[In Desperate Remedies: Psychiatry’s Turbulent Quest to Cure Mental Illness, Andrew] Scull stresses the degree to which external pressures have shaped psychiatry. “Community psychiatry” supplanted “institutional psychiatry” in part because of professional insecurity. Psychiatrists needed a new model for dealing with mental diseases to keep pace with the advances that mainstream health care was making with other diseases. Fiscal conservatives viewed the practice of confining hundreds of thousands of Americans to long-term commitment as overly expensive, and civil libertarians viewed it as unjust.

Deinstitutionalization began slowly at first, in the 1950s, but the pace accelerated around 1970, despite signs that all was not going according to plan. On the ground, psychiatrists noticed earlier than anyone else that the most obvious question — where are these people going to go when they leave the mental institutions? — had no clear answers. Whatever misgivings psychiatrists voiced over the system’s abandonment of the mentally ill to streets, slums, and jails was too little and too late.

That modern psychiatry is mostly practiced outside of mental institutions is not its only difference from premodern psychiatry. Scull devotes extensive coverage to two equally decisive developments: the rise and fall of Freudianism, and psychopharmacology.

The Freudians normalized therapy in America and provided crucial intellectual support for the idea that mental health care is for everyone, not just the deranged. Around the same time as deinstitutionalization, Freud’s reputation, especially in elite circles, was on a level with Newton and Copernicus. Since then, Freudianism has mostly gone the way of phlogiston and leeches. That happened not just because people decided the psychoanalysts’ approach to therapy didn’t work but also because insurance wouldn’t pay for it. Insurance would, however, pay for modes of therapy that were less open-ended than the “reconstruction of personality that psychoanalysis proclaimed as its mission”, more targeted to a specific psychological symptom, and, most crucially of all, performed by non-M.D.s. Therapy was on the rise, but psychiatrists found themselves doing less and less of it.

As psychiatry cast aside Freudian concepts such as the “refrigerator mother”, which rooted mental illness in psychodynamic tensions, it increasingly trained its focus on biology. Drugs contributed to, and gained a boost from, this reorientation. Scull loathes the drug industry and only grudgingly allows that it has made improvements in the lives of mentally ill Americans. He divides up the vast American drug-taking public into three groups: those for whom they work, those for whom they don’t work, and those for whom they may work, but not enough to counter the unpleasant side effects. He argues that the last two groups are insupportably large.

Stephen Eide, “Soul Doctors”, City Journal, 2022-05-18.

September 11, 2022

QotD: De-institutionalization

December 10, 2021

January 13, 2021

QotD: Bureaucracy as a filter

Imagine there’s a new $10,000 medication. Insurance companies are legally required to give it to people who really need it and would die without it. But they don’t want somebody who’s only a little bit sick demanding it as a “lifestyle” drug. In principle doctors are supposed to help with this, but doctors have no incentive to ever say no to their patients. If the insurance just sends the doctor a form asking “does this patient really need this medication?”, the doctor will always just check “yes” and send it back. Even if the form says in big red letters PLEASE ONLY SAY YES IF THERE IS AN IMPORTANT MEDICAL NEED, the doctor will still check “yes” more often than a rational central planner allocating scarce resources would like. And insurance companies are sometimes paranoid about refusing to do things doctors say are important, because sometimes the doctor was right and then they can get sued.

But imagine it takes the doctor an hour of painful phone calls to even get the right person from the insurance company on the line. Now there’s a cost involved. If your patient is going to die without the medication, you’ll probably groan and start making the phone calls. But if your patient doesn’t really need it, and you just wanted to approve it in order to be nice, now you might start having a heartfelt talk with your patient about the importance of trying less expensive medications before jumping right to the $10,000 one.

Organizations have a legal incentive not to deny people things, because the people involved can sue them. But they have an economic incentive not to say yes to every request they get. Seeing how much time and exasperation people are willing to put up with in order to get what they want is an elegant way of separating out the needy from the greedy if every other option is closed to you.

This story makes sense and would help explain why bureaucracy gets so bad, but I’m not sure it really fits the evidence. People complain a lot about bureaucracy in places like the Department of Motor Vehicles, but the DMV doesn’t lose anything by giving you a drivers license and isn’t interested in separating out people who really want licenses from people who only want them a little. If the DMV can be as bureaucratic as it is without any conspiratorial explanation, maybe everything is as bureaucratic as it is without any conspiratorial explanation.

Scott Alexander, “Bureaucracy as Active Ingredient”, Slate Star Codex, 2018-08-31.

September 4, 2020

“They have insurance”

Brad Polumbo debunks the notion that it’s somehow “okay” to loot and vandalize businesses “because they have insurance” and that somehow means that nobody suffers.

A building burning in Minneapolis following the death of George Floyd.

Photo by Hungryogrephotos via Wikipedia.

Since the death of George Floyd in late May, violent riots and looting have broken out in many major cities, eventually overshadowing peaceful protests and calls for criminal justice reform. From Portland to Chicago to Kenosha, rioters have smashed windows, lit fires, attacked government properties, assaulted people in the streets, and looted storefronts.

In Minneapolis alone, vandals have destroyed at least 1,500 properties, many of them minority-owned businesses, and caused billions of dollars in property damage. Many people have been injured or killed during the chaos.

[…]

Even if all the affected property was fully insured — and it wasn’t — rioting has taken a vast human toll as well.

Consider that at least 15 people were killed during the initial riots after Floyd’s death, and that more have died in the unrest since. When arson and looting consume the streets, people inevitably get hurt and caught in the crossfire. That’s why the Minneapolis police found a burnt corpse in a pawn shop days after arsonists had passed through.

Insurance might fund that property’s restoration, but it can’t bring a dead man back to life.

[…]

Big companies like Walmart and Target generally have expensive, premium insurance plans. But many of the mom-and-pop enterprises and small businesses targeted in the riots didn’t have expensive insurance plans. In some cases, their more modest plans don’t cover damage from riots or don’t cover it in full.

“Situations where there’s a lot of devastation like this, a lot of times people find they’re underinsured and don’t have enough coverage,” Illinois Insurance Association Hotline President Janet Patrick told CBS Minnesota. “And so once the damage has been done, it’s too late. You can’t buy more coverage.”

According to Insurance Journal, 75 percent of US businesses are under-insured. And according to the New York Times, about 40 percent of small businesses have no insurance at all.

December 27, 2019

QotD: The perils of tax reform

Deductions are the Cheez Doodles of tax policy: Everyone likes them; everyone who studies the matter knows they are not good for us; and nonetheless, most people will get very indignant if you attempt to replace them with something more wholesome.

This is why deductions rarely go away, no matter how stupid and detrimental to the fiscal and economic health of the republic. For example, virtually every wonk in Washington, from radical libertarian to fervent socialist, can agree upon at least one thing: the tax deductibility of employer-sponsored health insurance is a terrible idea. On the one hand, it costs the government a packet of money every year, money that has to be raised by higher taxes on someone else. On the other hand, it encourages employers to load as much compensation as possible into the health benefit package, which distorts our economy and contributes to ballooning costs. There is nothing nice to be said about this particular tax deduction, except that it undoubtedly seemed like a good idea during World War II.

And yet, when it comes time to, say, pass a major health-care reform, or reform the tax code, do our nation’s legislators start with the obvious, and get rid of this egregiously stupid deduction? I regret that there is no way to convey my hollow, despairing laugh in pixel form. Of course they don’t touch it. The very egregiousness of its immense costs, the massive distortions it has induced in American consumption patterns, mean that getting rid of it would be far too disruptive.

Megan McArdle, “Republicans Turned the Tax Code Into a Weapon”, Bloomberg View, 2017-11-03.

April 18, 2019

QotD: Roadblocks to deregulating the US healthcare market

One problem America has is simply that our government administration isn’t very good. That’s not true across the board — our government statistics are, IMHO, the finest in the world. But there’s stuff that other countries can do that we can’t, either because our government is more decentralized, or because our civil service just isn’t as prestigious (and therefore as full of competent, motivated people) as those in other countries. And our regulatory approach — rules rather than principles based, and highly adversarial — is also suboptimal, and hard to change.

Given how much the government now interferes in health care, that’s a big problem. Given our lack of administrative competency, our first step should be pulling back where we can — trying to push more ordinary expenses onto consumers, for example, who can manage those the same way they manage their aspirin and antacid purchases now. And eliminating the tax deduction for employer sponsored health care would be major. But I fear, politically impossible.

Megan McArdle, “Ask Me Anything”, Reddit, 2017-04-10.

April 8, 2019

QotD: Why does US healthcare cost so much?

This is a hotly debated question in health care policy. Here’s my rough stab at it: the 1970s inflation interacted particularly badly with two pre-existing policy choices: the tax deduction for employer-sponsored health insurance, and Medicare.

Start with employer-sponsored health insurance, which is, as everyone knows, tax advantaged relative to salary, because your employer can deduct it as an expense, but you don’t have to show it as income on your taxes.

This was an incredibly dumb decision, but in the defense of the folks who made it in the 1940s, at the time, health insurance wasn’t very expensive, because the health care system couldn’t do all that much (and the female labor that ran hospitals was cheap due to discrimination, or in the case of nuns, basically free).

Come the 1970s, inflation started causing a problem called “bracket creep”. Back then tax brackets weren’t indexed for inflation, so as inflation went up, folks got pushed into higher and higher tax brackets, even though the buying power of their salary had stayed the same, or [had] gone down. This was great for the government (and is a big reason our deficits were not disastrous in the 1970s), but it was terrible for people, and led to the tax revolts that helped put Reagan in office.

But I digress. The point is that bracket creep made non-taxed benefits much more attractive relative to salary, so insurance started getting more generous. That process has continued for decades. Insurance used to be “major medical” that covered big ticket items like hospital stays. Now we expect it to cover the cost of going to the doctor for the sniffles. Well, if you insulate people from those costs, they will incur more of them.

Effectively, this raises demand for health care services. But the US system, decentralized and litigation-happy, is very bad at controlling the supply side. End result: high costs.

The other thing that happened is Medicare. The original legislation called for reimbursing services at “reasonable and customary rates”. This was a gold mine for doctors and hospitals. In New York, for example, doctors used to be forced to do charity care as the price of their admitting privileges at prestigious city hospitals. Once Medicare came into the picture, there was no need for that! Or to economize on beds; you could always find someone to fill them. Eventually, Medicare tried to crack down (http://reason.com/archives/2011/12/13/medicare-whac-a-mole), but by then, it was damned hard to cut physician and hospital incomes, in part because they had made decisions based on their — like building new hospitals with all private rooms — that couldn’t be undone. Our cost base is permanently higher, and politically, we have shown no will to slash provider incomes. So even though our growth rate is about average for the OECD, we’re growing from a much higher level.

Megan McArdle, “Ask Me Anything”, Reddit, 2017-04-10.

August 14, 2018

QotD: The money pump

I would like to introduce you to the idea of a money pump. A money pump is a person whose irrationalities can be systematically exploited for financial gain. The simplest money pump is a person who prefers an apple to a doughnut, prefers a doughnut to a chocolate bar, and prefers a chocolate bar to an apple. Just offer them an apple in exchange for their doughnut plus a penny. They will accept. Then offer them a chocolate bar for their apple plus a penny. Then offer them a doughnut for their chocolate bar plus a penny. They end up with their original doughnut and are three pence poorer. Repeat for ever.

