While I haven’t been travelling much in the last few years, I always appreciate the chance to sample the local wines and beers in the regions I visit. Wired Mapland looks at some mapping projects to make that even easier (for craft beer, anyway):

Researching a recent business trip to San Diego (okay, not entirely business), I checked out two of them: The Beer Mapping Project, and Brewery Map. Both utilize Google’s map API (short for application programming interface, the set of programming instructions that enables developers to build new websites and apps that tap into an existing website’s data and functions), and they’re both easy to use: type in a location, and a map and list appear telling you what’s nearby. Brewery Map has Android and iPhone apps; several independent apps use the Beer Mapping Project’s API.

“The big reason we do what we do is we think it’s important, especially with the craft beer culture that’s growing, that people get out there and connect with the beer they like to drink, and help promote small businesses making craft beer, and meet the people who are making the kind of beer they like,” said Jason Austin, one of the trio of beer-loving developers behind Pint Labs, which created Brewery Map and the database behind it, BreweryDB.com.

Both sites rely on users to enter data, from plugging in the addresses and hours of existing brewpubs to adding new ones as they crop up. That means the sites are more useful in areas with more craft beer drinkers and can be a bit spotty elsewhere. It also means the more people who use them, the better they’ll get.

Here’s a brief review of their relative strengths and weaknesses:

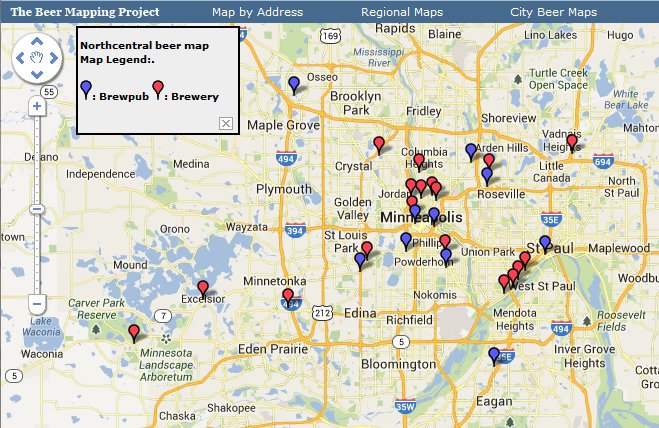

The Beer Mapping Project. WIRED: Lets you filter search results by type, making it easy to distinguish breweries from brewpubs, bars, and stores that sell microbrew. Click on a pin, and a window pops up with the official website, as well as links to reviews on BeerAdvocate and RateBeer. You can also look up homebrew stores. There are international maps too. TIRED: Beer trip planner isn’t very intuitive. Or maybe it doesn’t work. I got tired of trying to figure it out.

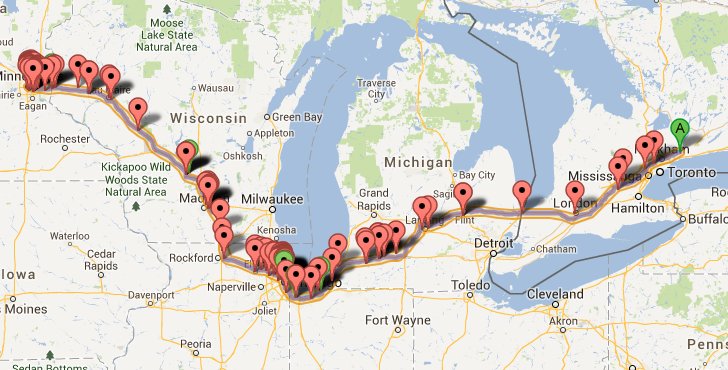

Brewery Map: WIRED: Great beer trip planner. Plug in two destinations and use a pulldown menu to indicate how far out of your way you’re willing to go for microbrew (see map above). TIRED: Designated driver not included. All the pins look the same, so if you want to find, say, a brewpub that serves food, you’ll have to do some extra Googling.

Should I decide to drive all the way to Minneapolis to catch a Vikings home game, here’s the high-level view of my trip according to BreweryMap:

If I’d already arrived at my destination, the Beer Mapping Project comes to my thirsty aid: