. . . repackage it as sleaze:

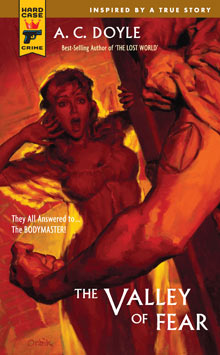

“Years ago, a PI out of Chicago brought justice to a dirty town. Now he’s going to pay,” trumpets the cover copy for US publisher Hard Case Crime’s new take on the classic novel, which it will release in December. “The man needs the help of a great detective … but could even Sherlock Holmes save him now?” The cover shows a scantily clad, backlit blond, reacting in terror to a muscled man showing off a brand on his forearm. Arthur Conan Doyle becomes AC Doyle, “bestselling author of The Lost World”, while the reader is further enticed by the tagline that “They All Answered to… The BODYMASTER!”

Publisher Charles Ardai said he had been looking for a classic novel to “playfully repackage” in Hard Case Crime’s pulp style since he launched the press five years ago, keen to follow in the footsteps of the 1940s and 1950s, which saw a cleavage-revealing cover dreamed up for 1984 (“Forbidden love … Fear … Betrayal”), and a “bosomy lipsticked redhead” on the cover of Frankenstein. “This is the tradition we wanted to revive with our edition of The Valley of Fear — presenting something ‘good for you’ in ‘bad for you’ garb,” he said.