so high that no Native would be likely to be employed.” Gert Beetge, secretary of the racist Building Workers’ Union, complained, “There is no job reservation left in the building industry, and in the circumstances, I support the rate for the job (minimum wage) as the second-best way of protecting our white artisans.” “Equal pay for equal work” became the rallying slogan of the South African white labor movement. These laborers knew that if employers were forced to pay black workers the same wages as white workers, there’d be reduced incentive to hire blacks.

South Africans were not alone in their minimum wage conspiracy against blacks. After a bitter 1909 strike by the Brotherhood of Locomotive Firemen and Enginemen in the U.S., an arbitration board decreed that blacks and whites were to be paid equal wages. Union members expressed their delight, saying, “If this course of action is followed by the company and the incentive for employing the Negro thus removed, the strike will not have been in vain.”

Our nation’s first minimum wage law, the Davis-Bacon Act of 1931, had racist motivation. During its legislative debate, its congressional supporters made such statements as, “That contractor has cheap colored labor that he transports, and he puts them in cabins, and it is labor of that sort that is in competition with white labor throughout the country.” During hearings, American Federation of Labor President William Green complained, “Colored labor is being sought to demoralize wage rates.”

Walter E. Williams, “Minimum Wage and Discrimination”, Creators Syndicate, 2017-02-08.

September 13, 2020

QotD: Price controls versus reality

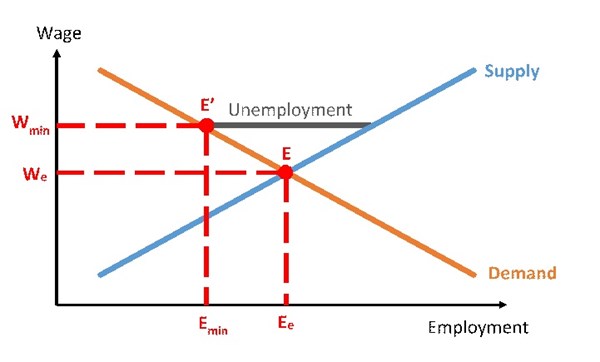

Economic reality is not optional. Government-imposed price ceilings and price floors — although believed by those who view prices as arbitrary results of bargaining or of “power” relationships as merely changing the distribution of economic gain or pain — distort people’s view of economic reality. Price controls prevent people as consumers (including as employers of workers) and as producers (including as workers) from seeing economic reality as clearly as possible. Blinded by minimum-wage commands and other price controls, people act in ways that are the opposite of the ways that those who support the price controls ostensibly want people to act. Rent control, for example, prompts landlords and potential landlords to offer fewer rental units on the market. Minimum-wage commands lead employers to employ fewer low-skilled workers.

Non- (and poor) economists, seeing only that which is in front of their noses, observe the government-controlled prices and conclude that the results of these controls must be just what the government publicly proclaims it wishes these results to be. “Look! Rents are lower with rent controls! Wages are higher with minimum wages! We have helped the poor!”

Those who fall for such superficial appearances, of course, do not grasp the nature of market forces and the role of prices. But the naiveté of such people runs much deeper: they are the sort of people who believe that if the messenger is forced to lie, the underlying reality changes, with the lie thereby converted into truth. Such people, in other words, believe in miracles. They believe that state officials performing incantations can miraculously change economic reality.

Don Boudreaux, “Quotation of the Day…”, Café Hayek, 2018-05-16.

August 27, 2020

QotD: Racism and the minimum wage

Minimum-wage laws can even affect the level of racial discrimination. In an earlier era, when racial discrimination was both legally and socially accepted, minimum-wage laws were often used openly to price minorities out of the job market.

In 1925, a minimum-wage law was passed in the Canadian province of British Columbia, with the intent and effect of pricing Japanese immigrants out of jobs in the lumbering industry.

A Harvard professor of that era referred approvingly to Australia’s minimum wage law as a means to “protect the white Australian’s standard of living from the invidious competition of the colored races, particularly of the Chinese” who were willing to work for less.