Money-pump arguments are sometimes deployed to object that people cannot be irrational, otherwise they would be bankrupted by money pumping. But economists are increasingly coming to realise that, instead, we should be looking for money pumping in action.

Given our anxiety about small risks, what would the money pumping look like? It would be an insurance policy focused on the narrowest possible slice of risk. It would be sold alongside another product or service, often at the last moment. It would be marketed by creating anxiety and then offering the product to make the anxiety go away. In short, it would look like the collision damage waiver, the extended warranty, and PPI [payment protection insurance]. These bespoke slices of insurance are among the largest money-pumping projects in the modern economy. No wonder the banks abandoned their principles to join in.

Tim Harford, “How insurers keep the money-pump flowing”, TimHarford.com, 2016-09-21.

August 5, 2018

QotD: Risk aversion

… let’s step back and ask ourselves what insurance is for. Classical economics has an answer: people are risk-averse, which means that they will pay good money to reduce the variability of outcomes they face. If home insurance guards against the loss of a million pounds when my house burns down, I’m happy to buy the insurance even though the insurance company expects to make a profit from it.

But this risk aversion emerges from the fact that money is worth more to poor people than to rich people. Gaining a million pounds would make me rich but losing a million pounds would make me poor. I should not gamble a million pounds on the toss of a coin, because the million pounds I might lose is more precious to me than the million pounds I might gain.

As so often with classical economics, this is an excellent description of how we should behave. It is not such an excellent description of how we actually do behave. Risk aversion can only explain why we insure large risks. It cannot explain why we insure small ones. This is because risk aversion turns on the idea that an extra pound is worth more if you are poor than if you are rich. But having to replace a phone is not going to make the difference between poverty and wealth.

In one of my favourite economics articles, written in 2001, the behavioural economists Richard Thaler and Matthew Rabin point out that anyone who rejects a 50/50 gamble to win £10.10 or lose £10 — apparently a reasonable enough taste for caution — cannot possibly be doing so because of risk aversion. (The degree of risk aversion necessary would mean that the same individual wouldn’t risk £1,000 on the toss of a coin for all the money in the world.) Risk aversion simply cannot explain why anyone would turn down that fractionally favourable gamble. And it cannot explain why anyone would insure a mobile phone.

A better explanation is that we tend to view risks in isolation. Rather than telling ourselves “a lost mobile phone would lower my lifetime wealth by 0.005 per cent”, we tell ourselves “it would be so annoying to have to pay for a new mobile phone”. Isolating and obsessing about risks in this way is arbitrary and illogical. But that does not mean we don’t do it.

Tim Harford, “How insurers keep the money-pump flowing”, TimHarford.com, 2016-09-21.

August 30, 2017

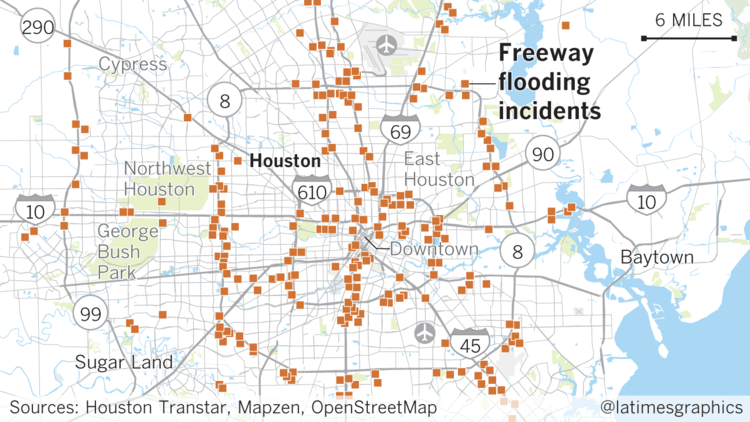

“Houston is built on what amounts to a massive flood plain”

While nobody expects 50 inches of rain to fall in one storm, Houston is still badly situated to withstand flooding even from lesser weather events due to its location on a flood plain:

Houston is built on what amounts to a massive flood plain, pitted against the tempestuous Gulf of Mexico and routinely hammered by the biggest rainstorms in the nation.

It is a combination of malicious climate and unforgiving geology, along with a deficit of zoning and land-use controls, that scientists and engineers say leaves the nation’s fourth most populous city vulnerable to devastating floods like the one caused this week by Hurricane Harvey.

“Houston is very flat,” said Robert Gilbert, a University of Texas at Austin civil engineer who helped investigate the flooding of New Orleans after Hurricane Katrina. “There is no way for the water to drain out.”

Indeed, the city has less slope than a shower floor.

Harvey poured as much as 374 billion gallons of water within the city limits, exceeding the capacity of rivers, bayous, lakes and reservoirs. Experts said the result was predictable.

The storm was unprecedented, but the city has been deceiving itself for decades about its vulnerability to flooding, said Robert Bea, a member of the National Academy of Engineering and UC Berkeley emeritus civil engineering professor who has studied hurricane risks along the Gulf Coast.

The city’s flood system is supposed to protect the public from a 100-year storm, but Bea calls that “a 100-year lie” because it is based on a rainfall total of 13 inches in 24 hours.

“That has happened more than eight times in the last 27 years,” Bea said. “It is wrong on two counts. It isn’t accurate about the past risk and it doesn’t reflect what will happen in the next 100 years.”

Some of the blame (a lot of the blame) for locating vulnerable properties in flood-prone areas is due to the US government’s flood insurance program:

Texans, watch out. An aftershock is following behind the catastrophic flooding produced by Hurricane Harvey in coastal Texas: The National Flood Insurance Program (NFIP) is coming up for reauthorization.

The main lesson that the public and policymakers ought to learn from Harvey is: Don’t build in flood plains, and especially don’t rebuild in flood plains. Unfortunately, the flood insurance program teaches the exact opposite lesson, selling subsidized insurance whose premiums do not come close to covering the risks home and business owners in flood prone areas face.

As a result, the NFIP is currently $25 billion in debt.

Federally subsidized flood insurance represents a moral hazard, Kevin Starbuck, Assistant City Manager and former Emergency Management Coordinator for the City of Amarillo, argues, because it encourages people to take on more risk because taxpayers bear the cost of those hazards.

Federal Emergency Management Agency data shows that from 1978 through 2015, 3.8 percent of flood insurance policyholders have filed repetitively for losses that account for a disproportionate 35.5 percent of flood loss claims and 30.5 percent of claim payments, Starbuck says. Most of these properties were grandfathered in before the NFIP issued its flood insurance rate maps. The NFIP is not permitted to refuse them insurance or charge them rates based on the actual risks they face.

Clearly, taxpayers should not be required to subsidize people who choose to build and live on flood plains. When Congress reauthorizes the NFIP, it should initiate a phase-in of charging grandfathered properities premiums commensurate with their risks. This will likely lower the market values of affected homes and businesses and thus send a strong signal to others to avoid building and living in such risky areas.

July 14, 2017

Brace yourself for the next round of Obamacare [repeal | reform | tweaking | posturing]

Megan McArdle doesn’t view this latest attempt to “fix” Obamacare with any great optimism:

Mitch McConnell is once again announcing that the Senate is going to come out with a new health-care bill and try to hold a vote next week. That exhaustion you feel is the same despair that seeps over you when a pair of ill-matched friends announce for the 17th time that they’re getting back together.

As with those friends (we all have them, don’t we?) there seems to be no set of mutual goals upon which a durable partnership can be built. Many Republican legislators want Obamacare to die. Others would probably attend the funeral with ill-concealed delight, but they don’t want a reputation for having killed it. Still others would like to be able to tell voters that they “did something” about Obamacare, even though in reality they are loath to actually, you know, do something — because their states would lose money, or voters would lose insurance.

