Kulak at Anarchonomicon points out that the US government’s debt situation — which was alarming 20 years ago — has continued to get worse every year:

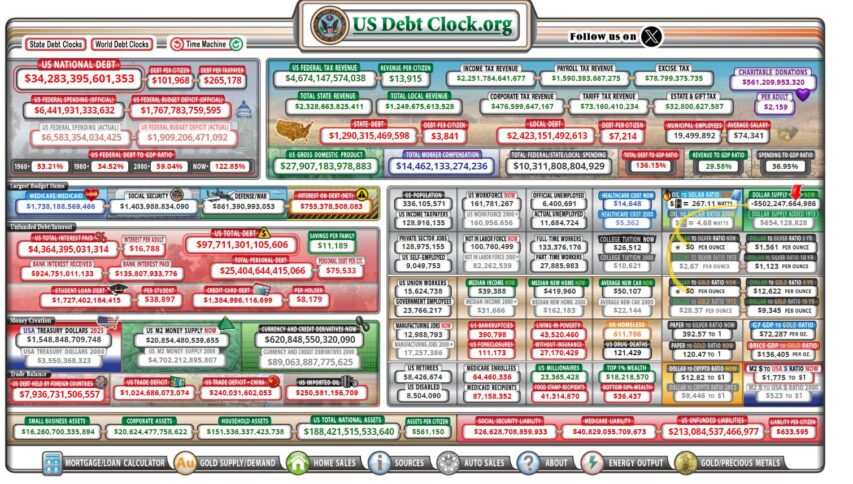

Libertarian Economists have been predicting this collapse of the federal system would happen “By About 2030” since before 2008. I remember in high school in the early 2010s listening to Ron Paul lectures and visiting USDebtClock.com, this was a hot button issue after 2008 … (then of course there was no political will to do anything and everyone just stopped talking about it)

I honestly forget that everyone around me doesn’t already know this, this is so common and accepted in libertarian and economic circles, and everyone who knows it got bored of eyes glossing over when they tried to explain it (in an autistic panic) decades ago.

US Unfunded liabilities:

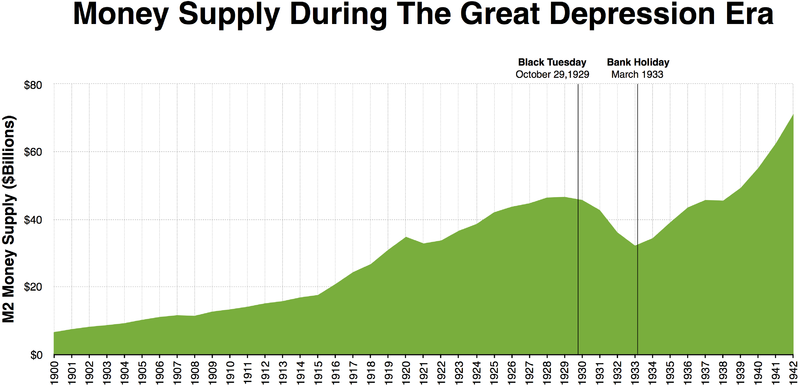

Social Security, Medicare, Medicaid, US Debt, and Federal employee benefits and pensions, are all basically intergenerational ponzi schemes that require constant 1950s level population growth amongst the productive tax paying middle-class to maintain. By 2000 it was obvious this population growth was not happening, that population was beginning to age and collapse, and NO, the illegals at the border weren’t adequate replacements … (they weren’t adequate to prop up federal expenses in 2000 when they were still Mexican, now that they’re Guatemalan, Haitian, and Senegalese they’re almost certainly a net drain).

The Specter of Mass Boomer retirements with few to no children and grandchildren to replace them and pay for all the costs of their retirements and healthcare was maybe the slowest but most assured crisis ever to be seen in human history … Demographics is destiny.

This was a foreseen problem in 2000 when US Debt to GDP (just the portion that’s already been spent and interest has to be paid on) was 59% of GDP. Today the US Debt to GDP ratio is 122% of GDP whilst just in the past 24 years. Absolute US Federal Debt (not including state or local) has grown from 5.6 trillion dollars to 34 trillion dollars (102k per citizen: man, woman, and child). just the interest that has to be paid out of your tax dollars on that debt is set to eclipse ALL US Military spending sometime this year … And by 2028 Debt to GDP will be 150% (46.4 Trillion, 132k per citizen, 12 trillion more in 4 years, with no additional spending bills) and the Interest (at current estimates) will be over 2.5 trillion dollars, over a third of all Tax Dollars brought in will be spent on just interest, because dollar confidence has collapsed and the only way to keep inflation from destroying the dollar has been to radically raise the interest rates the Federal Reserve offers.

Now all that, That catastrophic state of things, is just the debt, the money that’s been spent … The real crisis is the Unfunded liabilities, all the promises the US has made to Boomers (who dominate the vote) and others about money they’re GOING to spend.

As of now total Unfunded liabilities stand at 213 trillion dollars, $633,000 per US Citizen (Man woman, and newborn babe)… These are all dollars the US has promised to pay to someone somewhere at some point: Social Security, Medicare, Medicaid, Federal pensions, VA Benefits, etc. And cannot in any politically feasible way restructure or get out of.

If no one ever contributed another dime to social security, and in so doing was promised in turn significantly more than that dime (it’s a Ponzi scheme, it loses money in proportion to and at a greater rate than the money being contributed to it (every dollar you contribute you’re promised multiple dollars in return, and your dollar is not invested, it just pays off previous contributors)) … If everything froze and every young person was locked out of ever receiving Social Security, Medicare, or Medicaid, the Unfunded Liability would be $633k per every man, woman, and child … that’d be the debt a newborn American would be born with.

However because it is NOT frozen and it will not be, by 2028 that number will Rise to $837k and an ordinary household of 4 will have seen their, politically unavoidable, family obligation in future tax payments to the federal government increase by $804,000 in just 4 years.

If your response is that your family doesn’t even make 804k in 4 years and there’s no way you could ever pay that much in 4 years given its just going to increase at a faster rate the next 4 years … CONGRATULATIONS! 90% of families don’t make that much, and less than 1% of families could ever afford to pay that much in taxes in a 4 year time.

This has been slowly growing for decades, and in the late 2000s and 2010s Ron Paul types were screaming that those Benefits needed to be reformed NOW (in 2008) or they’d drown America. But of course, cutting benefits is political Anathema to boomers, so nothing was done …