In South Africa during the era of apartheid, white labor unions urged that a minimum-wage law be applied to all races, to keep black workers from taking jobs away from white unionized workers by working for less than the union pay scale.

Some supporters of the first federal minimum-wage law in the United States — the Davis-Bacon Act of 1931 — used exactly the same rationale, citing the fact that Southern construction companies, using non-union black workers, were able to come north and underbid construction companies using unionized white labor.

These supporters of minimum-wage laws understood long ago something that today’s supporters of such laws seem not to have bothered to think through. People whose wages are raised by law do not necessarily benefit, because they are often less likely to be hired at the imposed minimum-wage rate.

Thomas Sowell, “Why racists love the minimum wage laws”, New York Post, 2013-09-17.

August 20, 2020

QotD: Manipulating minimum wage laws to harm your competitors

I would be very surprised if careful research of the history of this Oregon statute did not reveal a producer group — or producer groups — who benefitted materially from the minimum-wage-induced stifling of competition.

The logic of such rent-creating legislation is plain: producer group A competes for many of the same customers against producer group B. Producer group A, however, uses for its production a mix of inputs (most importantly, capital and labor) that differs from the mix used by producer group B. Also, producer group B might compete most effectively against producer group A not by producing outputs as nearly identical as possible to that of A but, instead, by producing “substitute” goods or services that sell at prices lower than those charged by producer group A.

For example, producer group A might consist of locally owned restaurants with tablecloths and serving food freshly prepared by skilled chefs, while producer group B consists of chain restaurants serving food less exquisite but priced much lower. Members of producer group A are upset that producer group B is competing successfully for some diners who would likely otherwise eat more frequently at the restaurants of producer group A. What are the members of producer group A to do?

They could accept the fact that competition is not tortious — indeed, that economic competition is healthy for the economy at large — and do nothing other than compete harder to win more consumer patronage. That’d be the honest and honorable path to take. But government is in the picture, standing ready to escort those with little interest in honesty and honor down the rent-seeking path.

“So just pass legislation outlawing chain restaurants in our state,” suggests the leader of producer group A.

“Wish I could,” responds Sen. Slimey, “but that’s too blatant. Plus, it might not pass muster with the courts. But I’ve got an alternative plan that’s just as good.”

“Do tell!” exclaims the leader of producer group A.

“Well, I understand,” replies Sen. Slimey, “that the restaurants run by producer group B use many more low-skilled workers in their kitchens than your restaurants use.”

“That’s correct. We serve only fine food, so we hire experienced, high-skilled chefs, whose market wages are high.”

“So,” observes Sen. Slimey, “let’s enact a statute that raises the minimum wage above the average wage now paid to the average worker in producer group B’s restaurants, but lower than the average wage paid to workers in your — producer group A’s — restaurants.”

“Brilliant!” declares the leader of producer group A, who sees immediately that, while the minimum-wage legislation will on its face — de jure — apply to all restaurants, it will in fact have a differentially harsh effect on the restaurants in producer group B. The minimum wage will artificially raise producer group B’s costs of operation, causing them to reduce their outputs. One consequence of producer group B’s reduced outputs will be artificially increased demand for meals served at producer group A’s restaurants.

Sen. Slimey smiles, knowing that the news media, as well as most of the intellectuals in town, will applaud him for his apparent humanity and “Progressive” values. It’s a win-win for Sen. Slimey and for members of producer group A. And too few people will pay close-enough attention to the members, workers, and customers of producer group B to suspect that Sen. Slimey is anything other than a socially conscious public servant.

Don Boudreaux, “Doing Bad By Pretending to Do Good”, Café Hayek, 2018-05-13.

July 7, 2020

L. Neil Smith on the Progressive agenda

His latest article in the Libertarian Enterprise:

For the full length of the last century, Western culture has been commanded by the blind, deaf, but never speechless entities who see things stubbornly as they prefer to see them, and “dream the impossible dream”, rather than see them as they really are. This mental habit has led to various messes that we find ourselves in today. To any extent that it might help us to get out of those messes, it might help to understand how we got into them.

Don’t look to the wrong assistance. Psychology, for example, is nothing at all like a science and those who practice it are nothing at all like scientists. Mostly they’re hyper-opinionated liberals. No two shrinks ever agree on a diagnosis, and official definitions of various mental illnesses are a grammatical and logical laugh riot. The great truth of life is that understanding character is an art, best left to master novelists and story-tellers.

Although they’ll seldom admit it, even to themselves, so-called Progressives know by now that they are wrong, that they have always been wrong. You might say that their wrongness has stood the test of time. So what is it that they really want? Their high-flown theories and values having failed them embarrassingly — a good example of that is the minimum wage, which destroys employment for entry-level and minority youth — rather than seeking new theories and values that might serve them and everybody better, they have turned to a kind of bitter nihilism. They hate and fear the society that has stubbornly refused to bend to their wills, and so it must die. Every single policy recommendation that they make — like the $15 minimum wage, for example, or defunding the police — is directed to that purpose.

Another good example would be “gun control”, which its opponents correctly label “victim disarmament”. As unconstitutional political pressures on private gun ownership increased, and self-defense culture was forced to organize itself (contrary to liberal belief, gun companies and the National Rifle Association were followers in this, not leaders) existing gun laws were gradually weakened. It became easier to obtain and carry a weapon — and necessary, in the view of those of us “delorables” who were constantly being threatened by left-wing political figures. During the Obama-Biden regime, at least 100 million guns were sold. And as they were, violent criminality began to decrease in double digits.

Today, except for many liberal-dominated hell-holes like Chicago, New York, San Francisco, Atlanta, Baltimore, Detroit, and a dozen others, Americans are headed to 19th century crime levels. Did Progressives ever notice or admit that crime had diminished? They did not. The process conflicted with their erroneous belief system, so they still call today for various measures punishing firearms manufacturers and retailers, and disarming individuals who have solved the problem that the politicians and the police have only made much worse for decades.

And so it goes, in all such matters as economics, education, the environment, nutrition, and everything else. Psychologists (who, like a broken clock, are right just this once) call the phenomenon projection: if Progressives can’t run their own lives (and very largely, judging from the kids they raise, they can’t), naturally that makes them and the rest of the bizarre menagerie that was typical of the Obama-Biden Administration qualified to run everybody else’s lives. And because Progressive policies are (at least one hopes) unconsciously suicidal, the rest of us are in for a rough ride.

February 10, 2020

QotD: Welfare programs as a form of subsidy to employers

A final line of argument is that these public assistance programs have become de facto subsidies for low-wage employers. For a program to be a subsidy for an employer, it needs to lower wages. Is this plausible for the public assistance programs considered? I think it is for the EITC [Earned Income Tax Credit], but not for other programs. Depending on where one is on the EITC schedule, that policy can increase work incentives. And there is a lot of empirical evidence showing EITC encourages labor force participation. An unintended consequence of that labor supply response, however, is that employers capture some of the tax subsidies. This can happen in a simple supply and demand framework, where an increased labor supply to the market drive wages down. This can also happen in a bargaining context where the size of the bilateral surplus expands from lower taxes, and employers capture some of this increased surplus. Work by UC Berkeley’s Jesse Rothstein suggests that for every $1 of transfer to workers using the EITC, post-tax income rises only by $0.73 because of employer capture.

But what about other programs like food stamps or housing assistance? These means tested public assistance programs are not tied to work, and we should not expect them to lower wages. Let’s take food stamps, which are available to eligible families whether or not a family member works or not. Indeed, when people are not working, they are more likely to be eligible for food stamps since their family incomes will be lower. Therefore, SNAP [Supplemental Nutrition Assistance Program] is likely to raise, and not lower a worker’s reservation wages — the fallback position if she loses her job. This will tend to contract labor supply (or improve a worker’s bargaining position), putting an upward pressure on the wage. Whether or not wages are increased is an empirical matter: there is evidence that the initial roll-out of the food stamps program across counties in the 1970s lowered work hours, consistent with an increase in the reservation wage. The key point is that it is difficult to imagine how food stamps would lower wages. And if they don’t lower wages, they can’t be thought of as subsidies to low wage employers. The same logic applies to other means tested programs like energy or housing assistance. Moreover, these conclusions hold in a wide array of models of the labor market, including ones that emphasize bargaining or efficiency wage concerns.

Arindrajit Dube, “Public Assistance, Private Subsidies and Low Wage Jobs”, Arindrajit Dube, 2015-04-19.

September 23, 2019

The “Global Climate Strike”

The big “let’s all play hooky from school” event’s Toronto organizers have been getting positive coverage from some of the local media, because of course they have. Here’s Tanya Mok for BlogTO, listing the totally reasonable and not in any way unrealistic “demands” of the movement:

FridaysForFuture Demonstration, 25 January 2018 in Berlin.

Photo by C. Suthorn via Wikimedia Commons.

The coalition has made a list of seven demands, which “reflect the rallying cries of the intersectional movements” they belong to. Some of those demands include:

- Indigenous rights and sovereignty.

- The protection of forests, land, and water sources.

- A shift to publicly-owned renewable energy, and reducing national carbon emission by 65% by 203, reaching zero emissions by 2040.

- A $15 minimum wage for all, and higher taxation on the rich.

- Universal public services like health care and dental care, free university and college, housing as a human right, and free public transit.

- Justice for migrants and refugees, allowing status for all. That includes putting an end to deportations and allowing for the full access to public services.

There will be a concert at Queen’s Park after the rally, as well as a follow-up benefit concert at the Tranzac Club in the evening. A giant street mural project run by Greenpeace will also be taking place prior to the rally, around 10 a.m., at the southern point of Queen’s Park.

July 31, 2019

The quickest way to raise the real income of minimum wage earners

Tim Worstall explains how to quickly raise the living standards of everyone in Britain earning the minimum wage, without costing employers any more:

“Palace of Westminster”by michaelhenley is licensed under CC BY-NC-SA 2.0

I – Tim Worstall that is – then started pointing out that the difference between this living wage and the minimum wage was the amount of tax that we – shamefully – charge to the low paid. Tax being both income tax and national insurance contributions. In fact, I rather shouted about it around the place, at the ASI, and here in The Times in 2012.

The gross annual salary of a full-time worker on the minimum wage is £12,070.50. We could come close to lifting every low-paid worker out of poverty if we simply increased the personal tax allowance from £8,105 to that sum. Not a penny of income tax or NICs should leave their pay packet. A full-time worker, however, on the living wage would be taking home £12,410.74, after the taxman has taken a cut — that’s only £340 more. And before the Foundation uprated the living wage yesterday, the annual difference was just £8.74.

There are problems. Raising the personal allowance gives everyone a tax cut — which I’ll admit doesn’t break my heart. But we could lower the amount at which the higher rates of tax kick in to make up for that lost revenue. And won’t these workers lose their right to unemployment benefit and a pension, if they don’t pay NICs? No, they qualify already, as the system treats the very low paid as if they had made NI contributions. We should go farther. The link between the full-year minimum wage and the personal allowance for tax and NI should be made explicit. Change one and the government of the day must change the other. If the minimum wage is the minimum moral amount that someone’s labour is worth, then that is what they should get, not the amount after Denis MacShane’s European wanderings have been paid for.

Which leaves us with two competing visions of how everyone can be free of poverty pay. The Living Wage Campaign’s vision is to shout at every employer in the country until they give in. The Worstall Way is to increase the incomes of the working poor by stopping taxing them.

July 10, 2019

QotD: Price controls

Price controls – both price ceilings and price floors – reduce the quantities of price-controlled goods and services that consumers actually get. Forcing the money price of a good or service down with a government-imposed price ceiling reduces the amount of this good or service that consumers actually get by reducing the quantity supplied (from what that quantity would be were the money price not forced downward). Forcing the money price of a good or service up with a government-imposed price floor reduces the amount of this good or service that consumers actually get by reducing the quantity demanded (from what that quantity would be were the money price not forced upward). In both cases, the government intervention reduces economic output.

Minimum wages, statutory prohibitions on so-called “price gouging,” and other price controls reflect irrational mysticism. These controls are all premised on the notion that by forcibly changing the nominal reported value of a good or service – that is, by forcibly changing the name of the value – the real value of the good or service will change to correspond to the dictated name. It’s a notion no less batty than is the belief, say, that the New York Times can actually change the number of people killed in a terrorist attack by changing the name of the number. Yet who believes that if, say, 18 people are killed in a terrorist attack that the number of dead people will miraculously be reduced by three if the New York Times reports that “15 people were killed in a terrorist attack”? The answer, of course, is no one. Indeed, anyone who would suppose that reality is changed simply when newspaper reports of it are changed is recognized as being too far detached from reality to take seriously.

Those who support price controls are just as detached from reality. The market-determined price of a good or service is as accurate a report as is possible of the value of each unit of a good or service. This value will not move up or down simply if the government orders it to move up or down.

[…]

None of this matters to proponents of price controls. Such proponents are satisfied with the fact that the names of the values of good or services are changed in ways that please the eye and ear of the economically illiterate. If it is now possible to say that the highest name of the value of a gallon of gasoline is $1.00, then these proponents are content to believe that the real value is indeed $1.00. If it is now possible to say that the lowest name of the value of an hour of low-skilled labor is $7.25, then these proponents are content to believe that the real value is indeed $7.25.

It’s a foolish superstition. It is, however, a superstition that is very widespread, especially among those who today fancy themselves to be immune to superstitions.

Don Boudreaux, “Quotation of the Day…”, Café Hayek, 2017-06-19.

July 6, 2019

Putting global worker pay into perspective

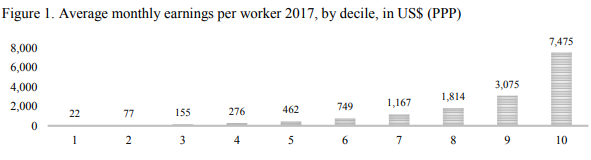

Tim Worstall explains why the headline-friendly numbers in a recent ILO report are nothing to be surprised at:

“Nearly half of all global pay is scooped up by only 10% of workers, according to the International Labour Organization, while the lowest-paid 50% receive only 6.4%.

“The lowest-paid 20% – about 650 million workers – get less than 1% of total pay, a figure that has barely moved in 13 years, ILO analysis found. It used labour income figures from 189 countries between 2004 and 2017, the latest available data.

“A worker in the top 10% receives $7,445 a month (£5,866), while a worker in the bottom 10% gets only $22. The average pay of the bottom half of the world’s workers is $198 a month.”

[…]

The explanation? To be in the top 10% of the global pay distribution you need to be making around and about minimum wage in one of the rich countries. Via another calculation route, perhaps median income in those rich countries. No, that £5,800 is the average of all the top 10%.

Note that this is in USD. About £2,000 a month puts you in the second decile, that’s about UK median income of 24,000 a year.

And as it happens about 20% of the people around the world are in one of the already rich countries. So, above median in a rich country and we’re there. Our definition of rich here not quite extending as far as all of the OECD countries even. Western Europe – plus offshoots like Oz and NZ, North America, Japan, S. Korea and, well, there’s not much else. Sure, it’s not exactly 10% of the people there but it’s not hugely off either.

So, what is it that these places have in common? They’ve been largely free market, largely capitalist, economies for more than a few decades. The most recent arrival, S. Korea, only just managing that few decades. It is also true that nowhere that hasn’t been such is in that listing. It’s even true that nowhere that is such hasn’t made it – not that we’d go to the wall for that last insistence although it’s difficult to think of places that breach that condition.