In the latest Weekly Dish, Andrew Sullivan considers just how much things have changed in recent years, especially with the publication of the Cass Report on the true medical situation for children being prescribed puberty blocking or opposite sex hormones … and it really doesn’t match the rhetoric we’ve been hearing from activists over the last few years:

Tribalization does funny things to people. If you’d told me a decade ago that within a few years, Republicans would be against Ukraine defending itself from a Russian invasion, and Democrats would be pulling the Full Churchill to counter the Kremlin, I’d have gently asked what sativa strain you were smoking.

If you’d told me the Democrats would soon be the party most protective of the CIA and the FBI, and that Republicans would regard them as part of an evil “deep state,” ditto. And who would have thought that a president accused in 2017 of having “no real ideology [but] white supremacy” would today be doubling his support with black voters, and tripling it with black men? Who would have bet the Dems would go all-in on Big Pharma when it came to Covid vaccines? And who would have thought Republicans who long carried little copies of the Constitution in their suit pockets would lead a riot to prevent the peaceful transfer of power? You live and learn.

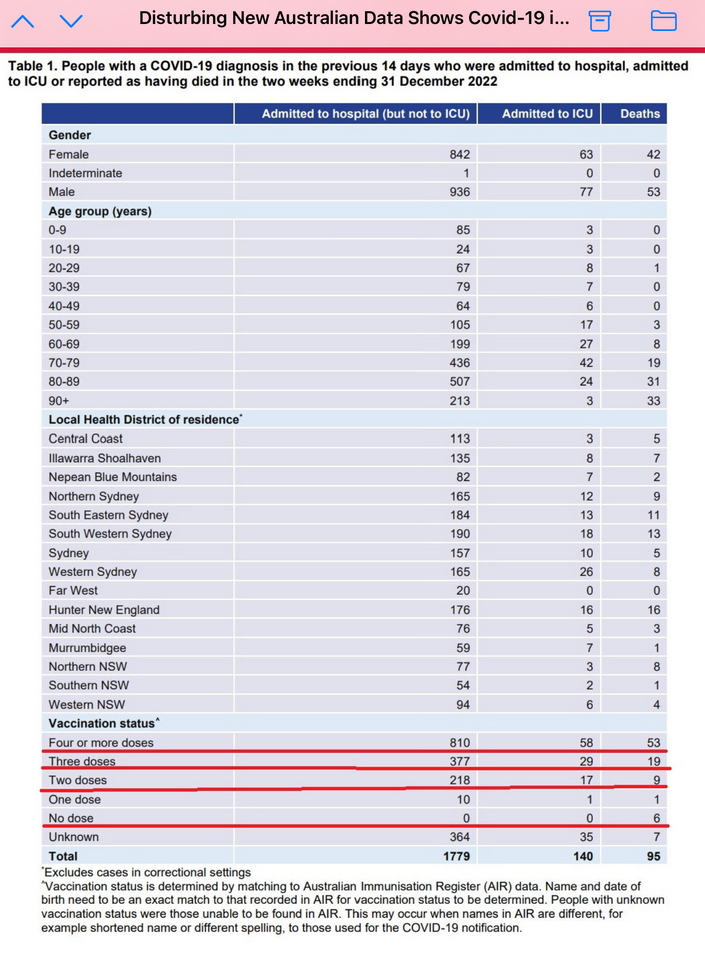

But would anyone have predicted that the Democrats and the left in general would soon favor a vast, completely unregulated, for-profit medical industry that would conduct a vast, new experimental treatment on children with drugs that were off-label and without any clinical trials to prove their effectiveness and safety? In the 2016 presidential race, both Dem contenders railed against Big Pharma, with Bernie going as far as calling the industry “a health hazard for the American people.” Back in 2009, you saw MSM stories like this:

The Food and Drug Administration said adults using prescription testosterone gel must be extra careful not to get any of it on children to avoid causing serious side effects. These include enlargement of the genital organs, aggressive behavior, early aging of the bones, premature growth of pubic hair, and increased sexual drive. Boys and girls are both at risk. The agency ordered its strongest warning on the products — a so-called black box.

Nowadays, it’s deemed a “genocide” if you don’t hand out these potent drugs to children almost on demand. Drugs used to castrate sex offenders and to treat adult prostate cancer have been re-purposed, off-label, to sexually reassign children before they even got through puberty. Big Pharma created lucrative “customers for life” by putting kids on irreversible drugs for a condition that could not be measured or identified by doctors and entirely self-diagnosed by … children.

And what if over 80 percent of the children subject to this experiment were of a marginalized group — gay kids? And the result of these procedures was to cure them of same-sex attraction by converting them to the opposite sex? I simply cannot imagine that any liberal or progressive would hand over gender-nonconforming children, let alone their own children, to the pharmaceutical and medical-industrial complex to be experimented on in this way.

And yet for years now, this has been the absolutely rigid left position on sex reassignments for children with gender dysphoria on the verge of puberty. And for years now, those of us who have expressed concern have been vilified, hounded, canceled and physically attacked for our advocacy. When we argued that children should get counseling and support but wait until they have matured before making irreversible, life-long medical choices they have no way of fully understanding, we were told we were bigots, transphobes and haters.

The reason we were told that children couldn’t wait and mature was that they would kill themselves if they didn’t. This is one of the most malicious lies ever told in pediatric medicine. While there is a higher chance of suicide among children with gender distress than those without, it is still extremely rare. And there is absolutely no solid evidence that treatment reduces suicide rates at all.

Don’t take this from me. The most authoritative and definitive study of the question has just been published in Britain, The Cass Report, by Hilary Cass, one of the most respected pediatricians in the country. It’s 388 pages long, crammed with references, five years in the making, based on serious research and interviews with countless doctors, parents, scientists and, most importantly, children and trans people directly affected. In the UK, its findings have been accepted by both major parties and even some of the groups who helped pioneer and enable this experiment. I urge you to read it — if only the preliminary summary.

It’s a decisive moment in this debate. After weighing all the credible evidence and data, the report concludes that puberty blockers are not reversible and not used to “take time” to consider sex reassignment, but rather irreversible precursors for a lifetime of medication. It says that gender incongruence among kids is perfectly normal and that kids should be left alone to explore their own identities; that early social transitioning is not neutral in affecting long-term outcomes; and that there is no evidence that sex reassignment for children increases or reduces suicides.

How on earth did all the American medical authorities come to support this? The report explains that as well: all the studies that purport to show positive results are plagued by profound limitations: no control group, no randomization, no double-blind studies, no subsequent follow-up with patients, or simply poor quality.