Megan McArdle on the plight of some health insurance companies as they try to offer healthcare policies and still make some sort of profit in the current American market:

… UnitedHealth abruptly said it expected to lose hundreds of millions of dollars on its exchange policies in 2015 and 2016, and would be assessing whether to pull out of the market altogether in the first half of next year.

This was part of a terrible, horrible, no good, very bad news cycle for Obamacare; as ProPublica journalist Charles Ornstein said on Twitter, “Not since 2013 have I seen such a disastrous stream of bad news headlines for Obamacare in one 24-hour stretch.” Stories included not just UnitedHealth’s dire warnings, but also updates in the ongoing saga of higher premiums, higher deductibles and smaller provider networks that have been coming out since open enrollment began.

It now looks pretty clear that insurers are having a very bad experience in these markets. The sizeable premium increases would have been even higher if insurers had not stepped up the deductibles and clamped down on provider networks. The future of Obamacare now looks like more money for less generous coverage than its architects had hoped in the first few years.

But of course, that doesn’t mean insurers need to leave the market. Insurance is priced based on expectations; if you expect to pay out more, you just raise the price. After all, people are required to buy the stuff, on pain of a hefty penalty. How hard can it be to make money in this market?

What UnitedHealth’s action suggests is that the company is not sure it can make money in this market at any price. Executives seem to be worried about our old enemy, the adverse selection death spiral, where prices go up and healthier customers drop out, which pushes insurers’ costs and customers’ prices up further, until all you’ve got is a handful of very sick people and a huge number of very expensive claims.

Some commentators, including me, worried a lot about death spirals in the early days of the disastrous exchange rollout. Some commentators, also including me, have eased off on those fears in recent years. Why the change? Because when the law was passed, I was mostly focused on whether the mandate penalty would be enough to encourage people to buy insurance. Over time, as the exchanges evolved, the subsidies, and the open enrollment limitations, started to look a lot more important than the penalty.

[…]

An earnings call like today’s can also be a bargaining tactic. Health insurers are engaged in a sort of perpetual negotiation with regulators over how much they’ll be allowed to charge, what sort of help they’ll get from the government if they lose money, and a thousand other things. Signaling that you’re willing to pull out of the market if you don’t get a better deal is a great way to improve your bargaining position with legislators and regulatory agencies.

That said, strategic positioning is obviously far from the whole story, or even the majority of it. UnitedHealth really is losing money on these policies right now. It really is seeing something that looks dangerously like adverse selection. And frankly, there’s not that much the company can get out of regulators at this point, because the Congressional Republicans have cut off the flow of funds. So while Obamacare certainly isn’t dead, or certain to spiral to its death, it’s got some very worrying symptoms.

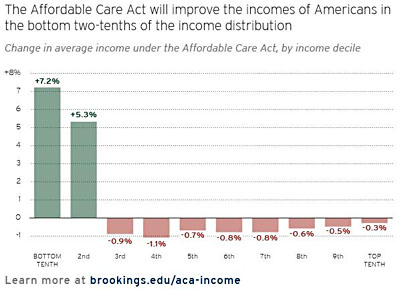

Here’s an interesting chart that follows up on

Here’s an interesting chart that follows up on