[Wearily] So what can be done here? Realistically.

As an exercise on paper, the answer is easy:

- Stop trying to make this a tax-cut bill, and focus on reforms that can pave the way to fiscal stability, and dismantling many of the perverse incentives that have so distorted our health-care system.

- Leave Obamacare’s taxes intact. (Yes, even the dumb ones, of which there are many.)

- Turn Medicaid into a fixed grant rather than an open-ended entitlement, either by making it a block grant, or switching to a flat per-beneficiary payout — but don’t try to make block grants a confusing cover for very deep cuts to the program.

- Provide generous funding to stabilize the individual health-insurance exchanges, but demand in return very wide latitude for states to decide how they stabilize their insurance markets — including jettisoning any of the Obamacare regulations they think are getting in the way.

- Meanwhile, move the system more aggressively toward health-savings accounts plus catastrophic insurance — and get Democrats on board by offering to have the government fund some portion of those health savings accounts for low-income citizens.

Is that my ideal health-care system? No. But it gives Republicans some of what they want (a more consumer-driven, pro-market program in the individual market, and a big start toward reforming the bloated and byzantine mess that is the Medicaid program). It gives Democrats some of what they want (money for people who don’t have very much of it, plus they don’t get splattered by the fallout of Obamacare exchanges melting down). In theory, it could pass.

And in theory, I could play third base for the Yankees, if Joe Girardi were willing to hire me. The truth is that after years of complaining about obstructionism, Democrats have developed a sudden taste for the stuff; there’s a substantial faction of both politicians and voters who want the Democrats to stand by and do nothing, nothing, that Republicans might like. And even among those who think they want bipartisan compromise — well, I spend a lot of time listening to those folks, and when you get down to it, frequently their idea of a “compromise” is that they get a huge government program that costs hundreds of billions of dollars, and Republicans get trivial increases in the size of health-savings accounts, and maybe to twiddle with a few of the outer decimal points on growth rates. In other words, what they think is a vision of compromise is too often actually a vision of America ca. 1992, when Republicans were a minority party who had to come begging for crumbs.

March 14, 2017

“Most policy ideas are bad” (especially in US healthcare)

Megan McArdle says that the best plan the Republicans could come up with to deal with Obamacare is to do nothing, at least in the short-term:

For a policy columnist, “Don’t do that” is the easiest column to write. Most policy ideas are bad. If you simply blindly oppose everything that anyone ever puts forward, you’ll end up being right most of the time.

However, that’s not very useful for politicians. If they just sit around Congress playing tiddlywinks all day, voters will get cranky. Congress is supposed to do things. So, having spent a few days saying unkind things about the Republican health-care plan, it probably behooves me to state what I think they should do.

Well, boy, that’s a hard question. Here’s the thing: For all the unkind words I’ve said, I get the forces that have brought Republicans to this point. As I wrote Thursday, Democrats built a shoddy and unworkable structure out of the political equivalent of concrete: nearly impossible to repair or renovate, and darned expensive to demolish. The task is made even harder by the fact that Democrats currently control just enough votes in the Senate to keep Republicans from passing any sort of clean, comprehensive bill.

[…]

What would I do in this situation? Well, the first thing I’d do is accept, deep in my heart, that there are no great outcomes possible at this point. The second thing I’d do is remember that nothing is always a policy option: If you can’t do something better than the status quo, don’t do anything. It’s what I said to Democrats in 2009, and it’s what I’m saying to Republicans now.

So what would I do to minimize the damage, within the constraints of political reality? Well, I foresee two potential futures for the current status quo. One, the exchanges where individuals buy policies could fail, leaving people unable to buy insurance. Or two, the exchanges don’t fail, and we’re left with an unsatisfactory but still operational system.

In either case, the Republicans’ best option is to wait. Why? Because what they can do now — hastily, without touching the underlying regulations that have destabilized the individual market — is worse than either of those outcomes. The partial-reform structure they think they’ll be able to get through the Senate is likely to make the problems in the individual market worse, not better. And the fact that they’ve tinkered with the program means that Republicans will take 100 percent of the blame.

She also re-iterates her own ideal solution (which she admits wouldn’t fly with the American public):

Longtime readers of my column know that my pet proposal is a radical overhaul of the whole system in which we zero out all the existing subsidies and just have the government pick up 100 percent of the tab for medical expenses that exceed 15 or 20 percent of a family’s adjusted gross income: basically, a single-payer catastrophic-care system for expenses that no one can realistically save for. Let people buy insurance for expenses below that, or, if it’s not too expensive taxwise, let people set aside more money tax-free in Health Savings Accounts. And make some more generous provisions for people closer to the poverty line, such as prefunding Health Savings Accounts for them. That’s the whole program. It fits on a postcard, though the finer details — like which cancer treatments we’re actually willing to pay for — obviously aren’t.

However, this is completely politically infeasible, because voters don’t want genuine insurance, by which I mean a pool that provides financial assistance for genuinely unforeseeable and unmanageable expenses. Voters want comprehensive coverage that kicks in at close to the first dollar of spending, no restrictions on treatments or their ability to see a doctor, nice American-style facilities, and so forth. They are also fond of their health-care professionals and do not wish to see provider incomes slashed and hospitals closed, nor do they want their taxes to go up, or to pay 10 percent of their annual income in premiums. This conflicting set of deeply held views is one major reason that Obamacare — and American health-care policy more generally — has the problems it does.

March 13, 2017

“It’s not really a debate over Obamacare, it’s a debate over Medicaid”

Robert Tracinski explains why the Republicans are having such a hard time with their oft-promised “repeal” of Obamacare:

House Republicans have released their proposed measure to “repeal and replace” Obamacare, and the whole enterprise is already losing steam right out of the gate. The measure is too small and incremental, less a repeal of Obamacare and more of a repair of it, keeping numerous basic features intact.

If you want to know why Republicans have bogged down, notice one peculiar thing about the Obamacare debate so far. It’s not really a debate over Obamacare, it’s a debate over Medicaid. That’s because Obamacare mostly turned out to be a big expansion of Medicaid. The health insurance exchanges that were supposed to provide affordable private health insurance (under a government aegis) never really delivered. They were launched in a state of chaos and incompetence, and ended up mostly offering plans that are expensive yet still have high deductibles. Rather than massively expanding the number of people with private insurance, a lot of the effect of Obamacare was to wreck people’s existing health care plans and push them into new exchange plans.

Ah, but what about all those people the Democrats are claiming were newly covered under Obamacare? A lot of them — up to two-thirds, by some estimates — are people who were made newly eligible for a government health-care entitlement, Medicaid. But shoving people onto Medicaid is not exactly a great achievement, since it is widely acknowledged to be a lousy program.

Conservative health care wonk Avik Roy explains why: “[T]he program’s dysfunctional 1965 design makes it impossible for states to manage their Medicaid budgets without ratcheting down what they pay doctors to care for Medicaid enrollees. That, in turn, has led many doctors to stop accepting Medicaid patients, such that Medicaid enrollees don’t get the care they need.” Partly as a result, a test in Oregon found no difference in health outcomes between those with access to Medicaid and those without.

February 3, 2017

September 15, 2016

Asymmetric Information and Health Insurance

Published on 23 Sep 2015

In this video, we discuss asymmetric information, adverse selection, and propitious selection in relation to the market for health insurance. Health insurance consumers come in a range of health, but to insurance companies, everyone has the same average health. Consumers have more information about their health than do insurers. How does this affect the price of health insurance? Why would some consumers prefer to not buy health insurance at all? And how does this all relate to the Affordable Care Act? Let’s dive in.