Jon Gabriel tries to set the record straight on what a natural disaster means for the economy (hint, ignore anyone who says the GDP will rise due to the recovery efforts):

Ever since Hurricane Harvey slammed into Texas two weeks ago, we’ve seen countless images of heroic rescues, flooded interstates and damaged buildings.

As awful as the human toll was, it was not as bad as many of us feared. But it will take months to repair the homes, businesses and infrastructure of Houston and the surrounding area. The same will be true in Florida after Hurricane Irma.

The economic impact could be felt for years, but many economists and financial experts think there’s a silver lining.

The Los Angeles Times crowed that Harvey’s destruction is expected to boost auto sales. CNBC reported that Harvey “could be a slight negative for U.S. growth in the third quarter, but economists say it may ultimately provide a tiny boost to the national economy because of the rebuilding in the Houston area.”

Even Goldman Sachs is looking at the bright side, noting that there could be an increase in economic activity, “reflecting a boost from rebuilding efforts and a catchup in economic activity displaced during the hurricane.”

Economically speaking, it’s great news that all this damage in Texas and Florida needs to be fixed, right? Not only does this mean big bucks for cleanup crews, but think of all the money that street sweepers, construction workers and Home Depots will rake in.

And what about all those windows broken by the high winds? This will be the Golden Age of Texas Glaziery!

Not so fast.

All of this is based on a misunderstanding of what the GDP actually measures. It’s a statistic that often gets mentioned in the newspapers and on TV, but it is almost always used in a way that misleads people about what is happening in the economy. GDP — Gross Domestic Product — is intended to show the approximate total of goods and services produced in a national economy. Thus, when the GDP goes up, it means that the current period being measured recorded more goods and services produced than in the previous period.

When a natural disaster like a hurricane, earthquake, flood, or tornado strikes a city, state or region, all the work required to fix the damage will artificially boost the recorded GDP for that year. But the affected area isn’t that much richer than it was before, despite the GDP going up, because the GDP does not measure the losses suffered during the natural disaster.

This is where Frédéric comes in. I’m referring to the French economist and author Frédéric Bastiat, who brilliantly illustrated the GDP misunderstanding in his essay “What Is Seen and What Is Not Seen“:

In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.

The GDP problem I identified at the start of this post is a general case of what Bastiat called the “Broken Window Fallacy”:

Have you ever been witness to the fury of that solid citizen, James Goodfellow, when his incorrigible son has happened to break a pane of glass? If you have been present at this spectacle, certainly you must also have observed that the onlookers, even if there are as many as thirty of them, seem with one accord to offer the unfortunate owner the selfsame consolation: “It’s an ill wind that blows nobody some good. Such accidents keep industry going. Everybody has to make a living. What would become of the glaziers if no one ever broke a window?”

Now, this formula of condolence contains a whole theory that it is a good idea for us to expose, flagrante delicto, in this very simple case, since it is exactly the same as that which, unfortunately, underlies most of our economic institutions.

Suppose that it will cost six francs to repair the damage. If you mean that the accident gives six francs’ worth of encouragement to the aforesaid industry, I agree. I do not contest it in any way; your reasoning is correct. The glazier will come, do his job, receive six francs, congratulate himself, and bless in his heart the careless child. That is what is seen.

But if, by way of deduction, you conclude, as happens only too often, that it is good to break windows, that it helps to circulate money, that it results in encouraging industry in general, I am obliged to cry out: That will never do! Your theory stops at what is seen. It does not take account of what is not seen.

It is not seen that, since our citizen has spent six francs for one thing, he will not be able to spend them for another. It is not seen that if he had not had a windowpane to replace, he would have replaced, for example, his worn-out shoes or added another book to his library. In brief, he would have put his six francs to some use or other for which he will not now have them.

Let us next consider industry in general. The window having been broken, the glass industry gets six francs’ worth of encouragement; that is what is seen.

If the window had not been broken, the shoe industry (or some other) would have received six francs’ worth of encouragement; that is what is not seen.

And if we were to take into consideration what is not seen, because it is a negative factor, as well as what is seen, because it is a positive factor, we should understand that there is no benefit to industry in general or to national employment as a whole, whether windows are broken or not broken.

Now let us consider James Goodfellow.

On the first hypothesis, that of the broken window, he spends six francs and has, neither more nor less than before, the enjoyment of one window.

On the second, that in which the accident did not happen, he would have spent six francs for new shoes and would have had the enjoyment of a pair of shoes as well as of a window.

Now, if James Goodfellow is part of society, we must conclude that society, considering its labors and its enjoyments, has lost the value of the broken window.

From which, by generalizing, we arrive at this unexpected conclusion: “Society loses the value of objects unnecessarily destroyed,” and at this aphorism, which will make the hair of the protectionists stand on end: “To break, to destroy, to dissipate is not to encourage national employment,” or more briefly: “Destruction is not profitable.”

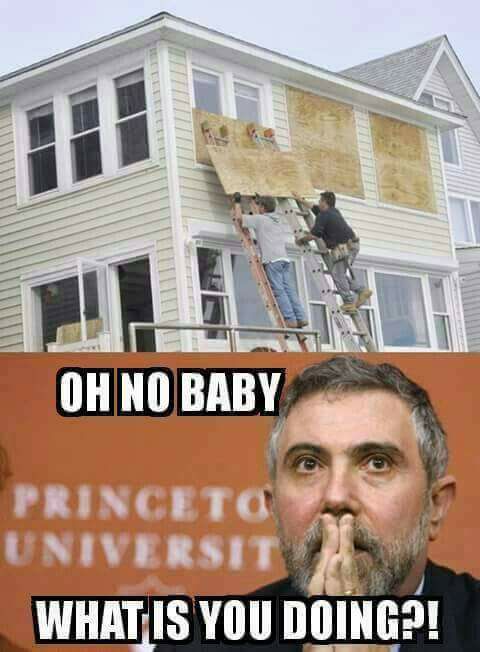

Related: Shared by Thomas Forsyth on Facebook: